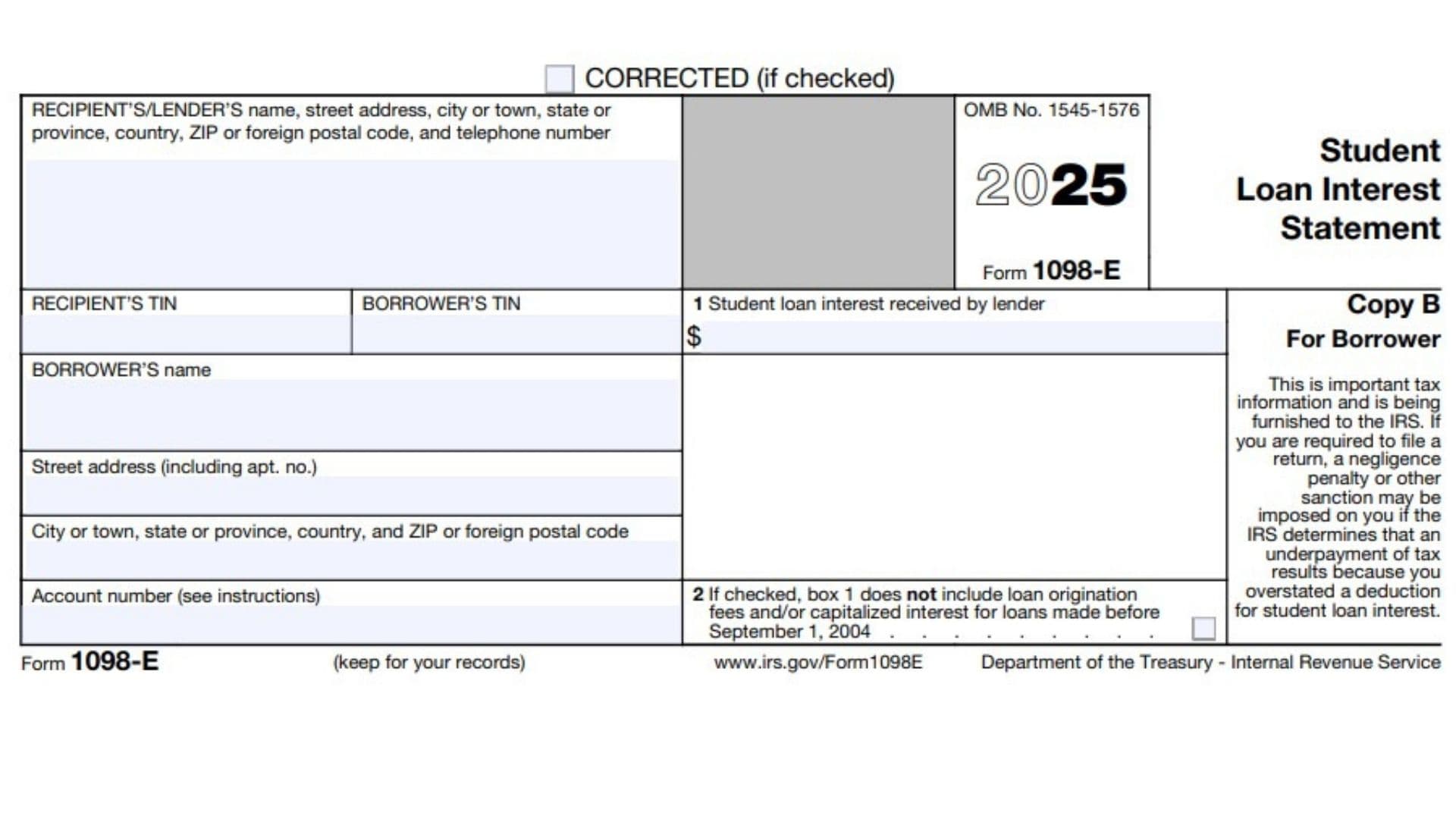

Form 1098-E, titled “Student Loan Interest Statement,” is an official IRS document used by lenders to report the amount of student loan interest they received from a borrower during the tax year. If a person has paid $600 or more in student loan interest, the lender is required to furnish Form 1098-E to both the borrower and the IRS. The form helps borrowers identify how much interest they paid, which may qualify for a student loan interest deduction on their federal income tax return. This deduction can reduce your taxable income, lowering your tax liability if you qualify. The form includes detailed information like the lender’s and borrower’s name, addresses, Taxpayer Identification Numbers (TIN), account number, and the amount of interest received. It also indicates whether loan origination fees or capitalized interest are included or excluded. Understanding Form 1098-E is essential for proper tax filing and ensuring that deductions are accurately claimed according to IRS rules.

How To File Form 1098-E

Form 1098-E is typically prepared and filed by lenders, not borrowers, but borrowers must use the information on the form to file their personal income tax returns correctly.

- Lenders send Copy A of Form 1098-E to the IRS and Copy B to borrowers.

- Lenders with 10 or more information returns typically must file electronically; fewer than 10 may file by paper, but e-filing is encouraged.

- Borrowers use the form information primarily to complete their IRS Form 1040, Schedule 1, to claim the student loan interest deduction.

- Keep Copy B for your records and tax preparation.

How To Complete Form 1098-E

Recipient’s/Lender’s Name and Address

Enter the full legal name, street address, city/town, state or province, country, ZIP/postal code, and phone number of the lender who received your student loan interest payments. This identifies the entity reporting the income.

Recipient’s TIN

This is the lender’s Taxpayer Identification Number (TIN), usually their Employer Identification Number (EIN). It is used by the IRS for tax processing and identification.

Borrower’s TIN

The borrower’s TIN is typically their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). For privacy, only the last four digits of the borrower’s TIN may be shown, but the full number is reported to the IRS.

Borrower’s Name

Enter the complete legal name of the borrower who made the student loan payments.

Borrower’s Address

Fill in the borrower’s street address including apartment or unit number, city or town, state or province, foreign country if applicable, and ZIP or foreign postal code.

Account Number

This field is for the lender to include an assigned account number or unique identifier to distinguish the borrower’s account. This is for internal tracking and not mandatory for all filers.

Box 1 — Student Loan Interest Received by Lender

Report the total amount of student loan interest the lender received from the borrower during the tax year. This includes interest paid and, if applicable, loan origination fees and capitalized interest for loans made on or after September 1, 2004.

Box 2 — Check Box if Box 1 Does Not Include Loan Origination Fees and/or Capitalized Interest

This box is checked if the amount in Box 1 excludes loan origination fees or capitalized interest and the loan was made before September 1, 2004. The borrower might be able to deduct these excluded amounts separately.

Additional Important Notes

- CORRECTED: This box is checked if the form is a corrected version replacing a previous submission.

- VOID: Marked if the form is void and should not be used for tax filing.

General Instructions and Resources

- The form is provided in multiple copies: Copy A is for the IRS, which must be scannable; Copy B goes to the borrower; other copies go to state tax authorities or for the lender’s records.

- Filing electronically is encouraged, especially for entities submitting 10 or more forms.

- For complete filing and printing rules, see IRS publications 1141, 1167, and 1179.

- Refer to IRS Publication 970 and instructions for Form 1040 for detailed guidance on student loan interest deductions.

- To avoid penalties, always file using official IRS forms or approved e-filing methods.