Form 1098, Mortgage Interest Statement, is an essential document for reporting mortgage interest paid by borrowers and received by lenders. Properly managing this form ensures compliance with IRS regulations and accurate reporting of tax-deductible mortgage interest. The primary purpose of Form 1098 is to report the amount of mortgage interest and related expenses paid by a borrower to a lender during the tax year. This form is used by borrowers to claim a deduction for mortgage interest on their federal income tax returns. By using Form 1098, lenders provide the IRS with a record of the interest received, ensuring transparency and compliance with tax regulations. For borrowers, the information on Form 1098 is necessary to substantiate their mortgage interest deduction, which can significantly reduce their taxable income.

Who Must File Form 1098?

Form 1098 must be filed by lenders who receive $600 or more in mortgage interest from an individual during the tax year. This includes:

- Banks, credit unions, and mortgage companies: These financial institutions must file Form 1098 if they receive $600 or more in mortgage interest from a borrower.

- Individuals and other entities: Private individuals or businesses that receive $600 or more in mortgage interest from a borrower must also file Form 1098.

The requirement applies to any interest received on a mortgage secured by real property, including a home, condominium, mobile home, or land.

How To File Form 1098?

Filing Form 1098 involves several steps and must be done by January 31 following the end of the tax year. The form can be filed electronically or by mail, depending on your filing preference.

- Obtain Form 1098: The form can be downloaded from the IRS website or ordered from the IRS. Ensure you have the correct version for the tax year in which you are filing.

- Complete the form: Fill out Form 1098 with the required information, including the lender’s and borrower’s names, addresses, taxpayer identification numbers (TINs), and the amount of mortgage interest received.

- Distribute copies: Provide a copy of Form 1098 to the borrower by January 31. File a copy with the IRS by February 28 if filing by mail or by March 31 if filing electronically.

- Submit the form: If filing electronically, use the IRS’s FIRE (Filing Information Returns Electronically) system. If filing by mail, send the form to the address provided in the instructions.

How To Fill Out Form 1098?

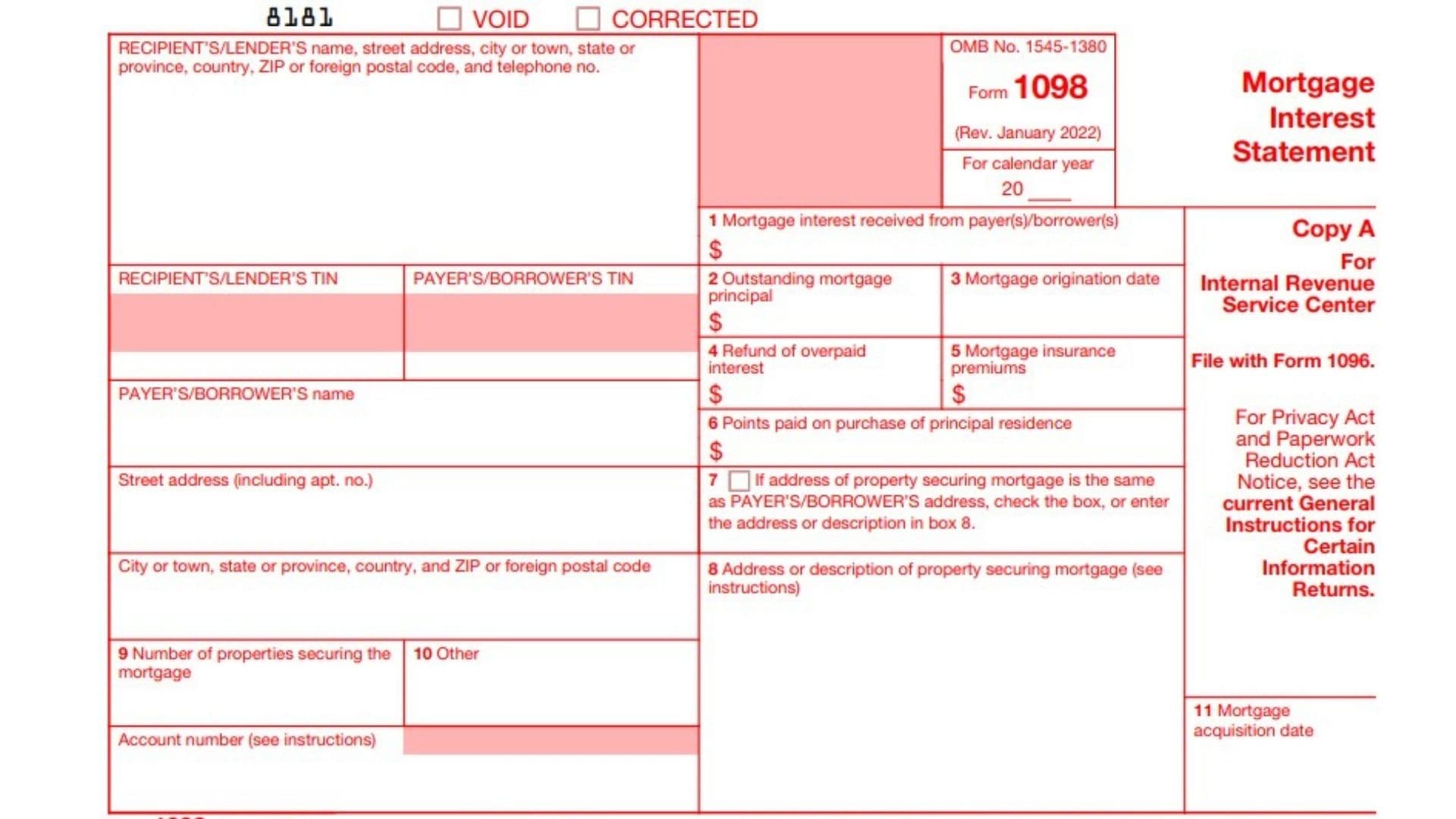

Filling out Form 1098 requires accurate and detailed information about the mortgage interest received. The form is divided into several sections, each addressing different aspects of the mortgage and interest payments.

- Box 1 – Mortgage Interest Received:

- Enter the total amount of mortgage interest received from the borrower during the tax year.

- Box 2 – Outstanding Mortgage Principal:

- Enter the outstanding principal on the mortgage as of January 1 of the tax year.

- Box 3 – Mortgage Origination Date:

- Enter the date the mortgage was originated.

- Box 4 – Refund of Overpaid Interest:

- Enter any refund of overpaid interest made during the tax year.

- Box 5 – Mortgage Insurance Premiums:

- Enter the total amount of mortgage insurance premiums received from the borrower.

- Box 6 – Points Paid on Purchase of Principal Residence:

- Enter the total points paid by the borrower for the purchase of the principal residence, if applicable.

- Box 7 – Address of Property Securing Mortgage:

- Enter the address of the property securing the mortgage.

- Box 8 – Other:

- Use this box for any other information that the lender needs to report.

- Box 9 – Number of Properties Securing Mortgage:

- Enter the number of properties securing the mortgage if more than one.

- Box 10 – Other Information:

- Use this box for additional information required by the IRS or to clarify any entries on the form.

Ensure all information is accurate and complete. Double-check calculations and ensure that the interest received and other amounts are correctly reported. If needed, seek assistance from a tax professional to ensure the form is filled out correctly and submitted on time.

Additional Information

Understanding the specific rules and implications of filing Form 1098 is essential for both lenders and borrowers.

Mortgage Interest Deduction: Borrowers use the information on Form 1098 to claim a mortgage interest deduction on their federal income tax return. The deduction is reported on Schedule A (Form 1040), Itemized Deductions. This deduction can significantly reduce taxable income, providing substantial tax savings.

Reporting Requirements: Lenders must report mortgage interest of $600 or more received during the tax year. This includes interest on mortgages secured by real property, such as homes, condominiums, mobile homes, and land. Failure to file Form 1098 can result in penalties.

Record Keeping: Both lenders and borrowers should maintain accurate records of all mortgage transactions. Lenders should keep records of interest received, refunds of overpaid interest, points paid, and other relevant information. Borrowers should keep copies of Form 1098 and other mortgage documents to substantiate their mortgage interest deduction.

Penalties and Interest: Failure to file Form 1098 on time or to accurately report interest received can result in penalties and interest. Ensure that all filing and payment deadlines are met to avoid these additional costs.

Mortgage Insurance Premiums: Mortgage insurance premiums paid by the borrower are reported in Box 5 of Form 1098. These premiums may be deductible as mortgage interest, subject to certain income limitations and phase-outs.

Points Paid: Points paid by the borrower for the purchase of a principal residence are reported in Box 6 of Form 1098. These points may be deductible in the year paid, provided certain conditions are met.

Changes in Tax Law: The rules and regulations governing the mortgage interest deduction and the reporting requirements for Form 1098 can change. Stay informed about any legislative updates that may impact your tax planning and compliance.