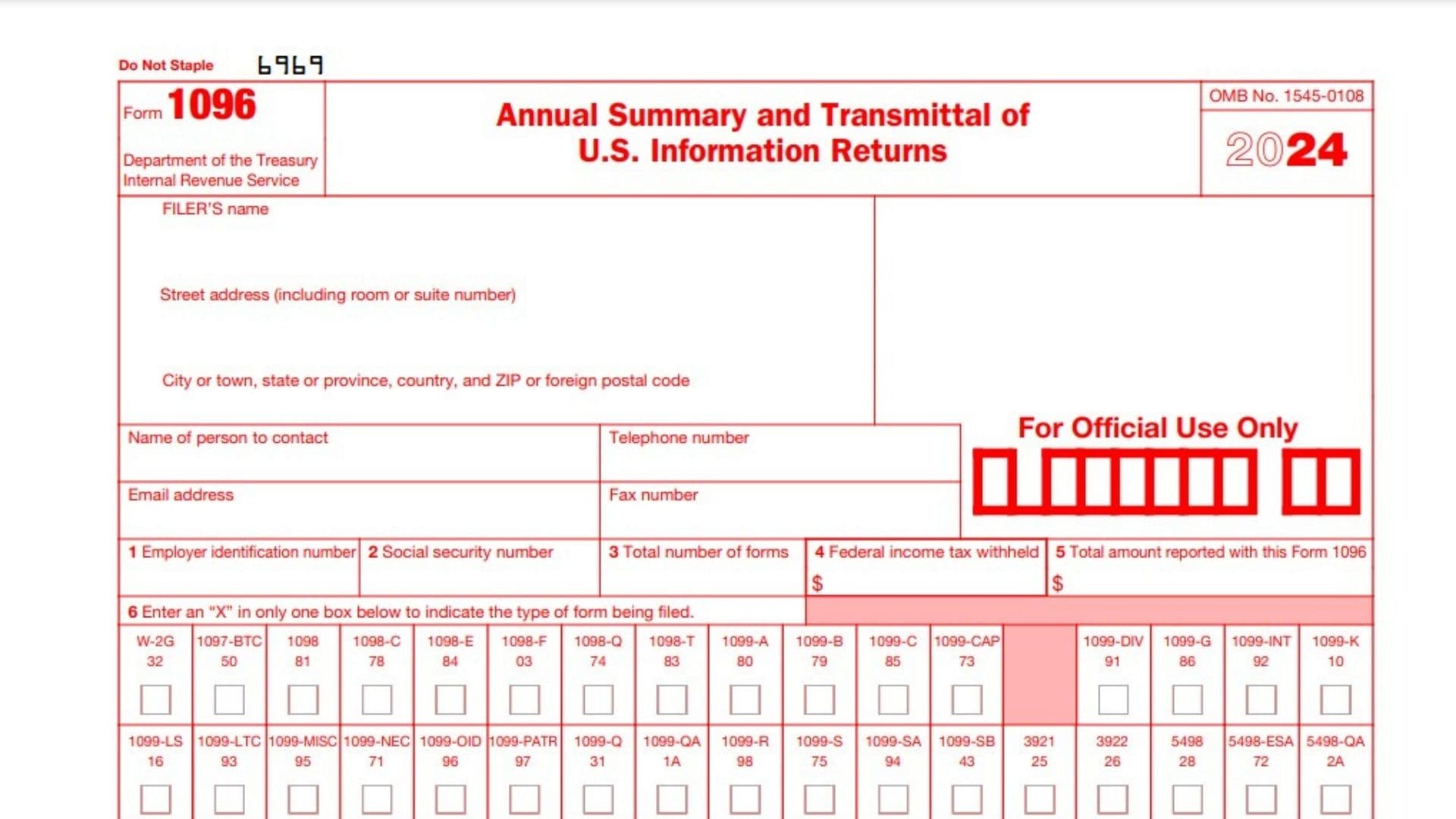

IRS Form 1096, titled “Annual Summary and Transmittal of U.S. Information Returns,” is used to summarize and transmit information returns filed with the IRS. Each type of information return requires a separate Form 1096. For example, if you file Forms 1099-INT and 1099-MISC, each set must have its own Form 1096 attached. This form is typically used by businesses, organizations, and individuals who file paper forms with the IRS.

Who Must File IRS Form 1096?

You must file Form 1096 if:

- You are submitting paper copies of information returns, such as Forms 1099, 1098, or W-2G.

- You are transmitting any of the information returns listed in Box 6 of Form 1096.

Important Note: If you file 250 or more information returns of a single type, you are required to file them electronically instead of using Form 1096.

How to Complete Form 1096?

- Header Information:

- Filer’s Name and Address: Enter your name, business name (if applicable), and complete mailing address, including room, suite, or apartment number.

- Name of Contact Person: Include the name of a person the IRS can contact regarding this submission.

- Telephone and Fax Numbers: Provide the phone and fax numbers of the contact person.

- Email Address: Enter the contact person’s email address.

- Box 1 – Employer Identification Number (EIN):

- Enter your EIN here. If you don’t have an EIN and you’re filing as an individual, skip this box and complete Box 2 instead.

- Box 2 – Social Security Number (SSN):

- Enter your SSN here if you do not have an EIN. Do not enter information in both Box 1 and Box 2.

- Box 3 – Total Number of Forms:

- Enter the total number of information return forms being transmitted with this Form 1096. Do not include voided or blank forms.

- Box 4 – Federal Income Tax Withheld:

- Enter the total amount of federal income tax withheld as reported on the accompanying information returns.

- Box 5 – Total Amount Reported:

- Enter the total of all amounts reported on the accompanying information returns. This could include gross income, payments, or distributions, depending on the type of form filed.

- Box 6 – Type of Form:

- Place an “X” in the box corresponding to the type of information return being transmitted. Only one type of form can be transmitted per Form 1096. For example:

- Form 1099-MISC: Box 95

- Form 1099-NEC: Box 71

- Form 1099-INT: Box 92

- Form W-2G: Box 32

- Place an “X” in the box corresponding to the type of information return being transmitted. Only one type of form can be transmitted per Form 1096. For example:

- Signature:

- Sign and date the form under the penalties of perjury declaration, confirming that the information provided is true, correct, and complete.

- Transmitting Information:

- Group information returns by form type, and include one Form 1096 for each group. For example, if filing both Form 1099-MISC and Form 1099-INT, prepare separate Form 1096s for each group.

- Mailing Instructions:

- Submit Form 1096 with the accompanying information returns to the IRS address corresponding to your location, as specified in the instructions. Use a flat mailer (not folded) to send the forms.