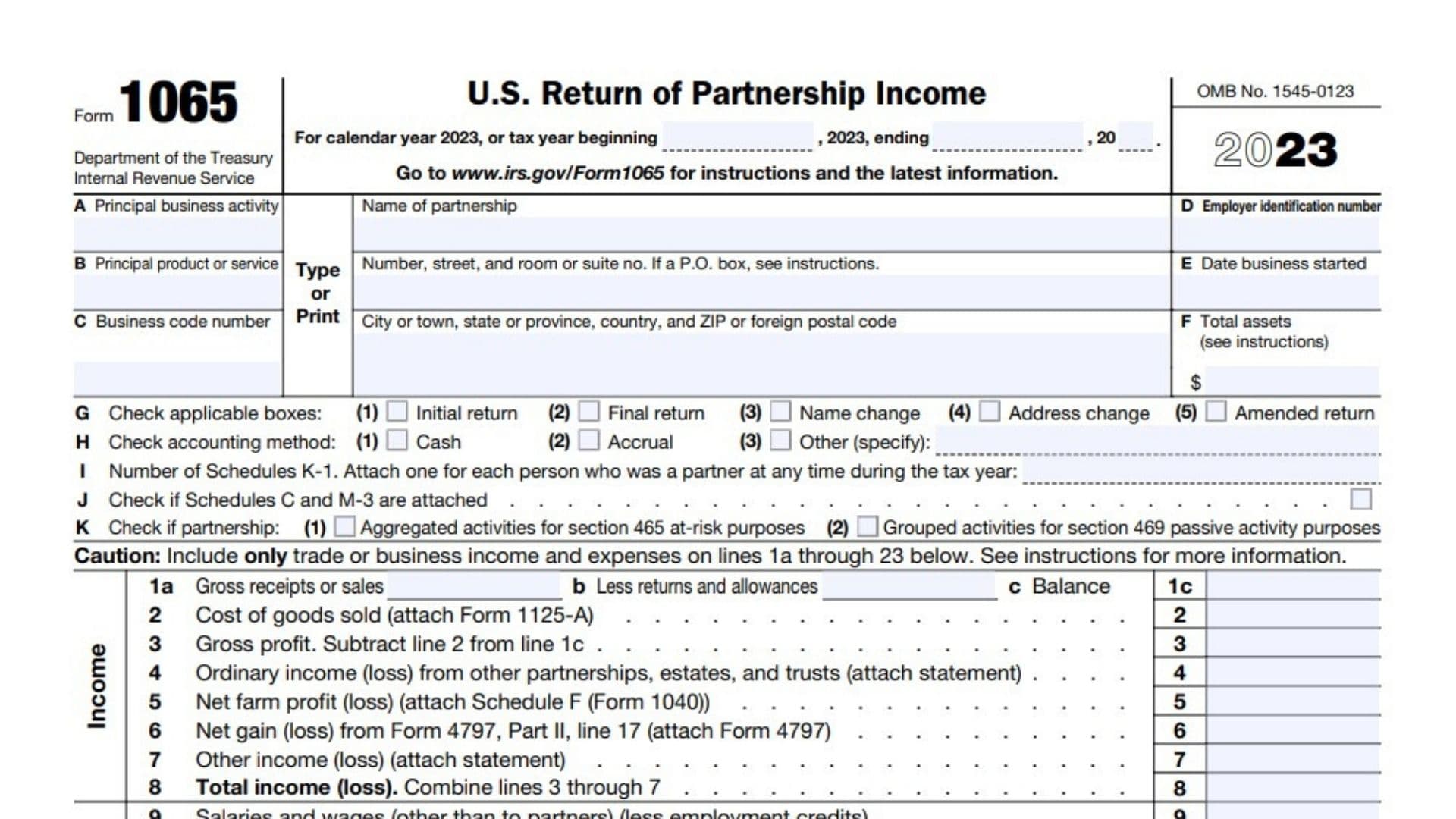

IRS Form 1065 is used by partnerships to report their income, gains, losses, deductions, and credits for federal tax purposes. The form consists of several sections and schedules that capture various aspects of the partnership’s financial activities and structure. This article provides comprehensive line-by-line instructions for completing IRS Form 1065, the U.S. Return of Partnership Income. By following these line-by-line instructions, partnerships can accurately complete Form 1065 and provide the IRS with a comprehensive picture of their financial activities and structure for the tax year.

Page 1

Top Section: General Information

- Name of partnership: Enter the legal name of your partnership.

- Address: Include the street address, city, state, and ZIP or foreign postal code. If using a P.O. box, refer to specific instructions.

- Principal business activity (A): Describe the main activity of the partnership.

- Principal product or service (B): Enter the primary product or service your business provides.

- Business code number (C): Use the business code found in the IRS instructions for partnerships.

- Employer identification number (D): Enter the EIN issued to the partnership by the IRS.

- Date business started (E): Provide the date the partnership was formed.

- Total assets (F): Enter the total assets as of the end of the tax year. Check the instructions for specifics on asset reporting.

Checkboxes (G through K): 9. Check any applicable boxes, such as if this is an initial return, final return, name change, address change, or amended return (G). 10. Choose the accounting method (cash, accrual, or other) (H). 11. List the number of partners for whom you’re attaching Schedule K-1 (I).

Income

Lines 1a–8: Report Your Partnership’s Income

- Line 1a: Enter gross receipts or sales.

- Line 1b: Enter any returns and allowances.

- Line 1c: Subtract line 1b from 1a to get the balance.

- Line 2: Report the cost of goods sold (you’ll need to attach Form 1125-A).

- Line 3: Subtract line 2 from line 1c to calculate gross profit.

- Line 4: Report any ordinary income or loss from other partnerships, estates, or trusts.

- Line 5: Include net farm profit or loss, if applicable (use Schedule F from Form 1040).

- Line 6: Report gains or losses from sales or exchanges (attach Form 4797).

- Line 7: Enter any other income or loss (attach a statement for specifics).

- Line 8: Total your partnership’s income by combining lines 3 through 7.

Deductions

Lines 9–23: Deduct Expenses Incurred by the Partnership

- Line 9: Report salaries and wages (excluding payments to partners).

- Line 10: Report guaranteed payments made to partners.

- Line 11: Enter the amount spent on repairs and maintenance.

- Line 12: Deduct bad debts, if applicable.

- Line 13: Report rent expenses.

- Line 14: Enter taxes and licenses paid.

- Line 15: Report interest expenses (follow specific instructions for this).

- Line 16a: Deduct depreciation by attaching Form 4562, if required.

- Line 17: Report depletion (except for oil and gas depletion).

- Line 18: Enter retirement plan contributions.

- Line 19: Deduct employee benefit programs costs.

- Line 20: Deduct any energy-efficient building deductions (attach Form 7205).

- Line 21: Include any other deductions (attach a statement for specifics).

- Line 22: Add the total deductions for lines 9 through 21.

- Line 23: Subtract line 22 from line 8 to calculate ordinary business income or loss.

Tax and Payments

Lines 24–32: Compute Tax Due

- Line 24: Enter any interest due under the look-back method for long-term contracts (attach Form 8697).

- Line 25: Enter interest due under the income forecast method (attach Form 8866).

- Line 26: Report any imputed underpayments (see instructions for BBA AAR).

- Line 27: Include other taxes owed.

- Line 28: Add lines 24 through 27 to calculate the total balance due.

- Line 29: Report elective payment election amounts from Form 3800.

- Line 30: Include any payments made.

- Line 31: If the amount on line 30 is smaller than line 28, enter the amount owed.

- Line 32: If line 30 exceeds line 28, report the overpayment.

Signature

- Ensure a partner or limited liability company member signs the form, certifying its accuracy under penalty of perjury.

- If a paid preparer was used, they must provide their signature and relevant details, including PTIN and firm information.

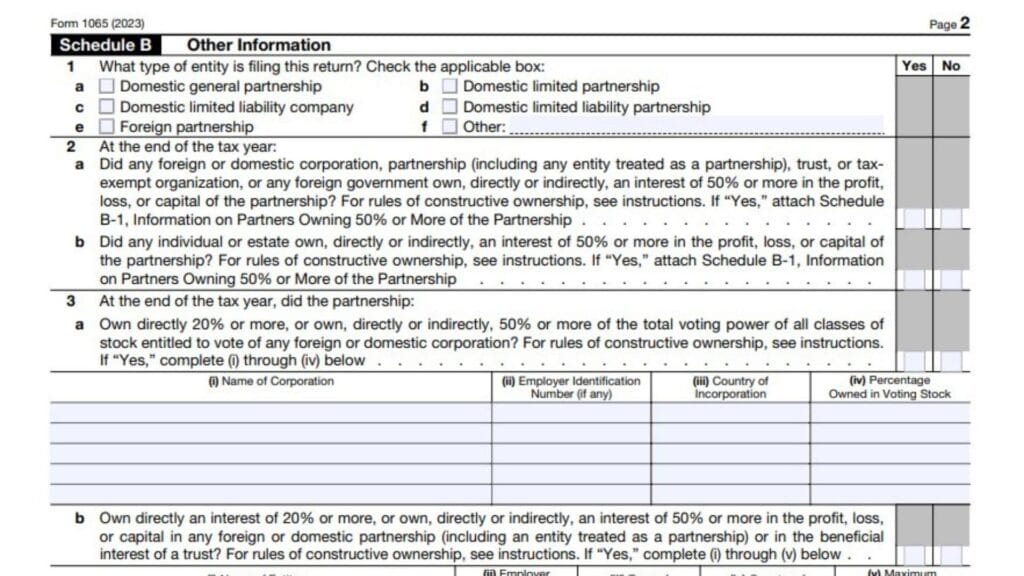

Page 2 (Continued)

Schedule B – Other Information

Questions 1–29: Answer Yes or No

- Type of entity filing this return:

- Choose the appropriate entity type, such as domestic general partnership, domestic limited partnership, domestic limited liability company, foreign partnership, etc.

- Ownership at the end of the tax year:

- 2a: Did any entity or organization (foreign or domestic) own 50% or more of the partnership’s profit, loss, or capital? If “Yes,” attach Schedule B-1 for additional details.

- 2b: Did any individual or estate own 50% or more? If “Yes,” attach Schedule B-1.

- Partnership’s ownership in other entities:

- 3a: Did the partnership own 20% or more of any domestic or foreign corporation’s stock? If so, complete information on that ownership, including name, EIN, country of incorporation, and percentage owned.

- 3b: Did the partnership own 20% or more of any other partnership’s interest in profit, loss, or capital? If so, complete the same details for that entity.

- Qualifying for filing exceptions:

- If the partnership’s receipts were less than $250,000 and assets were below $1 million, and Schedule K-1s were filed on time, and no Schedule M-3 is required, answer Yes. If “Yes,” the partnership is not required to complete Schedules L, M-1, or M-2.

- Publicly traded partnership:

- Answer whether the partnership is classified as a publicly traded partnership under section 469(k)(2).

- Debt cancellation:

- Indicate if the partnership had any debt that was forgiven or canceled.

- Material Advisor Disclosure Statement:

- Report whether Form 8918, regarding reportable transactions, was filed or required to be filed.

- Foreign accounts:

- Did the partnership have signature authority over a foreign financial account? If yes, FinCEN Form 114 may be required.

- Foreign trust transactions:

- Report whether the partnership received a distribution from, or was the grantor of, a foreign trust.

- Section 754 election:

- Indicate if the partnership made a Section 754 election, and provide the effective date.

- Like-kind exchanges:

- Check if any property received from a like-kind exchange was distributed or contributed to another entity.

- Tenancy-in-common or undivided interest:

- Report whether the partnership distributed any undivided interest in property.

- Enter the number of Forms 8858 (related to foreign disregarded entities or branches) attached to the return.

- Foreign partners:

- Enter the number of Forms 8805 (withholding tax statements for foreign partners) attached.

- Forms 8865:

- Report the number of Forms 8865 (for U.S. persons in foreign partnerships) attached.

- 1099 reporting:

- Indicate whether payments were made that require filing Form(s) 1099, and whether you filed or will file them.

- Forms 5471:

- Enter the number of Forms 5471 attached, relating to U.S. persons with respect to certain foreign corporations.

- Foreign governments as partners:

- Indicate the number of partners that are foreign governments under section 892.

- Forms 1042 and 1042-S:

- Report whether the partnership made any payments that would require filing Forms 1042 and 1042-S for withholding on foreign income.

- Specified domestic entity:

- Indicate whether the partnership was required to file Form 8938 for the tax year (for foreign assets).

- Section 721(c) partnership:

- Check if the partnership is defined as a section 721(c) partnership under Regulations section 1.721(c)-1(b)(14).

- Disallowed deductions under Section 267A:

- Indicate if there were any interest or royalty payments where deductions were disallowed under section 267A.

- Section 163(j) election:

- Report whether the partnership made an election for any real property trade or business or farming business under section 163(j).

- Interest expense and tax shelter:

- If the partnership meets the business interest expense and tax shelter conditions, indicate this and file Form 8990.

- Qualified Opportunity Fund certification:

- Indicate if the partnership is certifying as a Qualified Opportunity Fund by attaching Form 8996.

- Foreign partners under section 864(c)(8):

- Report any transfers of partnership interest or distributions affecting foreign partners, requiring Schedule K-3 (Form 1065).

- Regulations section 1.707-8 transfers:

- Indicate whether the partnership had any transfers subject to disclosure under this section.

- Foreign corporation acquisition:

- Report if a foreign corporation acquired substantially all the trade or business of the partnership.

29. Excise Tax on Repurchase of Corporate Stock:

Indicate whether the partnership is required to file Form 7208 relating to the excise tax on repurchase of corporate stock:

- Line 29a: Under the applicable foreign corporation rules?

- Line 29b: Under the covered surrogate foreign corporation rules?

30. Election Out of the Centralized Partnership Audit Regime:

State whether the partnership is electing out of the centralized partnership audit regime under section 6221(b):

- If “Yes,” complete Schedule B-2 (Form 1065) and enter the total from Schedule B-2, Part III, line 3.

Designation of Partnership Representative:

Provide the information for the partnership representative (PR) for the tax year covered by this return:

- Enter the name, U.S. address, and U.S. phone number of the PR.

- If the PR is an entity, also include the name of the designated individual for the PR, along with their U.S. address and phone number.

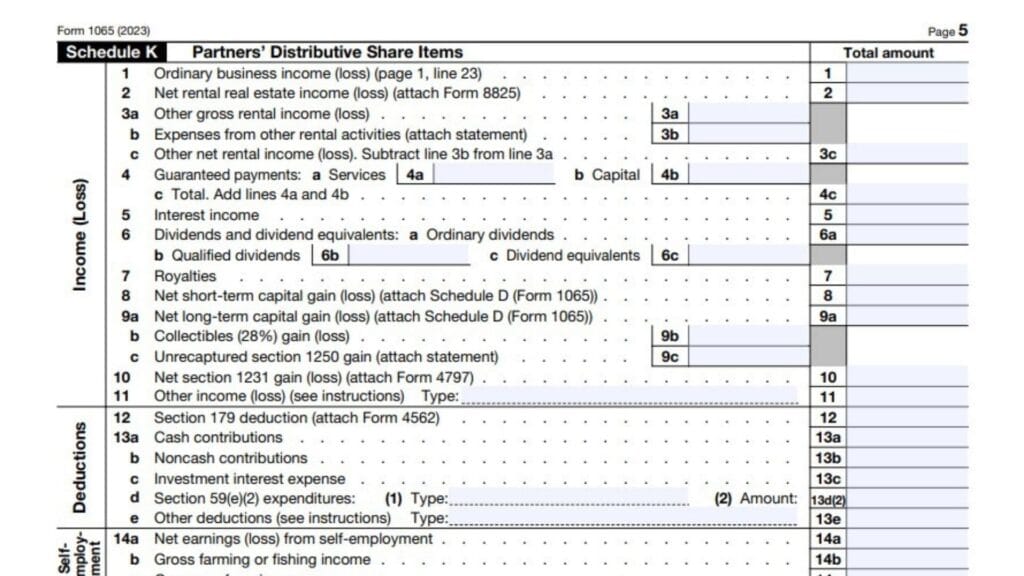

Schedule K is used to report the partnership’s income, deductions, credits, and other items that are distributed to the partners based on their share of the partnership. Each partner’s share of these items will also be reported individually on Schedule K-1.

Income (Loss) (Lines 1–11)

- Line 1 – Ordinary Business Income (Loss):

- Enter the partnership’s ordinary income or loss from line 23 of Form 1065. This is the net income or loss from the partnership’s trade or business activities.

- Line 2 – Net Rental Real Estate Income (Loss):

- Report the partnership’s net income or loss from rental real estate activities. Use Form 8825 to calculate this amount and attach it to Form 1065.

- Line 3 – Other Net Rental Income (Loss):

- Line 3a – Other Gross Rental Income (Loss): Report any gross income or loss from other rental activities (not related to real estate).

- Line 3b – Expenses from Other Rental Activities: Deduct expenses related to these other rental activities.

- Line 3c – Other Net Rental Income (Loss): Subtract line 3b from line 3a to calculate the net rental income or loss.

- Line 4 – Guaranteed Payments:

- Line 4a – Guaranteed Payments for Services: Enter the guaranteed payments made to partners for services provided.

- Line 4b – Guaranteed Payments for Use of Capital: Report guaranteed payments made to partners for the use of capital.

- Line 4c – Total Guaranteed Payments: Add lines 4a and 4b to calculate the total guaranteed payments made to partners.

- Line 5 – Interest Income:

- Report any interest income earned by the partnership during the year.

- Line 6 – Dividends and Dividend Equivalents:

- Line 6a – Ordinary Dividends: Enter the total ordinary dividends received.

- Line 6b – Qualified Dividends: Report the portion of the dividends that are qualified for the lower capital gains tax rate.

- Line 6c – Dividend Equivalents: Report any dividend equivalent payments received.

- Line 7 – Royalties:

- Report any royalties received by the partnership.

- Line 8 – Net Short-Term Capital Gain (Loss):

- Include the net short-term capital gains or losses from the sale of capital assets held for one year or less. Attach Schedule D (Form 1065).

- Line 9 – Net Long-Term Capital Gain (Loss):

- Line 9a – Net Long-Term Capital Gain (Loss): Report the net long-term capital gains or losses from the sale of capital assets held for more than one year. Attach Schedule D (Form 1065).

- Line 9b – Collectibles (28%) Gain (Loss): Enter any gains or losses from the sale of collectibles, which are subject to a 28% tax rate.

- Line 9c – Unrecaptured Section 1250 Gain: Report any unrecaptured section 1250 gain (related to depreciation on real property). Attach a statement showing the details of this gain.

- Line 10 – Net Section 1231 Gain (Loss):

- Include any gains or losses from the sale of business property. Attach Form 4797 if required.

- Line 11 – Other Income (Loss):

- Report any other income or loss not included in the previous categories. Specify the type of income or loss (e.g., gambling winnings, cancellation of debt income).

Deductions (Lines 12–13)

- Line 12 – Section 179 Deduction:

- Report the Section 179 expense deduction claimed for depreciable property used in the partnership’s trade or business. Attach Form 4562 if required.

- Line 13 – Other Deductions:

- Line 13a – Cash Contributions: Report cash charitable contributions made by the partnership. Include contributions to qualified organizations under Section 170.

- Line 13b – Noncash Contributions: Report the fair market value of noncash property contributions made to qualified charitable organizations. Attach a detailed statement if the value exceeds $500.

- Line 13c – Investment Interest Expense: Report the amount of interest paid on loans to acquire or carry investment property.

- Line 13d – Section 59(e)(2) Expenditures: Report any qualified expenditures you elect to amortize under Section 59(e)(2) (e.g., research and experimental expenditures). Specify the type and amount of the expenditure.

- Line 13e – Other Deductions: Include any other deductions not reported elsewhere. Specify the type of deduction on an attached statement (e.g., business meals, business use of home).

Self-Employment (Lines 14a–14c)

- Line 14a – Net Earnings (Loss) from Self-Employment:

- Report each partner’s share of net earnings or loss from self-employment, excluding rental income from real estate and other passive activities.

- Line 14b – Gross Farming or Fishing Income:

- Enter the partnership’s gross income from farming or fishing activities.

- Line 14c – Gross Nonfarm Income:

- Report gross nonfarm income from other self-employment activities.

Credits (Lines 15a–15f)

- Line 15a – Low-Income Housing Credit (Section 42(j)(5)):

- Report any low-income housing credits the partnership is claiming under Section 42(j)(5) for qualified housing projects.

- Line 15b – Low-Income Housing Credit (Other):

- Enter any other low-income housing credits the partnership is claiming.

- Line 15c – Qualified Rehabilitation Expenditures (Rental Real Estate):

- Report the partnership’s qualified rehabilitation expenditures for rental real estate. Attach Form 3468 if applicable.

- Line 15d – Other Rental Real Estate Credits:

- Specify any other rental real estate credits being claimed and report them on this line.

- Line 15e – Other Rental Credits:

- Report any other rental credits being claimed by the partnership. Attach statements to explain.

- Line 15f – Other Credits:

- Report any additional credits not listed above (e.g., credits for energy-efficient buildings, small employer health insurance premiums).

International (Line 16)

- Line 16 – Partners’ Distributive Share Items—International:

- Attach Schedule K-2 to report any international tax items relevant to the partnership. Check the box to indicate that this section includes international tax information.

Alternative Minimum Tax (AMT) Items (Lines 17a–17f)

- Line 17a – Post-1986 Depreciation Adjustment:

- Report any adjustments related to depreciation for AMT purposes.

- Line 17b – Adjusted Gain or Loss:

- Report any adjusted gain or loss for AMT purposes.

- Line 17c – Depletion (Other Than Oil and Gas):

- Include any depletion amounts other than those related to oil and gas properties.

- Line 17d – Oil, Gas, and Geothermal Properties—Gross Income:

- Report gross income from oil, gas, and geothermal properties.

- Line 17e – Oil, Gas, and Geothermal Properties—Deductions:

- Report deductions related to oil, gas, and geothermal properties.

- Line 17f – Other AMT Items:

- Attach a statement listing any other items affecting AMT.

Other Information (Lines 18a–20b)

- Line 18a – Tax-Exempt Interest Income:

- Report any tax-exempt interest income earned by the partnership.

- Line 18b – Other Tax-Exempt Income:

- Include any other tax-exempt income not related to interest.

- Line 18c – Nondeductible Expenses:

- Report any expenses that are not deductible for tax purposes, such as fines, penalties, or political contributions.

- Line 19a – Distributions of Cash and Marketable Securities:

- Report any distributions of cash or marketable securities made to partners.

- Line 19b – Distributions of Other Property:

- Include any distributions of noncash property made to partners.

- Line 20a – Investment Income:

- Report each partner’s share of the partnership’s investment income.

- Line 20b – Investment Expenses:

- Include each partner’s share of investment-related expenses.

Foreign Taxes (Line 21)

- Line 21 – Total Foreign Taxes Paid or Accrued:

- Report the total foreign taxes paid or accrued by the partnership during the tax year.

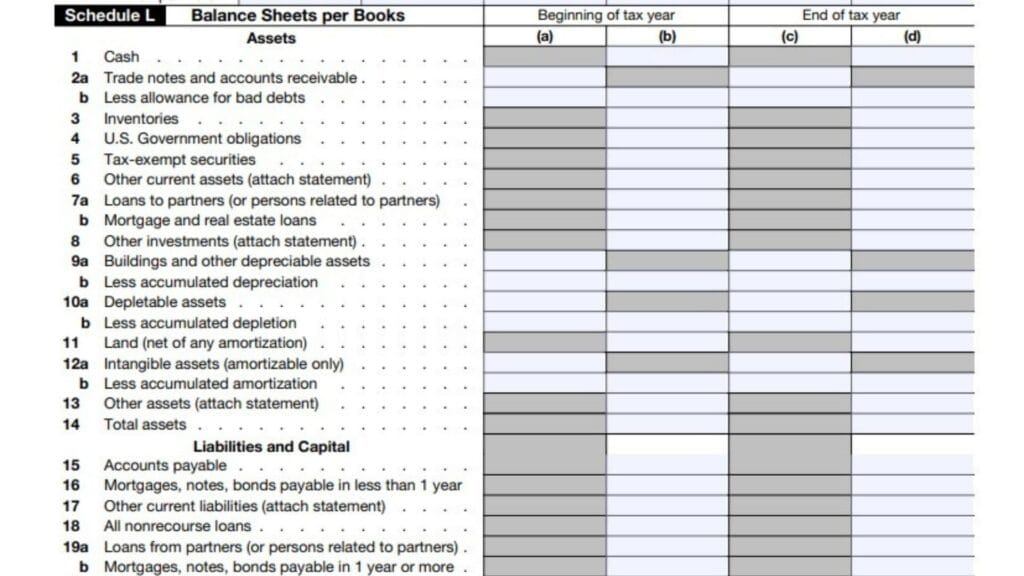

Schedule L – Balance Sheets per Books

Schedule L is used to report the partnership’s assets, liabilities, and capital as reflected in the partnership’s books at the beginning and end of the tax year.

Assets (Lines 1–14)

- Line 1 – Cash:

- Enter the amount of cash the partnership had on hand at the beginning (column (b)) and end of the tax year (column (d)).

- Line 2a – Trade Notes and Accounts Receivable:

- Report the total amount of trade notes and accounts receivable before deducting allowances for bad debts.

- Line 2b – Less Allowance for Bad Debts:

- Enter the amount set aside as an allowance for bad debts.

- Line 3 – Inventories:

- Enter the value of inventories on hand at the beginning and end of the tax year.

- Line 4 – U.S. Government Obligations:

- Report the value of U.S. government obligations held at the beginning and end of the year.

- Line 5 – Tax-Exempt Securities:

- Include the value of tax-exempt securities held by the partnership.

- Line 6 – Other Current Assets:

- Report other current assets not included in the previous lines (e.g., prepaid expenses). Attach a statement detailing these assets.

- Line 7a – Loans to Partners (or Persons Related to Partners):

- Enter the value of loans made to partners or related persons.

- Line 7b – Mortgage and Real Estate Loans:

- Report the total amount of mortgage and real estate loans.

- Line 8 – Other Investments:

- Include other investments, such as stocks and bonds. Attach a statement detailing these assets.

- Line 9a – Buildings and Other Depreciable Assets:

- Report the cost of buildings and other depreciable assets.

- Line 9b – Less Accumulated Depreciation:

- Deduct the accumulated depreciation related to buildings and depreciable assets.

- Line 10a – Depletable Assets:

- Enter the cost of depletable assets, such as natural resources.

- Line 10b – Less Accumulated Depletion:

- Deduct accumulated depletion for the depletable assets.

- Line 11 – Land (Net of Any Amortization):

- Report the value of land, excluding any amortization.

- Line 12a – Intangible Assets (Amortizable Only):

- Report the total cost of amortizable intangible assets (e.g., patents, copyrights).

- Line 12b – Less Accumulated Amortization:

- Deduct the accumulated amortization of intangible assets.

- Line 13 – Other Assets:

- Report any other assets not included in the categories above. Attach a statement if necessary.

- Line 14 – Total Assets:

- Add lines 1 through 13 to report total assets at the beginning and end of the year.

Liabilities and Capital (Lines 15–22)

- Line 15 – Accounts Payable:

- Report the partnership’s total accounts payable at the beginning and end of the tax year.

- Line 16 – Mortgages, Notes, Bonds Payable in Less Than 1 Year:

- Include the total value of mortgages, notes, and bonds payable within one year.

- Line 17 – Other Current Liabilities:

- Report other current liabilities (e.g., accrued expenses) not listed elsewhere.

- Line 18 – All Nonrecourse Loans:

- Include the value of all nonrecourse loans.

- Line 19a – Loans from Partners (or Persons Related to Partners):

- Report any loans from partners or persons related to partners.

- Line 19b – Mortgages, Notes, Bonds Payable in 1 Year or More:

- Include the total value of long-term debt, such as mortgages, notes, and bonds payable beyond one year.

- Line 20 – Other Liabilities:

- Include any other liabilities not categorized elsewhere. Attach a statement if necessary.

- Line 21 – Partners’ Capital Accounts:

- Report the total partners’ capital accounts at the beginning and end of the tax year. This figure includes capital contributed by partners, net income or loss, and any distributions.

- Line 22 – Total Liabilities and Capital:

- Add lines 15 through 21 to calculate the total liabilities and capital for the beginning and end of the tax year.

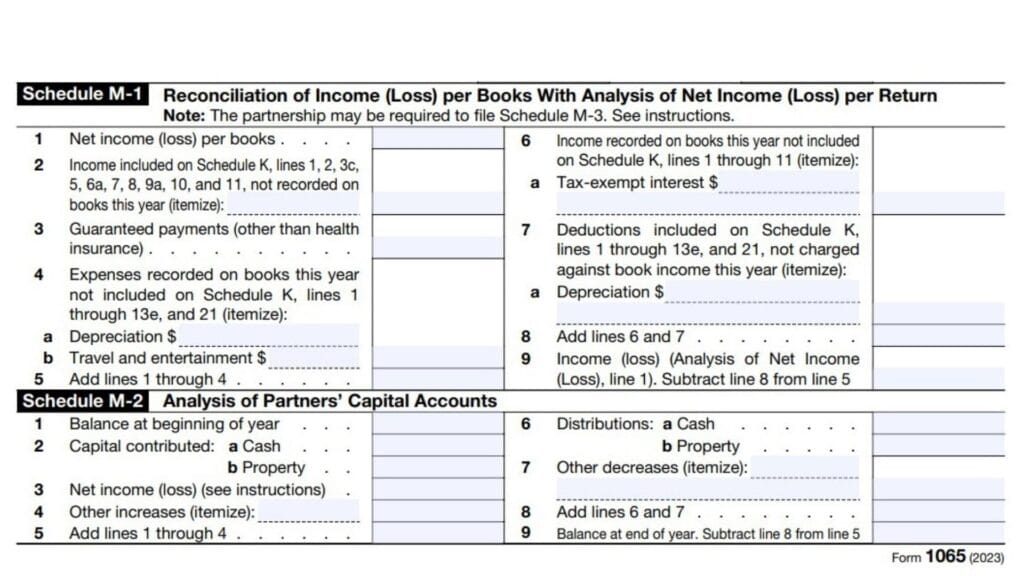

Schedule M-1 – Reconciliation of Income (Loss) per Books with Income (Loss) per Return

Schedule M-1 reconciles the income or loss per the partnership’s financial books with the income or loss reported on Form 1065.

Schedule M-1 Instructions

- Line 1 – Net Income (Loss) per Books:

- Enter the partnership’s net income or loss as reported on its financial books.

- Line 2 – Income Included on Schedule K, Lines 1, 2, 3c, 5, 6a, 7, 8, 9a, 10, and 11, Not Recorded on Books This Year:

- Report any income included on Schedule K but not recorded on the partnership’s books during the year. For example, this might include tax-exempt income.

- Line 3 – Guaranteed Payments (Other Than Health Insurance):

- Enter the total amount of guaranteed payments made to partners. Do not include guaranteed payments related to health insurance.

- Line 4 – Expenses Recorded on Books This Year Not Included on Schedule K, Lines 1 Through 13e, and 21 (Itemize):

- Line 4a – Depreciation: Report depreciation recorded in the partnership’s books but not included on Schedule K.

- Line 4b – Travel and Entertainment: Include travel and entertainment expenses that were recorded on the books but not reported on Schedule K.

- Line 5 – Add Lines 1 Through 4:

- Add together the amounts from lines 1 through 4. This gives the total book income adjusted for income and expenses not included on Schedule K.

- Line 6 – Income Recorded on Books This Year Not Included on Schedule K, Lines 1 Through 11 (Itemize):

- Line 6a – Tax-Exempt Interest: Report any tax-exempt interest income that was recorded in the partnership’s books but not included on Schedule K.

- Line 7 – Deductions Included on Schedule K, Lines 1 Through 13e, and 21, Not Charged Against Book Income This Year (Itemize):

- Line 7a – Depreciation: Report any depreciation that was deducted on Schedule K but not charged against book income this year.

- Line 8 – Add Lines 6 and 7:

- Add together the amounts from lines 6 and 7 to get the total of income and deductions not included in book income.

- Line 9 – Income (Loss) (Analysis of Net Income (Loss), Line 1). Subtract Line 8 from Line 5:

- Subtract the total from line 8 from the total on line 5 to reconcile book income with the income reported on Form 1065.

Schedule M-2 – Analysis of Partners’ Capital Accounts

Schedule M-2 reports changes in the partners’ capital accounts throughout the year. This schedule shows how the beginning balance in the capital accounts changes due to contributions, distributions, income, losses, and other factors.

Schedule M-2 Instructions

- Line 1 – Balance at Beginning of Year:

- Enter the total balance in the partners’ capital accounts at the beginning of the year. This amount should match the ending balance from the previous year’s Schedule M-2 or Schedule L (partners’ capital accounts).

- Line 2 – Capital Contributed During Year:

- Line 2a – Cash:

Report the total amount of cash contributions made by the partners during the year. - Line 2b – Property:

Include the fair market value of any non-cash property contributed by partners during the year.

- Line 2a – Cash:

- Line 3 – Net Income (Loss) (See Instructions):

- Enter the partnership’s net income or loss for the year. This amount should correspond to the net income or loss reported on Schedule K, line 1.

- Line 4 – Other Increases (Itemize):

- Report any other increases to partners’ capital accounts not covered in the previous lines. Examples include adjustments for changes in partners’ interests or unrealized gains. Attach a statement to itemize these increases.

- Line 5 – Add Lines 1 Through 4:

- Add the amounts from lines 1 through 4. This gives the total capital account balance before any distributions or decreases are accounted for.

- Line 6 – Distributions:

- Line 6a – Cash:

Report the total amount of cash distributions made to partners during the year. - Line 6b – Property:

Enter the fair market value of any non-cash property distributions made to partners during the year.

- Line 6a – Cash:

- Line 7 – Other Decreases (Itemize):

- Include any other decreases to partners’ capital accounts not covered in the previous lines. This might include adjustments for changes in partners’ interests or unrealized losses. Attach a statement to itemize these decreases.

- Line 8 – Add Lines 6 and 7:

- Add the total amounts from lines 6 and 7. This gives the total amount of distributions and other decreases.

- Line 9 – Balance at End of Year (Subtract Line 8 From Line 5):

- Subtract the total from line 8 from the total on line 5 to get the balance in the partners’ capital accounts at the end of the year. This figure should match the partners’ capital accounts reported on Schedule L, line 21.