IRS Form 1042 is the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. This form is required to report and pay withholding taxes on certain types of income paid to foreign persons, including non-resident aliens and foreign entities. The types of income that may be reported on Form 1042 include fixed or determinable annual or periodic (FDAP) income such as dividends, interest, rents, and royalties. Entities that are considered “withholding agents,” which include U.S. businesses and financial institutions making payments to foreign persons, must file this form. Filing is typically done annually, with the due date falling on March 15 of the year following the tax year in which the payments were made. To file Form 1042, withholding agents must complete the form accurately, report all relevant income and tax liabilities, and submit it to the IRS along with any required payments.

How to Complete Form 1042?

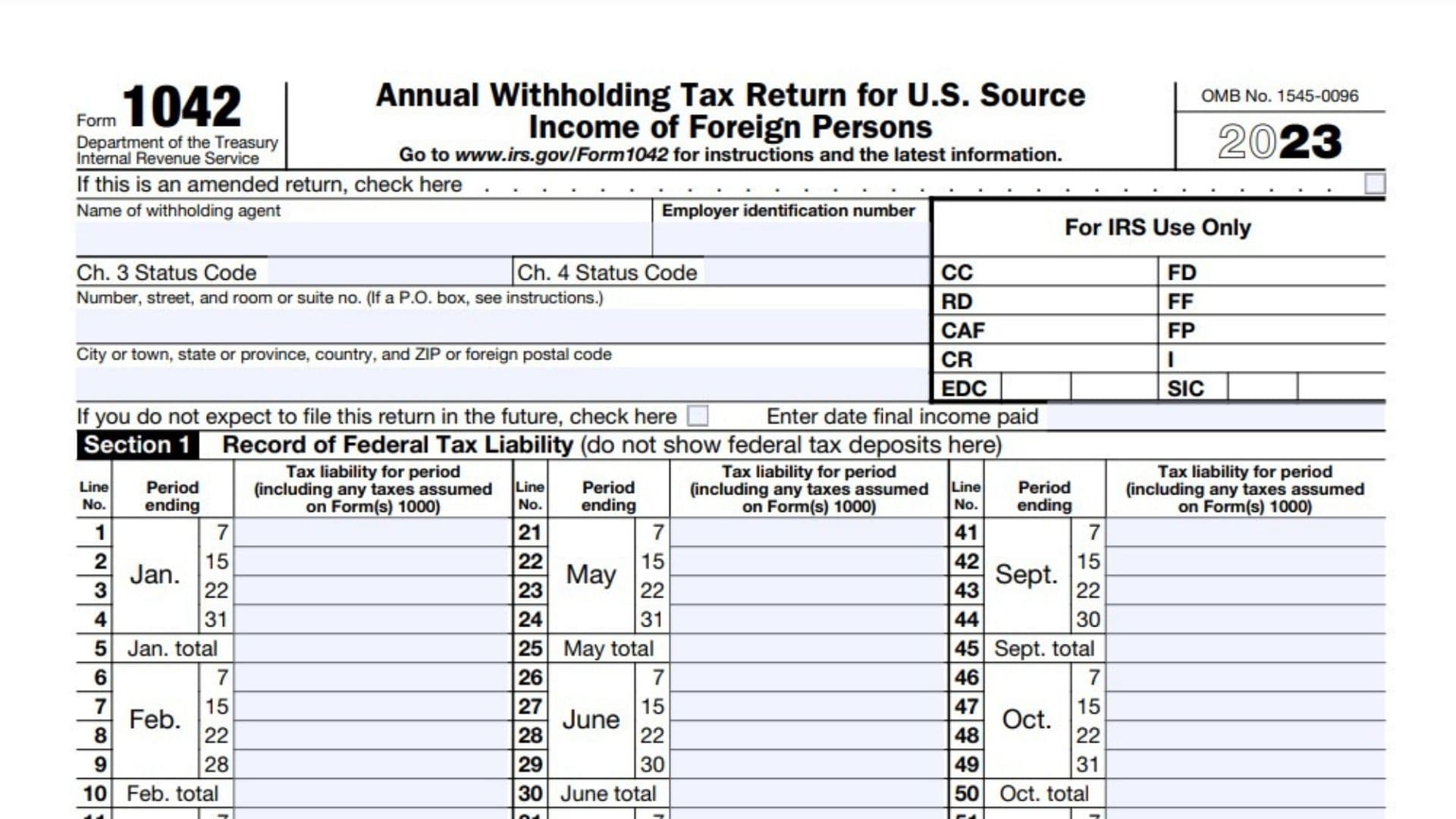

Header Information

- Name of Withholding Agent: Enter the full name of the withholding agent.

- Employer Identification Number (EIN): Provide the EIN assigned to the withholding agent.

- Chapter 3 Status Code: Indicate the appropriate status code for Chapter 3.

- Chapter 4 Status Code: Indicate the appropriate status code for Chapter 4.

- Address: Fill in the complete address of the withholding agent, including street number, city, state, and ZIP code.

- Final Return Checkbox: If this is your final return, check the box provided.

- Date Final Income Paid: Enter the date when final income was paid.

Section 1: Record of Federal Tax Liability

- Monthly Tax Liability: For each month (January through December), report the tax liability for periods ending in that month.

- Use lines numbered 1 through 60 to record amounts.

- At the end of each month’s entries, calculate and enter totals on lines designated for monthly totals.

- Total Forms Filed: On line 61, report the number of Forms 1042-S filed both on paper and electronically.

- Total Gross Amounts Reported:

- Line 62a: Enter total U.S. source FDAP income reported.

- Line 62b(1): Enter total U.S. source substitute dividend payments reported.

- Line 62b(2): Enter total U.S. source substitute payments reported other than substitute dividends.

- Line 62c: Add lines 62a and 62b for total gross amounts reported.

- Line 62d: Enter gross amounts actually paid if different from amounts reported.

Tax Calculation and Payment

- Total Tax Reported:

- Line 63a: Report tax withheld by withholding agent.

- Line 63b(1): Report tax withheld by other agents for non-substitute dividends.

- Line 63b(2): Report tax withheld by other agents for substitute dividends.

- Line 63c(1): Adjustments to overwithholding.

- Line 63c(2): Adjustments to underwithholding.

- Line 63d: Report tax paid by withholding agent.

- Line 63e: Total tax reported as withheld or paid (add lines 63a through d).

- Computation of Tax Due or Overpayment:

- Line 64a: Adjustments to total net tax liability.

- Line 64b: Total net tax liability under Chapter 3.

- Line 64c: Total net tax liability under Chapter 4.

- Line 64d: Excise tax on specified federal procurement payments (total payments made x 2%).

- Line 64e: Total net tax liability (add lines 64a through d).

- Total Payments:

- Lines numbered from 65 through 67 will guide you through reporting total payments made during the calendar year and any applicable credits from previous returns.

- Balance Due or Overpayment:

- Line 69: If line 64e is larger than line 68, enter balance due here.

- Lines numbered from70a through b will help you report any overpayments attributable to overwithholding or excise tax credits.

- Line 71: Apply overpayment (sum of lines 70a and 70b) to (check one)

- Signature Section: The form must be signed by the withholding agent or authorized representative along with their capacity and contact information.

Section 2: Reconciliation of Payments of U.S. Source FDAP Income

- Total U.S. Source FDAP Income Required to Withhold:

On line 1, report the total amount of U.S. source fixed or determinable annual or periodic (FDAP) income that is required to be withheld upon according to Chapter 4 regulations. - Total U.S. Source FDAP Income Not Required to Be Withheld:

Line 2 is divided into several sublines where you will report various categories of income that do not require withholding:- Line 2a: Enter the amount of income paid to recipients whose Chapter 4 status indicates that no withholding is required.

- Line 2b: Report the amount of excluded nonfinancial payments.

- Line 2c: Enter the amount of income paid with respect to grandfathered obligations.

- Line 2d: Report the amount of income effectively connected with the conduct of a trade or business in the United States.

- Line 2e: Add lines 2a through 2d to determine the total U.S. source FDAP income required to be reported under Chapter 4 but not subject to withholding.

- Total U.S. Source FDAP Income Reportable Under Chapter 4:

On line 3, add line 1 and line 2e to calculate the total U.S. source FDAP income that is reportable under Chapter 4. - Total U.S. Source FDAP Income Reported on All Forms 1042-S:

Line 4 should reflect the total U.S. source FDAP income reported on all Forms 1042-S, which includes amounts from lines 62a, 62b(1), and 62b(2) as previously reported in Section 1. - Total Variance:

On line 5, subtract line 3 from line 4 to find any variance between the total reported and required amounts. If this amount is not zero, provide an explanation on line 6. - Explanation for Variance (if applicable):

Use line 6 to explain any discrepancies noted in line 5, ensuring clarity on why there may be differences in reported amounts.

Section 3: Potential Section 871(m) Transactions

- Check Box for Potential Section 871(m) Transactions:

In this section, check the box if any payments (including gross proceeds) were made by the withholding agent under a potential Section 871(m) transaction. This includes transactions involving notional principal contracts or other derivatives contracts that reference, in whole or in part, a U.S. stock or other underlying security. - Refer to Instructions:

It is essential to refer to the instructions provided for Section 871(m) transactions to ensure compliance with IRS regulations. This section is crucial for identifying transactions that may have specific withholding tax implications under U.S. tax law.

Section 4: Dividend Equivalent Payments by a Qualified Derivatives Dealer (QDD)

- Check Box for QDD Payments:

Check this box if any payments were made by a Qualified Derivatives Dealer (QDD). This indicates that the withholding agent has made payments that may be subject to specific reporting requirements under IRS regulations. - Required Actions if Box is Checked:

If you check the box indicating payments were made by a QDD, you must complete the following:- (1) Attach Schedule(s) Q (Form 1042): This schedule provides detailed information about the dividend equivalent payments made by the QDD.

- (2) Enter Your EIN: Provide your Employer Identification Number (EIN), ensuring it is not the same as your Qualified Intermediary EIN (QI-EIN). This identification is necessary for proper reporting and compliance.