Form 1040-X, known as the Amended U.S. Individual Income Tax Return, is used to make corrections to previously filed tax returns. Whether you forgot to include income, made a mistake on deductions or credits, or need to change your filing status, this form is the way to update your tax information with the IRS. While there is no specific due date for filing Form 1040-X, it must be filed within three years from the date you filed the original return or within two years from the date you paid the tax, whichever is later. This time frame is important for claiming any additional refunds due to the amendments.

Reasons to File Form 1040-X

Taxpayers should file Form 1040-X if they need to:

- Correct errors or omissions on a previously filed tax return.

- Change their filing status (e.g., from single to married filing jointly).

- Claim missed deductions or credits.

- Report additional income not originally reported.

It is important to note that Form 1040-X cannot be used for clerical errors, such as mathematical mistakes, as the IRS will typically correct these during processing.

How to File Form 1040-X?

Filing the IRS Form 1040-X involves several steps:

- Obtain the Form: You can obtain Form 1040-X from the IRS website or through tax preparation software.

- Complete the Form: Fill out the form with the corrected information, indicating the changes from the original return.

- Attach Supporting Documents: Include any necessary schedules or forms that support the changes. For example, if you are claiming a new deduction, attach the relevant schedule or form.

- Submit to the IRS: Mail the completed form and any attachments to the appropriate IRS address listed in the form’s instructions. Currently, electronic filing of Form 1040-X is available for tax years 2019 and later through certain tax software providers.

- Pay Any Additional Tax: If the amended return results in additional tax owed, pay this amount as soon as possible to avoid interest and penalties.

How to Complete Form 1040-X?

Completing the Form 1040-X involves several sections that require detailed information about the changes being made:

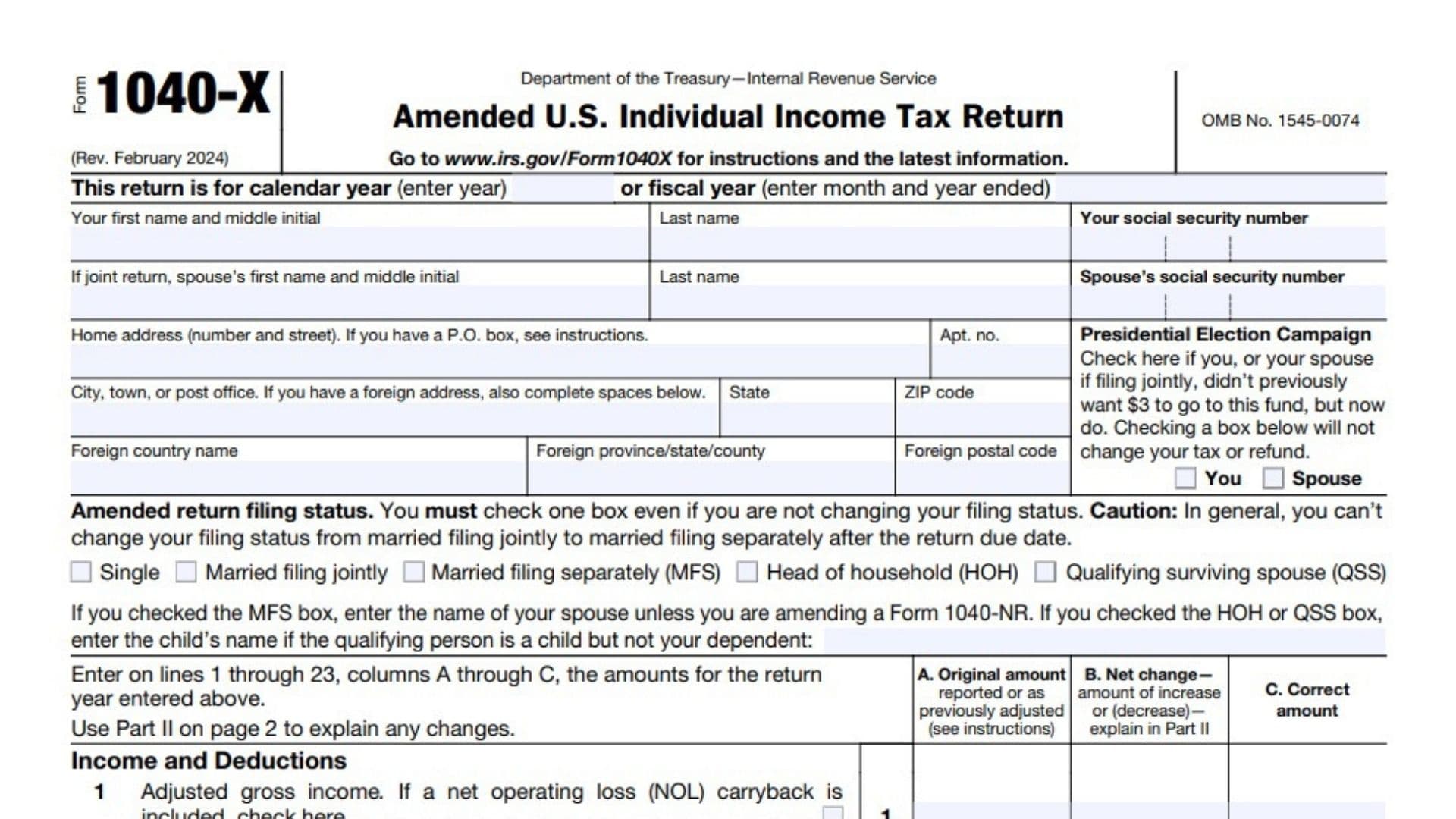

Part I: Basic Information

Header Section

- This return is for calendar year or fiscal year:

Enter the tax year you are amending. If you’re filing for a calendar year, specify the year. If filing for a fiscal year, indicate the ending month and year (MM/YYYY). - Your first name and middle initial, Last name, Your social security number:

Enter your full name and Social Security Number (SSN) exactly as it appeared on the original tax return. If the amended return is a joint return, provide the same information for your spouse. - Home address, Apt. no., City, state, ZIP code:

Enter your current home address, including apartment number, city, state, and ZIP code. - Foreign country name, Foreign province/state/county, Foreign postal code:

If you have a foreign address, fill in the appropriate country, province or state, and postal code. - Presidential Election Campaign:

Check this box if you or your spouse (if filing jointly) now want $3 to go to the Presidential Election Campaign Fund, even though you didn’t check it on the original return. This will not affect your tax or refund.

Amended Return Filing Status

- Check one of the following boxes to indicate your filing status:

- Single

- Married filing jointly

- Married filing separately (MFS)

- Head of household (HOH)

- Qualifying surviving spouse (QSS)

- If applicable, provide the name of your spouse if you checked the “MFS” box. If amending HOH or QSS status, provide the child’s name if the qualifying person is a child but not your dependent.

Income and Deductions (Lines 1-5)

- Line 1: Adjusted gross income:

- Column A: Enter the adjusted gross income (AGI) from your original return or as previously adjusted.

- Column B: Enter the net change (increase or decrease) in AGI.

- Column C: Enter the correct AGI after applying the net change.

- Line 2: Itemized deductions or standard deduction:

Enter the original and corrected amount of either your standard deduction or itemized deductions (based on which one you used). - Line 3: Subtract line 2 from line 1:

This is your taxable income. Follow the same steps as in previous lines to show the original, net change, and correct amounts. - Line 4a: Reserved for future use:

This line is reserved and does not require any input. - Line 4b: Qualified business income deduction:

If you claimed a Qualified Business Income (QBI) deduction, enter the corrected amounts. - Line 5: Taxable income:

Subtract line 4b from line 3. If the result in Column C is zero or less, enter “0.”

Tax Liability (Lines 6-11)

- Line 6: Tax:

Enter the tax amount from your original return (Column A), the net change (Column B), and the corrected tax (Column C). Include the method you used to calculate your tax (e.g., tax table, tax computation worksheet). - Line 7: Nonrefundable credits:

If you claimed nonrefundable credits, such as the Child Tax Credit, enter the original, net change, and corrected amounts. - Line 8: Subtract line 7 from line 6:

Calculate and enter the result for each column. If zero or less, enter “0.” - Line 9: Reserved for future use:

No action is needed for this line. - Line 10: Other taxes:

Enter any additional taxes you owe (e.g., self-employment tax, additional Medicare tax). - Line 11: Total tax:

Add lines 8 and 10. This is your total tax liability.

Payments (Lines 12-17)

- Line 12: Federal income tax withheld and excess Social Security tax withheld:

Enter the original and corrected amounts of federal tax withheld from wages and any excess Social Security tax withheld. - Line 13: Estimated tax payments:

If you made estimated tax payments or applied overpayments from a prior year, enter the original and corrected amounts. - Line 14: Earned income credit (EIC):

If you claimed the EIC on your original return, provide the updated amounts. - Line 15: Refundable credits:

Include any refundable credits you claimed, such as credits from Schedule 8812, Form 8863, or Form 8962. - Line 16: Total amount paid:

Include the total amount paid with your original return, any extensions, and any additional tax payments. - Line 17: Total payments:

Add lines 12 through 15 (Column C) and line 16. This is your total payments.

Refund or Amount You Owe (Lines 18-23)

- Line 18: Overpayment from original return:

Enter any overpayment you reported on your original return. - Line 19: Subtract line 18 from line 17:

If this amount is less than zero, follow the instructions carefully for handling negative amounts. - Line 20: Amount you owe:

If your total tax (line 11) is more than your total payments (line 19), enter the amount you owe. - Line 21: Overpayment:

If your total tax (line 11) is less than your total payments (line 19), enter the amount you overpaid. - Line 22: Amount you want refunded:

Indicate the amount of the overpayment (from line 21) that you want refunded to you. - Line 23: Amount you want applied to your estimated tax:

Specify how much of your overpayment you want applied to your estimated taxes for the next year.

Part I: Dependents (Lines 24-30)

- Complete this section if you need to change any information about your dependents on the amended return. Enter the original number of dependents, the net change, and the correct number. Use the space provided to list the names, SSNs, and relationship of all dependents you are claiming on the amended return.

Part II: Explanation of Changes

- In this section, explain the changes made to your original tax return. Be specific about why the changes were necessary (e.g., corrected income, missed credits, deductions). Attach any relevant supporting documents, schedules, or forms related to the changes.

Signature and Date

- Sign and date the amended return. If filing a joint return, both spouses must sign. Enter your occupation and, if applicable, the Identity Protection PIN provided by the IRS.

- Paid Preparer Use Only:

If a tax preparer completed the form for you, they must fill out this section with their information, including name, Preparer Tax Identification Number (PTIN), firm’s name, and signature.

Where to Mail Form 1040-X?

The mailing address for Form 1040-X depends on your state of residence and whether you are including a payment with the form. The IRS provides specific addresses for different regions, which are listed in the form’s instructions. Always refer to the most current IRS instructions to find the correct mailing address. For electronic filings, use the e-file system provided by authorized tax software providers.

FAQ

- Can I file Form 1040-X electronically? Yes, electronic filing of Form 1040-X is available for tax years 2019 and later through certain tax software providers.

- What if I owe additional taxes? Pay any additional tax owed as soon as possible to minimize interest and penalties. You can pay online through the IRS website or include a check or money order with your mailed form.

- How will I know if the IRS accepts my amended return? You can track the status of your amended return using the “Where’s My Amended Return?” tool on the IRS website.