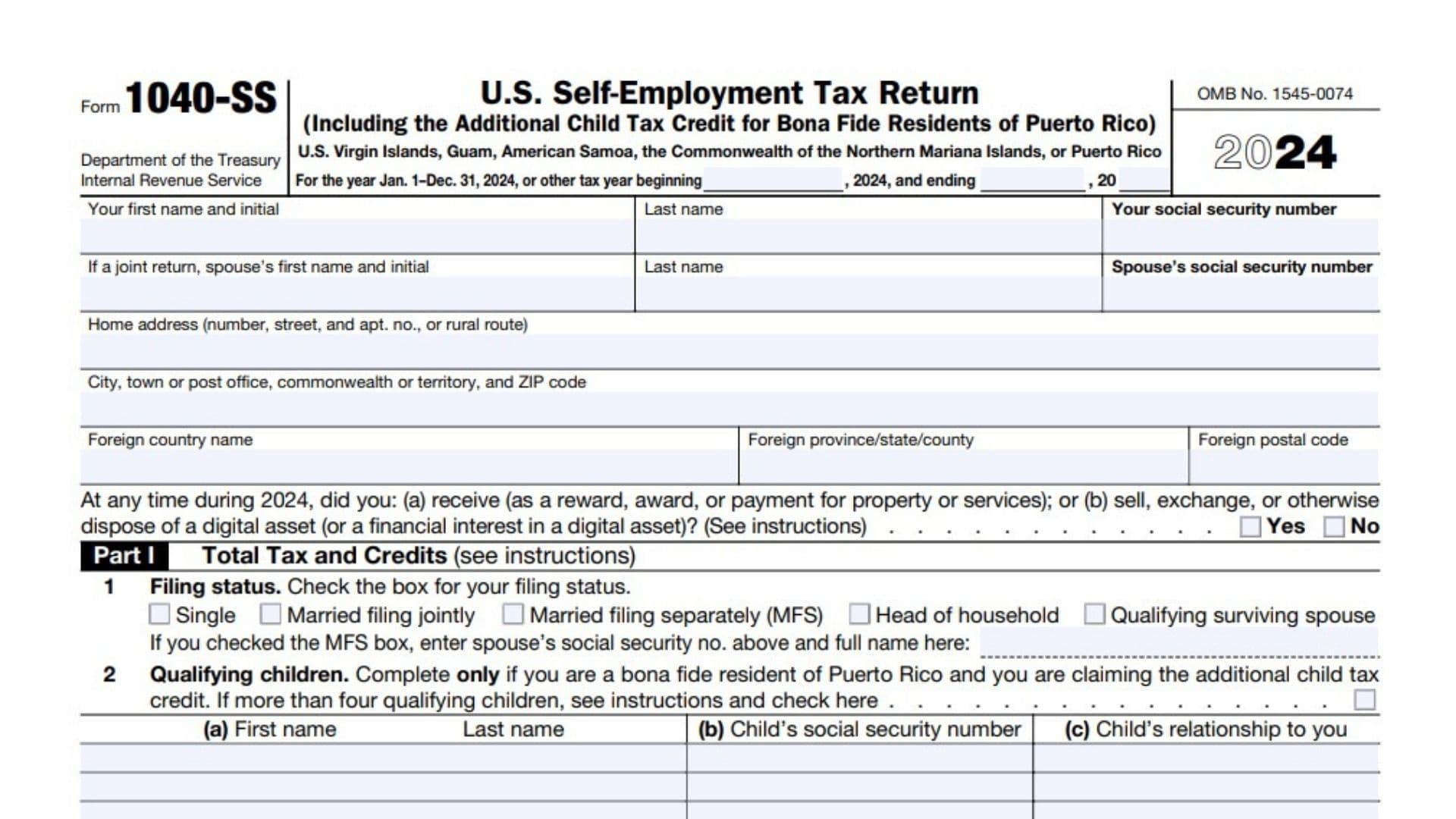

IRS Form 1040-SS, also known as the “U.S. Self-Employment Tax Return,” is primarily used by self-employed individuals residing in certain U.S. territories. It allows taxpayers to report income from self-employment, calculate self-employment taxes (including Social Security and Medicare taxes), and claim the Additional Child Tax Credit if eligible. This form is particularly relevant for bona fide residents of Puerto Rico, who can use it to claim the child tax credit without filing a full federal income tax return. Form 1040-SS also includes sections for reporting household employment taxes, Medicare taxes, and excess Social Security taxes.

How to File Form 1040-SS?

- Obtain the Form: Download Form 1040-SS from the official IRS website or request it via mail if needed.

- Gather Required Information: Collect documentation, including income statements, expenses, and Social Security numbers for all dependents.

- Complete the Form: Follow the instructions for each section of the form (detailed below).

- Attach Necessary Schedules: Attach supporting schedules, such as Schedule SE (Self-Employment Tax) and Schedule H (Household Employment Taxes), as applicable.

- File the Form: Submit the completed form to the IRS by the due date, typically April 15, unless you have an extension.

How to Complete Form 1040-SS?

- Personal Information:

- Enter your full name, Social Security number (SSN), and home address.

- If filing jointly, include your spouse’s information.

- Filing Status:

- Indicate your filing status by checking the appropriate box: Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Surviving Spouse.

- Part I: Total Tax and Credits:

- Line 3: Report self-employment tax from Schedule SE (Form 1040).

- Line 4: Include household employment taxes from Schedule H.

- Line 5: Enter any additional Medicare tax from Form 8959.

- Line 6: Add any other applicable taxes.

- Line 7: Calculate the total tax by summing lines 3 through 6.

- Line 8: Record estimated tax payments made during the year.

- Line 9: Include any excess Social Security tax withheld.

- Line 10: Enter the Additional Child Tax Credit amount from Part II, Line 19.

- Lines 11a–11b: Include additional Medicare tax withheld and payments made with an extension request.

- Line 12: Total all payments and credits from lines 8 through 11b.

- Line 13: Subtract total tax (line 7) from total payments and credits (line 12) to calculate the overpayment, if any.

- Line 14a: Specify the amount of overpayment you want refunded and provide bank account details for direct deposit.

- Line 15: Indicate any overpayment you wish to apply toward next year’s estimated tax.

- Line 16: If you owe tax, calculate the amount due by subtracting line 12 from line 7.

Part II: Bona Fide Residents of Puerto Rico Claiming ACTC

Line 1 – Qualifying Children:

- Confirm if you have children under age 17 with valid Social Security numbers.

- If “No,” you cannot claim this credit.

Line 2 – Number of Qualifying Children:

- Enter the total number of qualifying children.

Lines 3-5 – Adjusted Gross Income (AGI):

- Enter your AGI and compare it against thresholds ($400,000 for joint filers; $200,000 for others).

- If your AGI exceeds these limits, calculate reductions based on excess income.

Lines 7-9 – Credit Calculation:

- Multiply qualifying children by $2,000 each.

- Add any additional dependents at $500 per dependent.

Lines 10-11 – Final Credit Amount:

- Compare calculated credits with reductions and enter the smaller amount.

Part III: Other Taxes and Payments

- Lines 12a-c: Enter one-half of your self-employment tax and any additional Medicare tax from Form 8959.

- Lines 13a-f: Include withheld Social Security and Medicare taxes reported on Puerto Rico forms (e.g., Form 499R-2/W-2PR).

- Line 14: Add lines from previous sections for total taxes owed.

- Line 15: Enter the amount of Additional Medicare Tax withheld, if any, from Form 8959, line 22. This represents any extra Medicare tax that was withheld during the year.

- Line 16: Subtract the amount on line 15 from the total on line 14. This gives you your adjusted tax liability after accounting for any Additional Medicare Tax withheld.

- Line 17: Enter the amount, if any, from Part I, line 9. This reflects any reserved credits or amounts carried over from earlier calculations.

- Line 18: Compare the amounts on lines 16 and 17:

- If the amount on line 16 is less than or equal to the amount on line 17, stop here—you cannot claim the Additional Child Tax Credit.

- If the amount on line 16 is greater than the amount on line 17, subtract line 17 from line 16 and enter the result.

- Line 19: Calculate your Additional Child Tax Credit. Enter the smaller of:

- The amount on line 11 (credit based on qualifying children), orThe amount on line 18 (remaining tax liability after adjustments).