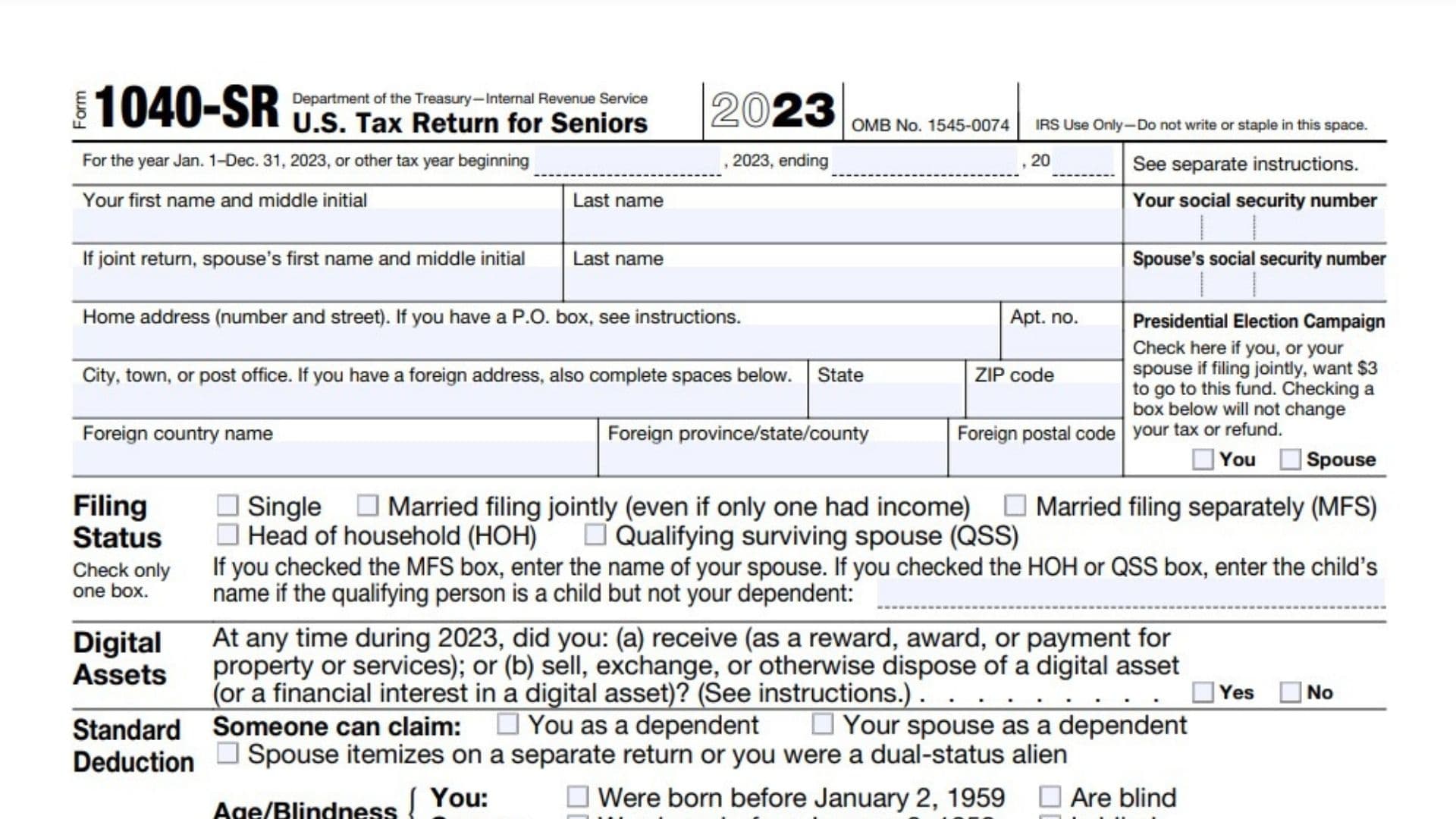

Form 1040-SR, known as the U.S. Tax Return for Seniors, was introduced to provide a more accessible option for taxpayers aged 65 and older. This form mirrors the standard Form 1040 but includes features that cater to seniors, such as a larger font size and a simplified layout that makes it easier to read and understand. The form also allows seniors to claim specific tax benefits, including the higher standard deduction available to taxpayers over 65. By using Form 1040-SR, seniors can ensure that they are taking advantage of all the tax benefits available to them, making the tax filing process less daunting and more efficient.

Who Must File Form 1040-SR?

To use Form 1040-SR, taxpayers must meet the following criteria:

Age Requirement: The taxpayer must be 65 years of age or older by the end of the tax year. If married and filing jointly, only one spouse needs to be 65 or older.

Income Sources: The form is designed to accommodate common sources of income for seniors, such as Social Security benefits, pensions, retirement account distributions, and investment income. However, it can be used for any type of income that would be reported on the standard Form 1040.

Seniors who meet these criteria can choose to use Form 1040-SR instead of the standard Form 1040.

How to Complete Form 1040-SR?

Completing the Form 1040-SR involves several steps, similar to the standard Form 1040:

- Personal Information: Enter your name, address, Social Security number, and filing status. If filing jointly, include your spouse’s information.

- Income Section: Report all sources of income, including wages, Social Security benefits, pensions, annuities, retirement account distributions, interest, dividends, and other income.

- Adjusted Gross Income (AGI): Calculate your adjusted gross income by subtracting any adjustments to income, such as contributions to traditional IRAs, health savings accounts (HSAs), or educator expenses.

- Standard Deduction or Itemized Deductions: Choose between the standard deduction and itemized deductions. The form includes a chart to help seniors determine their higher standard deduction amount.

- Tax and Credits: Calculate your tax liability using the tax tables or tax computation worksheets. Apply any available credits, such as the credit for the elderly or disabled, and other tax credits.

- Other Taxes: Report any additional taxes, such as self-employment tax, household employment taxes, or the additional tax on IRAs and retirement plans.

- Payments: Enter any tax payments made during the year, including federal income tax withheld, estimated tax payments, and any refundable credits.

- Refund or Amount You Owe: Calculate whether you are due a refund or if you owe additional taxes. Provide your bank account information for direct deposit if you are owed a refund.

- Signature: Sign and date the form. If filing jointly, your spouse must also sign. If you are using a paid preparer, they must sign and provide their information.

Review all entries for accuracy and completeness before submitting the form.

Additional Considerations for Seniors

- Higher Standard Deduction: Seniors are eligible for a higher standard deduction, which can significantly reduce taxable income. For the 2023 tax year, the standard deduction for taxpayers over 65 is $1,750 higher for single filers and $1,400 higher per spouse for married couples filing jointly.

- Credit for the Elderly or Disabled: Seniors may qualify for this credit if they meet certain income and disability requirements. This credit can further reduce tax liability.

- Investment Income: Seniors often have investment income from interest, dividends, and capital gains. Form 1040-SR accommodates these types of income and provides space to report them accurately.

- Retirement Account Distributions: Distributions from IRAs, 401(k)s, and other retirement accounts must be reported on Form 1040-SR. Seniors should be aware of required minimum distributions (RMDs) to avoid penalties.

Where to Mail Form 1040-SR?

The mailing address for Form 1040-SR depends on the taxpayer’s location and whether they are including a payment with the form. The IRS provides specific addresses for different regions, listed in the form’s instructions. Electronic filing is also an option, which can expedite processing and ensure quicker confirmation of receipt.

Due Dates

The Form 1040-SR must be filed by the regular tax filing deadline, typically April 15th. If you cannot file by this date, you can request an extension by filing Form 4868, which grants an additional six months to file the return. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Frequently Asked Questions

- Can I use Form 1040-SR if I have complex financial situations?Yes, Form 1040-SR can be used for any income situation that would be reported on the standard Form 1040. It includes all the necessary sections and schedules for various types of income and deductions.

- Is there an income limit for using Form 1040-SR?No, there is no income limit for using Form 1040-SR. Any senior taxpayer aged 65 or older can use this form regardless of their income level.

- Can I switch between Form 1040 and Form 1040-SR each year?Yes, seniors can choose to use either Form 1040-SR or the standard Form 1040 each year, depending on their preference.