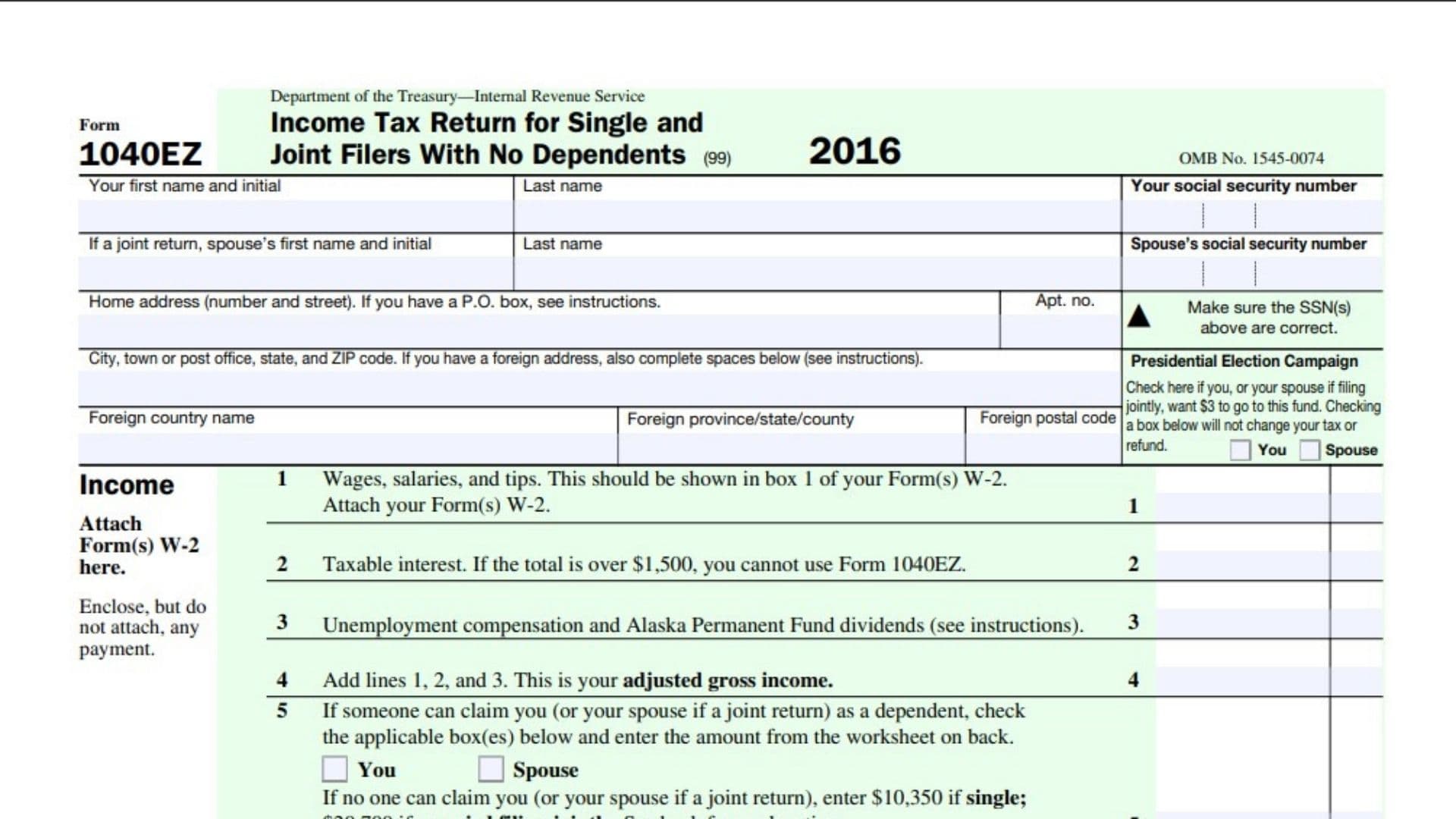

IRS Form 1040-EZ is the simplest federal income tax return form designed for taxpayers with straightforward tax situations. It’s ideal for individuals and married couples filing jointly with no dependents, taxable income below $100,000, and only basic types of income—such as wages, tips, taxable interest, unemployment compensation, and Alaska Permanent Fund dividends. Using Form 1040-EZ means you aren’t claiming itemized deductions or most tax credits, just the basic earned income credit (EIC), and you don’t have complicated investments or advanced financial situations. For eligible taxpayers, this form speeds up the filing process by focusing only on essential tax components. It’s direct, user-friendly, and helps you report your income, credits, and payments in a concise way for fast processing and potential refunds.

How to File Form 1040-EZ

- Check eligibility: Use only if you meet all requirements: single or married filing jointly, under 65, not blind, no dependents, taxable income under $100,000, only basic income sources, no itemized deductions, and you aren’t claiming other credits besides EIC.

- Gather documents: Collect your W-2(s), 1099(s) for interest or unemployment, and bank info for direct deposit.

- Download Form 1040-EZ: Find the official PDF on the IRS website.

- Fill out line-by-line: Use the instructions below to complete every line with precision.

- Sign and date: Both spouses must sign if filing jointly.

- Mail or file electronically: Use the address in the instructions or file online if eligible.

How to Complete Form 1040-EZ

Top Section (Identification)

- Your first name and initial, Last name: Enter your full legal name.

- Your social security number: Write your SSN.

- If a joint return, spouse’s first name and initial, Last name, Spouse’s SSN: Enter spouse’s full name and SSN if joint.

- Home address: Include your full mailing address.

- Apt. no.: Add if applicable.

- City, state, ZIP code: Write your complete city, state, and ZIP.

- Foreign address lines: Complete “Foreign country name,” “Foreign province/state/county,” and “Foreign postal code” only if you’re using a non-U.S. address.

Presidential Election Campaign

- Check box for $3 to go to the Presidential Election Campaign Fund: Optional—does not affect your tax or refund. You and/or your spouse may check a box.

Income

- Attach Form(s) W-2 here: Staple W-2(s) at the top.

- 1. Wages, salaries, tips: Write the total from box 1 of all W-2s.

- 2. Taxable interest: Enter taxable interest (if more than $1,500, you cannot use 1040-EZ).

- 3. Unemployment compensation and Alaska Permanent Fund dividends: Add amounts from unemployment or Alaska dividends.

- 4. Add lines 1, 2, and 3: This is your adjusted gross income (AGI).

Dependents

- 5. If someone can claim you (or spouse) as a dependent:

- Check the “You” and/or “Spouse” box(es) if you (or your spouse) can be claimed as a dependent by someone else.

- Enter the amount from the worksheet on the back (see instructions) for your standard deduction and exemption.

- If neither you nor your spouse can be claimed as a dependent: Enter $10,350 if single, $20,700 if married filing jointly.

Taxable Income

- 6. Subtract line 5 from 4: If negative, enter -0-. This is your taxable income.

Payments, Credits, and Tax

- 7. Federal income tax withheld from Form(s) W-2 and 1099: Enter all federal tax withheld.

- 8a. Earned income credit (EIC): If eligible, enter EIC amount from the worksheet or IRS instructions.

- 8b. Nontaxable combat pay election: If you choose to include nontaxable combat pay for EIC calculation, enter the amount here.

- 9. Add lines 7 and 8a: Total payments and credits.

Tax

- 10. Tax: Use your amount from line 6 and look up your tax in the IRS tax tables. Enter the amount here.

- 11. Health care: individual responsibility: Check the box for “Full-year coverage” if you and spouse were covered all year. Otherwise, see instructions.

- 12. Add lines 10 and 11: This is your total tax.

Refund

- 13a. If line 9 is larger than 12, subtract 12 from 9: This is your refund.

- Form 8888 attached: Check the box if splitting your refund into more than one account.

- 13b. Routing number: For direct deposit, fill in your U.S. bank’s routing number.

- 13c. Checking/Savings: Mark the account type for the direct deposit.

- 13d. Account number: Enter your full account number.

Amount You Owe

- 14. If line 12 is larger than line 9, subtract 9 from 12: This is what you owe. Refer to payment instructions on how to pay.

Third-Party Designee

- Allow another person to discuss this return with the IRS?

- Check “Yes” and enter designee’s name, phone, and personal identification number (PIN) to allow the IRS to talk with someone you trust about your return.

- Otherwise, check “No.”

Signature

- Your signature: Sign the completed return.

- Date: List the date signed.

- Your occupation: Fill in your job title.

- Daytime phone number: Provide a number where the IRS can reach you.

- Spouse’s signature, occupation, date: Complete if filing jointly.

- Identity Protection PIN: If the IRS issued you an IP PIN, enter here.

Paid Preparer Use Only

- If someone else prepares your return, they must fill in:

- Preparer’s name, signature, date

- PTIN (Preparer Tax Identification Number)

- Firm’s name, address, EIN, and phone number

- Check box if self-employed

FAQs

Q: Can anyone use IRS Form 1040-EZ?

A: No, only taxpayers with simple tax situations, no dependents, and income under $100,000 are eligible.

Q: What if my interest is over $1,500?

A: You can’t use Form 1040-EZ if your taxable interest is more than $1,500.

Q: Who needs to sign 1040-EZ?

A: The taxpayer (and spouse, if joint) must sign the form—even for a refund.