Form 1040-ES, Estimated Tax for Individuals, is a vital document for taxpayers who need to pay estimated taxes throughout the year. Properly managing these payments ensures compliance with IRS regulations and avoids penalties. The primary purpose of Form 1040-ES is to help individuals calculate and pay estimated taxes on income that is not subject to withholding. This includes income from self-employment, interest, dividends, alimony, rent, gains from the sale of assets, prizes, and awards. Since taxes are typically paid as income is earned or received, Form 1040-ES allows taxpayers to spread their tax payments throughout the year, rather than paying a large sum at the end of the tax year. By making quarterly estimated tax payments, individuals can avoid underpayment penalties and ensure they meet their tax obligations in a timely manner.

Who Must File Form 1040-ES?

Form 1040-ES must be filed by individuals, including sole proprietors, partners, and S corporation shareholders, who expect to owe tax of $1,000 or more when their return is filed. This is typically required if your income is not subject to withholding or if your withholding does not cover your tax liability. If you receive income such as self-employment earnings, interest, dividends, rents, or alimony, you need to use Form 1040-ES to calculate and pay estimated taxes. Additionally, if you had a tax liability for the previous year, you are generally required to make estimated tax payments for the current year.

How to File Form 1040-ES?

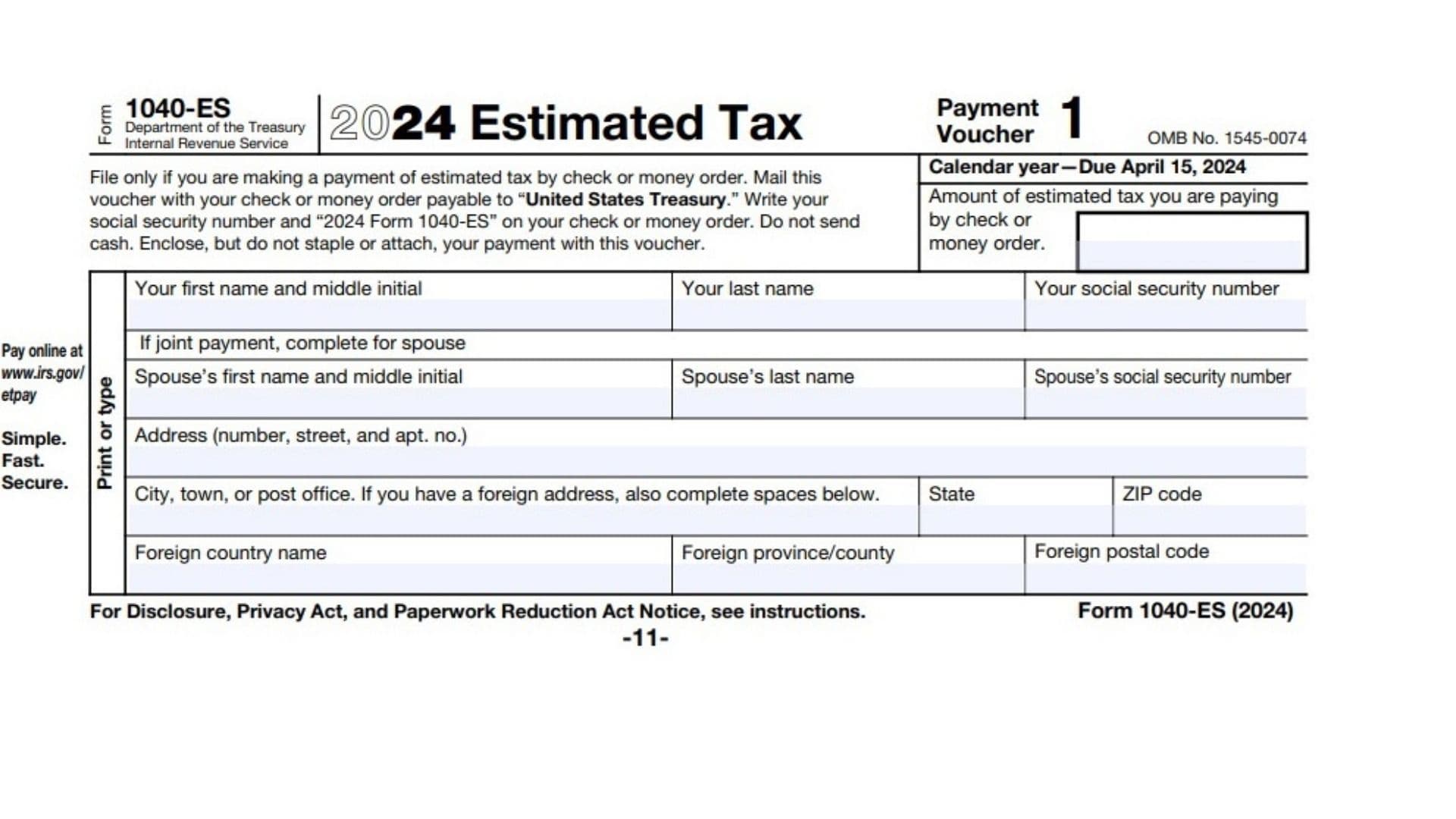

Filing Form 1040-ES involves several steps and can be done online, by mail, or through the Electronic Federal Tax Payment System (EFTPS). First, download Form 1040-ES from the IRS website. The form includes a worksheet to help you calculate your estimated tax liability. Use your expected adjusted gross income, taxable income, taxes, deductions, and credits for the year to complete the worksheet. Once you determine your estimated tax, you need to make quarterly payments to the IRS. The due dates for the quarterly payments are generally April 15, June 15, September 15, and January 15 of the following year. You can mail your payments with the payment vouchers provided in Form 1040-ES or use the IRS Direct Pay, EFTPS, or other electronic payment methods.

How to Complete Form 1040-ES?

Filling out Form 1040-ES requires accurate estimation of your income and deductions for the year. The form is divided into several parts, each addressing different aspects of your estimated tax calculation.

- Part I – Annualized Estimated Tax Worksheet: This section helps you calculate your total estimated tax for the year based on your expected income, deductions, and credits. It includes lines for adjusted gross income, taxable income, tax, credits, and other payments.

- Part II – Payment Vouchers: Once you have calculated your estimated tax, you need to fill out the payment vouchers for each quarter. Each voucher includes your name, address, Social Security number, and the amount of the estimated tax payment.

Accurate and complete information is crucial for each section. Attach any required documentation to support your entries, such as income statements and records of deductions. Double-check all calculations to ensure you are paying the correct amount of estimated tax. If needed, seek assistance from a tax professional to ensure everything is properly filled out and submitted. Properly completing Form 1040-ES helps you comply with IRS regulations and avoid underpayment penalties.

Additional Information

Understanding the safe harbor rules can help you avoid underpayment penalties. There are two primary safe harbor rules:

- Paying at least 90% of your current year’s tax liability: If your estimated tax payments, along with any withholdings, equal at least 90% of your current year’s tax liability, you can avoid penalties.

- Paying 100% of your previous year’s tax liability: If you pay estimated taxes based on your previous year’s tax liability (110% if your adjusted gross income is over $150,000), you can avoid penalties regardless of your current year’s income.

Additionally, understanding how to handle changes in income throughout the year is essential. If you experience significant changes in your income, you should recalculate your estimated tax payments to ensure you are on track to meet your tax obligations. Use the IRS’s Annualized Income Installment Method (Schedule AI) if your income is not received evenly throughout the year.

Finally, knowing the importance of keeping detailed records is crucial. Maintain thorough documentation of your income, deductions, and payments throughout the year to support your estimated tax calculations and ensure accurate filing. By staying organized and proactive with your estimated tax payments, you can effectively manage your tax obligations and avoid any surprises at tax time