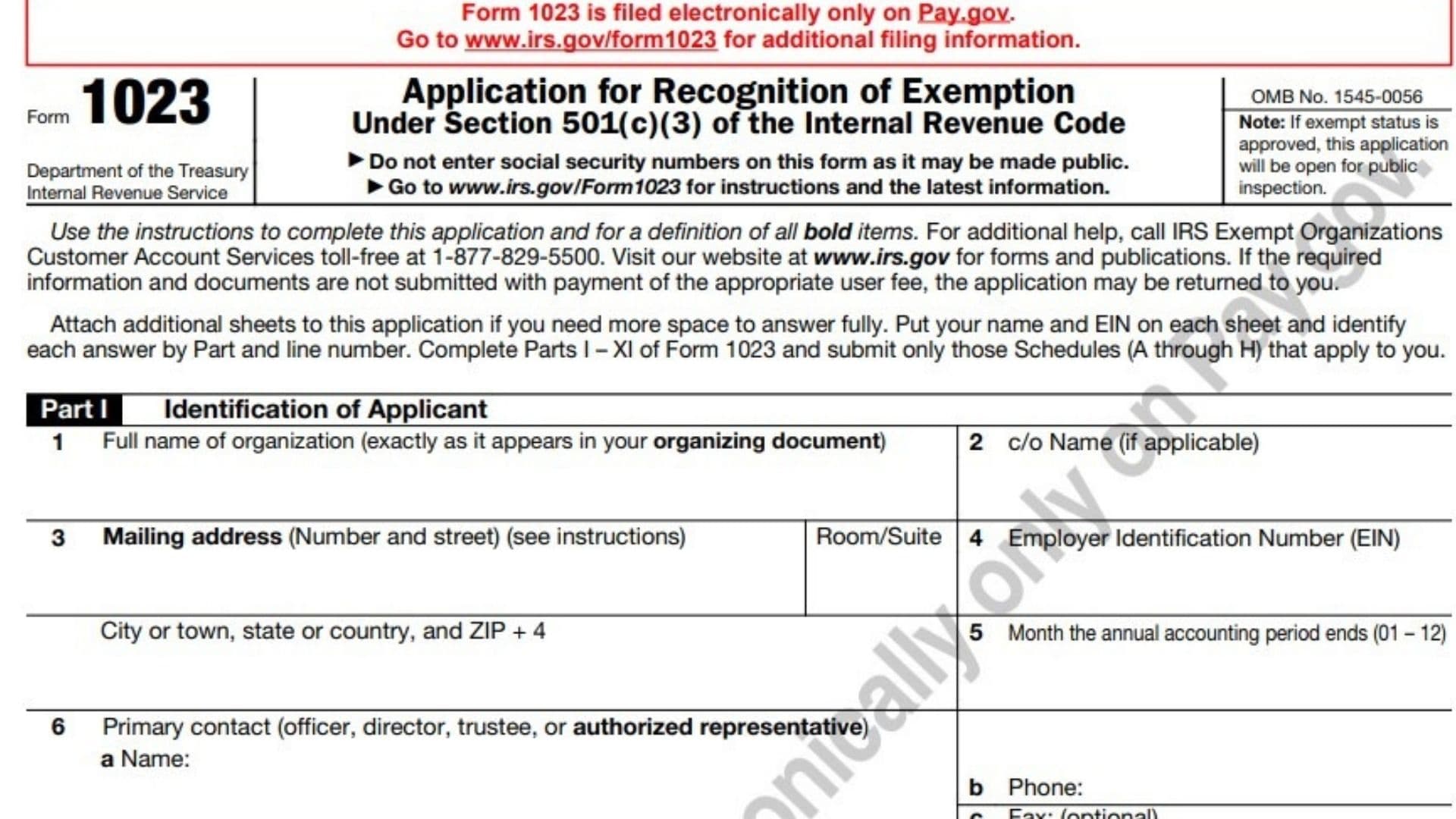

Form 1023, or Application for Recognition of Exemption Under the 501 Internal Revenue Code, is a form that nonprofits file with the IRS to receive exemption status. Organizations should aim to file a well-prepared, accurate, and high-quality Form 1023 application. When filing Form 1023, keep in mind that the information contained in the document may be subject to public inspection. This means that anyone can view your organization’s information. You should also know that the IRS released Form 1023-EZ in 2014, which is more suited for smaller organizations.

Who Must File Form 1023?

- Are you interested in becoming a nonprofit organization? You must know how to file Form 1023 with the IRS to become one.

- Form 1023 is the only federal tax-exempt form that nonprofit organizations must fill out.

This tax form is usually made up of 11 sections. The first Part asks you to describe your organization, including its purpose and key members. The next two sections require more details about your organization.

Once you have gathered your information, you can complete Form 1023 or Form 1023-EZ. It should take about 48 minutes to complete. However, the process can take hours if you submit more than one form. You can get help from the IRS by visiting their website.

How to File Form 1023?

Form 1023 has several parts, including a financial statement and bylaws. The financial information should reflect the description of the organization.

It should also demonstrate the organization’s nonprofit status and public support. This information is critical for a successful Form 1023 application. To fill out Form 1023, organizations should review their eligibility checklist.

- You must know that Form 1023 is filed electronically only on Pay.gov, and you must pay the filing fee to proceed.

- The name of the organization, board members, office location, website, and other similar information should be included.

- Make sure that the name of the organization is consistent with other official documents, and avoid abbreviations.

- In addition, it is important to standardize accents and punctuation.

- The organization can use a P.O. Box number if it has no street address.

How to Complete Form 1023?

Part I. Identification of Applicant

Line 1a: Enter your complete name, including amendments.

Line 1b: If you have an “”in care of “”name, enter it here; otherwise, leave this space blank.

Line 1c-i: Enter your complete address where all correspondence will be sent

Line 2: Employer Identification Number (EIN). You must have your own EIN. Enter the 9-digit EIN the IRS assigned to you

Line 3: Month tax year ends. Select the month your tax year (annual accounting period) ends.

Line 4: Person to contact. Enter the name and title of the person you want the IRS to contact if they need more information.

Line 5: Phone Number

Line 6: Fax Number

Line 7: Pay.gov will populate this field with the current user fee for filing Form 1023.

Line 8: Enter your complete website address if you have one

Line 9: Officers, directors, and trustees. Enter the full names, titles, and mailing addresses of your officers, directors, and/or trustees

Part II. Organizational Structure

Line 1: Type of organization and copy of organizing document. Select your type of organization

Line 2: Formation date. The date you enter should be consistent with your organizing document.

Line 3: State of formation. Enter the jurisdiction (for instance, the state or the federally recognized tribal government) under the laws of which you were incorporated or otherwise formed

Line 4: “”Bylaws”” are generally an organization’s internal rules and regulations. If you have bylaws, upload a current copy.

Line 5: Successor organization part.

Part III: Required Provisions in Your Organizing Document

Line 1: Purpose clause. Your organizing document must limit your purposes to those described in section 501(c)(3).

Line 2: Dissolution clause. Your organizing document must provide for the permanent dedication of your assets to a section 501(c)(3) purpose.

Part IV: Your Activities

Line 1: Describe completely and in detail your past, present, and planned activities

Line 2: National Taxonomy of Exempt Entities (NTEE) code

Line 3: If programs are limited to specific individuals, describe how you select or identify those individuals.

Line 4: Describe any business or family relationship between individuals who receive goods, services, or funds through your programs and any officers, directors, trustees, highest compensated employees, or independent contractors.

Line 5: You participate in a political campaign if you promote or oppose the candidacy of an individual for public office

Line 6: You are attempting to influence legislation if you directly contact or urge the public to contact members of a legislative body to propose, support, or oppose the legislation.

Line 6a: Form 5768

Line 7: Intellectual property

- Patents (for inventions)

- Copyrights

- • Trade names, trademarks, and service marks

- Formulas, know-how, and trade secrets.

Line 8: These activities involve the consumer’s education on budgeting, personal finance, financial literacy, mortgage foreclosure assistance, or other consumer credit areas.

Line 9: A Relationship between you and the recipient organization includes:

- You control the recipient organization, or it controls you through common officers, directors, or trustees, or through authority to approve budgets or expenditures.

- You and the recipient organization were created at approximately the same time and by the same persons.

- You and the recipient organization coordinated with respect to facilities, programs, employees, or other activities.

- Persons who exercise substantial influence over you also exercise substantial influence over the recipient organization

Line 9b: A Yes or No question.

Line 9g-i: Visit www.treasury.gov/ofac for information about OFAC sanction programs and the OFAC SDN List.

Line 10: A “”foreign country”” is a country other than the U.S

Line 10a–c: See instructions for lines 9g– i.

Line 11: You are a sponsoring organization of a donor-advised fund if you establish separate accounts that you own or control for a donor, whereby the donor or donor-advisor may make recommendations about the investments or distributions from the account. See the IRS’sIRS’s Pub. 557 for more information on the definitions of sponsoring organizations and donor-advised funds.

Line 12: A school may include the following:

- Primary, secondary, preparatory, or high school.

- College or university.

- Trade or technical school.

- Nursery or pre-school.

Line 13: “”Hospital”” or “”medical care.””

Line 14: “”Low-income housing“” refers to rental or ownership housing provided to persons based on financial need. Complete Schedule F if you provide low-income housing.

Line 15: Answer “”Yes,”” if you pay money to an individual as a scholarship, fellowship, or education loan; for travel or study.

Line 16: “”Fundraising“” includes efforts to raise funds through appeals for financial support.

Part V. Compensation and Other Financial Arrangements

Line 1: Compensation. Check “”Yes,”” if you do, or you will compensate your officers, directors, or trustees

Line 1e: “”Similarly situated organizations”” means tax-exempt or taxable organizations of comparable size, purpose, and resources

Line 1g: “”Reasonable compensation”” is the amount that would ordinarily be paid for like services by like organizations under like circumstances as of the date the compensation arrangement is made

Line 2: A conflict of interest arises when a person in a position of authority over an organization, such as a director, officer, or manager, may benefit personally from a decision they could make

Line 3: Fixed Payment and Non-fixed payment.

Line 4: Answer “”Yes,”” if any of your officers, directors, or trustees: • Is an officer, director, or trustee of another organization (other than a section 501(c)(3) organization) that you will purchase or sell goods, services, or assets from or to; or • Possesses more than 35% ownership interest in any organization that you will purchase or sell goods, services, or assets from or to.

Line 5: Answer “”YES”” if any of your officers, directors, or trustees is

- An officer, director, or trustee in another organization (other than a section 501(c)(3) organization) that has a lease, contract, loan, or other agreement with you

- Possesses more than a 35% ownership interest in any organization that has a lease, contract, loan, or other agreement with you

Line 6: “”Develop”” means the planning, financing, construction, or provision of similar services involved in the acquisition of real property, such as land or a building.

Line 7: “”Manage”” means to direct or administer

Line 8: A “”joint venture”” is a legal agreement in which the persons jointly undertake a transaction for mutual profit.

Part VI. Financial Data

Line 1: Select the option that best describes you.

A. Statement of Revenue and Expenses

Line 1: Enter the total gifts, grants, and contributions you receive. Include items of value you receive as gifts, grants, or contributions.

Line 2: Enter the amount you receive from members to provide support to the organization

Line 3: Enter your gross income from dividends, interest, payments received on securities, loans, rents, and royalties you hold for investment purposes.

Line 4: Enter your net income from unrelated business activities.

Line 5: Enter amounts any local tax authority collects from the public on your behalf

Line 6: Enter the value of services or facilities a governmental unit furnishes to you

Line 7: Enter your total income from all sources not reported on lines 1 through 6, or lines 9, 11, and 12

Line 8: Lines 1 through 7 will be added for you

Line 9: Enter income from activities that you conduct to further your exempt purposes

Line 10: Lines 8 and 9 will be added for you.

Line 11: Enter any net gain or loss on the sale of capital assets

Line 12: Enter any “”unusual grants,”” which generally are any substantial contributions and bequests you received from disinterested persons that, by their size, adversely affect your classification as a public charity

Line 13: Lines 10 through 12 will be added for you.

Lines 14: Enter the total expenses you incur for soliciting gifts, grants, and contributions.

Line 15. Enter the total amount you pay out to both individuals and organizations.

Line 16: Enter the total payments you make to or for the benefit of your members

Line 17: Enter your compensations to your officers, directors, and trustees.

Line 18: Enter the total amount of salaries and wages you pay to employees

Line 19: Enter your total interest expenses for the year.

Line 20: Enter the amount you pay using office space or other facilities, heat, light, power and other utilities, outside janitorial services, mortgage interest, real estate taxes, and similar expenses.

Line 21: Enter the total depreciation, depletion, and similar expenses you incur.

Line 22: Enter the total professional fees you pay.

Line 23: Enter any expenses which the lines above don’t cover

Provide an itemized list in line 25, showing the type and amount of each significant expense.

Line 24: Lines 14 through 23 will be added for you.

B. Balance Sheet

Line 1: Enter your total cash in checking and savings accounts, temporary cash investments, and petty cash funds.

Line 2: Line 2. Enter your total accounts receivable that arose from the sale of goods and/or performance of services, less any reserve for bad debt.

Line 3: Enter the amount of materials, goods, and supplies you purchased, manufactured, and held to be sold or used in a future period.

Line 4: Enter the total amount of bonds or notes you issued that will be repaid to you

Line 5: Enter the total fair market value of corporate stocks you hold

Line 6: Total amount of loans receivable.

Line 7: Total book value of your other investments.

Line 8: Enter the total book value of buildings and equipment not held for investment purposes

Line 9: Enter the total book value of land not held for investment purposes

Line 10: Enter the total book value of any other category of your assets not reported on lines 1 through 9.

Line 11: Lines 1-10 will be added for you.

Line 12: Enter the total amount of your accounts payable to suppliers and others, such as salaries payable, accrued payroll taxes, and interest payable.

Line 13: Enter the total unpaid portion of grants and contributions you committed to pay to other organizations or individuals

Line 14: Enter the total of your mortgages and other notes payable outstanding at the end of the current tax period

Line 15: Enter the total amount of any other liabilities not reported on lines 12-14

Line 16: Lines 12 through 15 will be added for you.

Line 17: Under fund accounting, an organization segregates its assets, liabilities, and net assets into separate funds according to restrictions on the use of certain assets

Line 18: Lines 16 and 17 will be added for you.

Part VII. Foundation Classification

Line 1: Select the foundation classification you’re requesting from the list below

Line 1a: Section 508(e) provides that a private foundation isn’t tax-exempt unless its organizing document contains specific provisions.

Line 1c: Some private foundations are private operating foundations. Private operating foundations make qualifying distributions directly for the active conduct of their educational, charitable, and religious purposes.

- Suppose you have existed for 1 year or more. In that case, you must provide information that demonstrates you meet the requirements to be classified as a private operating foundation, including the income test and either the endowment test, the assets test, or the support test.

- If you have existed for less than 1 year, you must sufficiently describe how you will likely meet these requirements and tests. You may also submit an affidavit or opinion of counsel giving enough facts about your operations and support to enable us to determine that you’re likely to meet these requirements.

Line 2: Confirmation of public support status

Line 2(i). 509(a)(1) and 170(b)(1)(A) (vi): Check Yes or No, which describes your situation the most.

Line 2(ii): Use Schedule A (Form 990 or 990-EZ) Public Charity Status and Public Support, Part II, Support Schedule for Organizations Described in Sections 170(b)(1)(A)(iv) and 170(b)(1)(A)(vi), and its instructions to determine if you met the public support test for your most recent 5-year period.

Line 2a(i): 509(a)(2):

Line 2a(ii):

- Check Yes if you received amounts paid by an individual or organization greater than the larger of 1% of line 10 of Part VI-A.

- Statement of Revenues and Expenses, or $5,000 for any completed tax year.

- Identify those individuals or organizations by letter and list the amount(s) received from each.

Line 2a(iii): Use Schedule A (Form 990 or 990-EZ), Public Charity Status and Public Support, Part III, Support Schedule for Organizations Described in Section 509(a)(2), and its instructions to determine if you meet the public support test for your most recent 5-year period.

Part VIII: Effective Date

Line 1:

- Use the formation date you listed in Part II, line 2

- The date you will submit this electronic form.

- Required user fee payment to determine whether you’re submitting this application within 27 months from the month in which you were formed

Part IX: Annual Filing Requirement

Line 1: Check “Yes,” if you’re claiming you are excepted from filing a Form 990-series return or notice and indicate the reason you believe you’re excepted from filing

Part X. Signature

Sign the form, and you’re all set.