Estate, Gift, and Trust Tax Forms

Forms in this category cover taxes related to estates, gifts, and trusts. Executors and trustees use these forms to report income and wealth transfers. Important forms include Form 706, 709, and 1041.

-

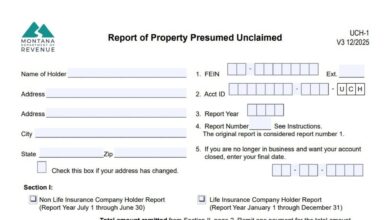

Montana Form UCH-1

Form UCH-1 is used by holders to report unclaimed property—any financial asset where an owner hasn’t generated activity during a…

-

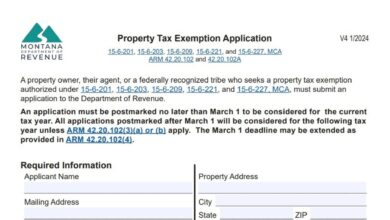

Montana Property Tax Exemption Application Form

Applying for a property tax exemption in Montana can significantly reduce the financial burden on qualifying organizations, but the process…

-

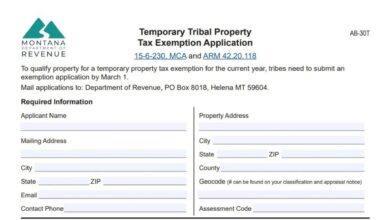

Montana Form AB-30T

Montana Form AB-30T is the state’s application a tribe uses to request a temporary property tax exemption for the current…

-

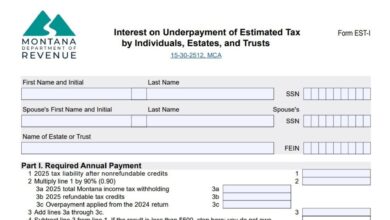

Montana Form EST-I

Montana Form EST-I, formally known as the Estate Tax Information Form, is an essential document required by the Montana Department…

-

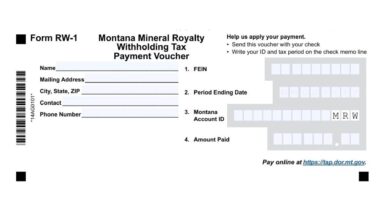

Montana Form RW-1

Montana Form RW-1, officially titled the Mineral Royalty Withholding Tax Payment Voucher, is a specific remittance document used by remitters…

-

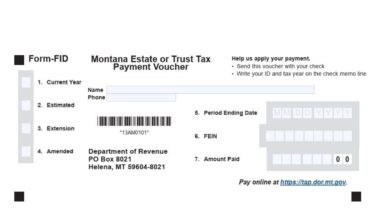

Montana Form FID

The Montana Estate or Trust Tax Payment Voucher Form FID is a document used by taxpayers to submit payments for…

-

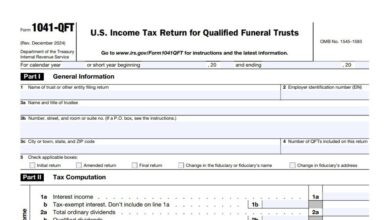

Form 1041-QFT

IRS Form 1041-QFT is the U.S. Income Tax Return for Qualified Funeral Trusts. This special tax form is designed specifically…

-

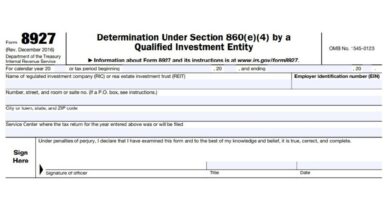

Form 8927

IRS Form 8927, officially titled “Determination Under Section 860(e)(4) by a Qualified Investment Entity,” is a tax document used by…

-

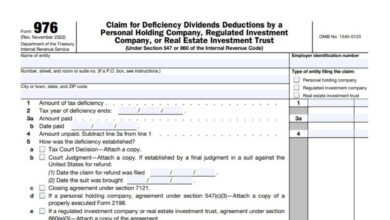

Form 976

IRS Form 976 is used by personal holding companies (PHCs), regulated investment companies (RICs), and real estate investment trusts (REITs)…

-

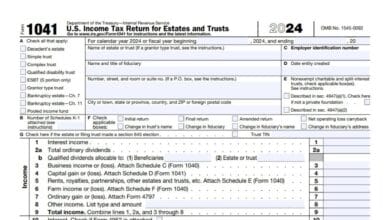

Form 1041

IRS Form 1041 is the U.S. Income Tax Return for Estates and Trusts. This form is used to report income,…