Employment and Payroll Tax Forms

These forms are used by employers to report employee wages and withholdings. They ensure accurate reporting of federal income tax, Social Security, Medicare, and unemployment taxes. Examples include Forms W-2, W-4, and 941.

-

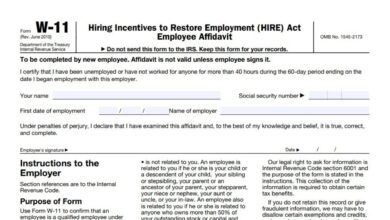

Form W-11

IRS Form W-11, also known as the Employee Affidavit under the Hiring Incentives to Restore Employment (HIRE) Act, is a…

-

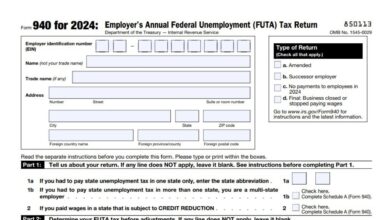

Form 940

IRS Form 940, officially titled “Employer’s Annual Federal Unemployment (FUTA) Tax Return,” is used by employers to report and pay…

-

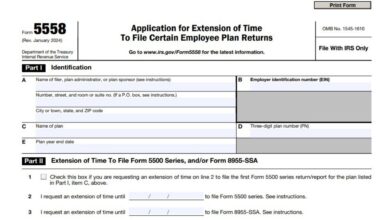

Form 5558

Form 5558, Application for Extension of Time to File Certain Employee Plan Returns, is used by plan administrators and certain…

-

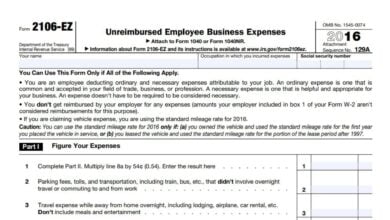

Form 2106-EZ

Form 2106-EZ, Unreimbursed Employee Business Expenses, is an essential document for employees who incur work-related expenses that are not reimbursed…

-

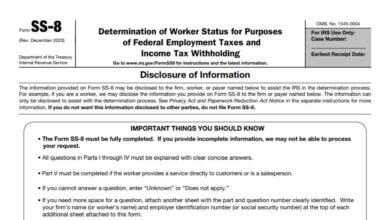

Form SS-8

Worker classification—whether a worker is an employee or an independent contractor—has significant tax implications for both the worker and the…

-

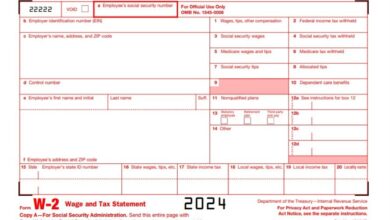

Form W-2

IRS Form W-2, Wage and Tax Statement, is a form that employers provide to employees and the IRS to report…

-

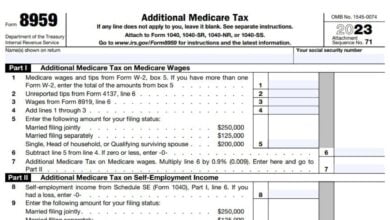

Form 8959

IRS Form 8959, Additional Medicare Tax, is used by taxpayers to calculate and report the additional 0.9% Medicare tax on…

-

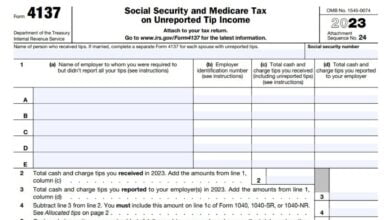

Form 4137

Form 4137 is a tax form you must complete along with your federal income tax return. It should be submitted by…

-

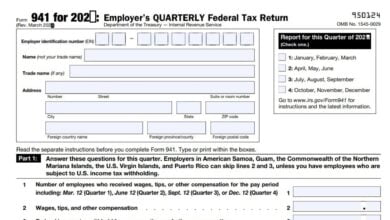

Form 941

Form 941, also known as the Employer’s Quarterly Federal Tax Return, is a tax form that is required to be…