Credits and Other Specific Purpose Forms

These forms are used to claim various tax credits or to report specific financial activities that don’t fall neatly into other standard categories. These forms help taxpayers take advantage of certain tax benefits, such as credits for specific energy investments, educational expenses, or business incentives.

-

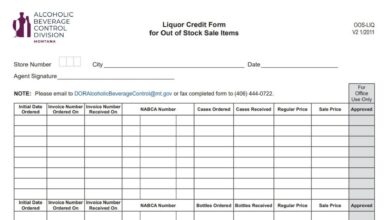

Montana Liquor Credit Form For Out Of Stock Sale Items

The Montana Liquor Credit Form for Out of Stock Sale Items (OOS-LIQ) allows agency liquor stores to request a credit…

-

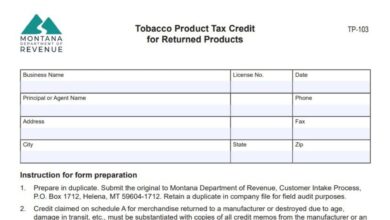

Montana Form TP-103

Montana Form TP-103 is used for claiming a tax credit for tobacco products that have been returned to the manufacturer…

-

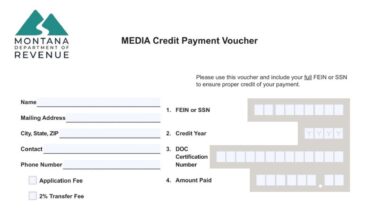

Montana MEDIA Credit Payment Voucher Form

The MEDIA Credit Payment Voucher is a specialized remittance slip used to ensure your payment is correctly credited to your…

-

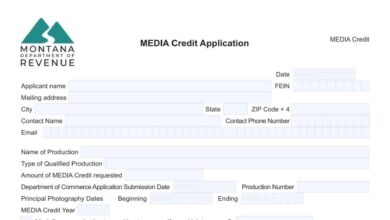

Montana MEDIA Credit Application Form

The Montana MEDIA Credit Application is a formal request document that production companies submit to the Montana Department of Revenue…

-

Montana MEDIA Credit Claim Form

Form MEDIA-CLAIM is the official MEDIA Credit Claim form issued by the Montana Department of Revenue, designed to allow media…

-

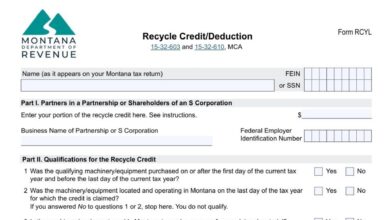

Montana Form RCYL

The Montana Form RCYL (Recycle Credit/Deduction) is a valuable tax document that rewards businesses and individuals for investing in recycling.…

-

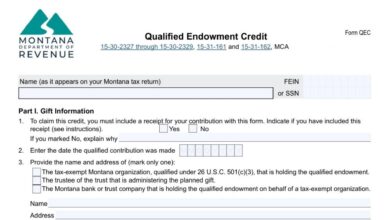

Montana Form QEC

The Montana Form QEC (Qualified Endowment Credit) is a designated tax form used by individuals, corporations, estates, and trusts to…

-

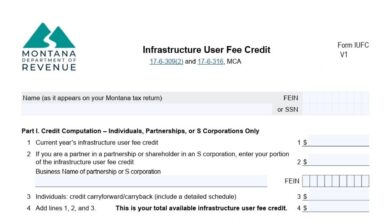

Montana Form IUFC

The Montana Form IUFC (Infrastructure User Fee Credit) is a specific tax document designed for businesses that have expanded or…

-

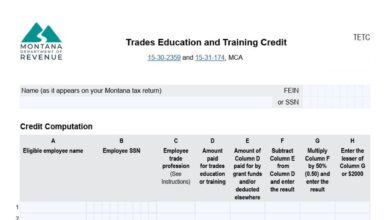

Montana Form TETC

Montana Form TETC is the worksheet-style credit form used to claim the Trades Education And Training Tax Credit for employers…

-

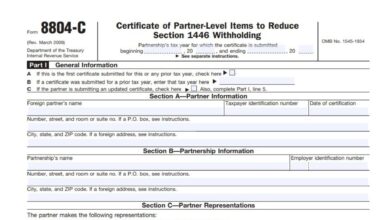

Form 8804-C

IRS Form 8804-C, titled “Certificate of Partner-Level Items to Reduce Section 1446 Withholding,” is a critical document designed specifically for…