Business Tax Forms

Business tax forms are used by corporations, partnerships, and small businesses to report income and tax liabilities. They cover annual returns, employment taxes, and other business-related filings. Proper use ensures businesses meet IRS requirements. Key forms include Form 1120, 1065, and 940.

-

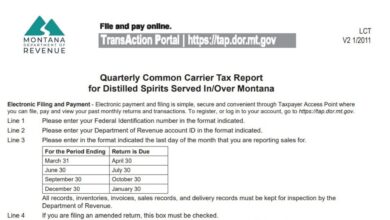

Montana Form LCT

For airlines, railroads, and other common carriers, serving a drink to a passenger while crossing state lines involves specific tax…

-

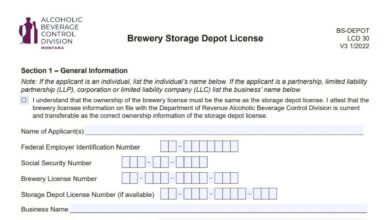

Montana Form BS-DEPOT

Form BS-DEPOT, the “Brewery Storage Depot License Application,” is a state document used by licensed Montana breweries to apply for…

-

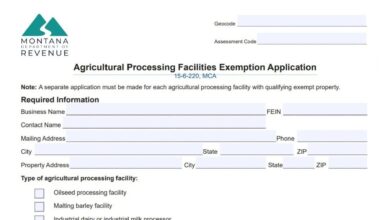

Montana Agricultural Processing Facilities Exemption Form

The Agricultural Processing Facilities Exemption Application is a specialized tax form administered by the Montana Department of Revenue. It allows…

-

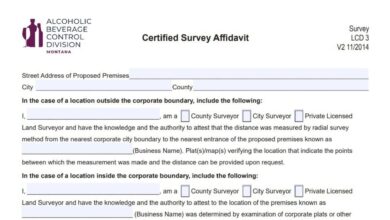

Montana Certified Survey Affidavit Form

The Certified Survey Affidavit is a mandatory legal document issued by the Alcoholic Beverage Control Division of Montana. It serves…

-

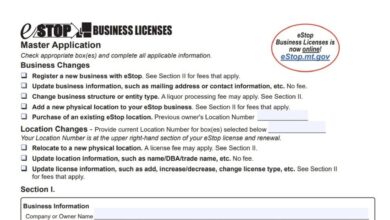

Montana eStop Master Application Form

The eStop Business Licenses Master Application is a multi-purpose document designed by the Montana Department of Revenue to streamline the…

-

Montana Brewery Collaboration Notification Form

The Montana Brewery Collaboration Notification Form (Brewery Collab, V1 10/2023) is a mandatory document used when two or more licensed…

-

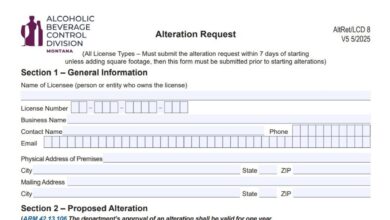

Montana Alteration Request Form

The Montana Alteration Request form (AltRet/LCD 8, Version 5 5/2025) is a mandatory document used by liquor licensees to notify…

-

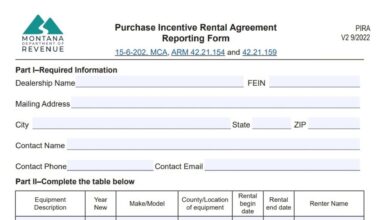

Montana Form PIRA

Montana Form PIRA is an annual report required under Montana law for farm implement and construction equipment dealers who rent…

-

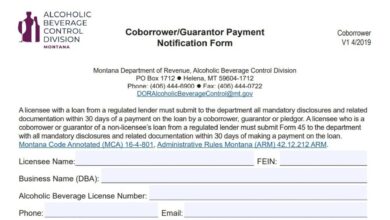

Montana Coborrower/Guarantor Payment Notification Form

The Coborrower/Guarantor Payment Notification Form is a critical compliance document issued by the Montana Department of Revenue’s Alcoholic Beverage Control…

-

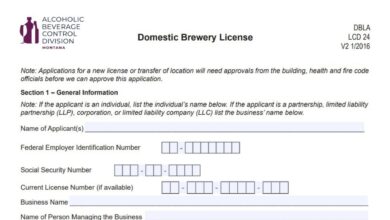

Montana Domestic Brewery License Application

The Montana Domestic Brewery License Application is a formal request document submitted to the Montana Department of Revenue’s Alcoholic Beverage…