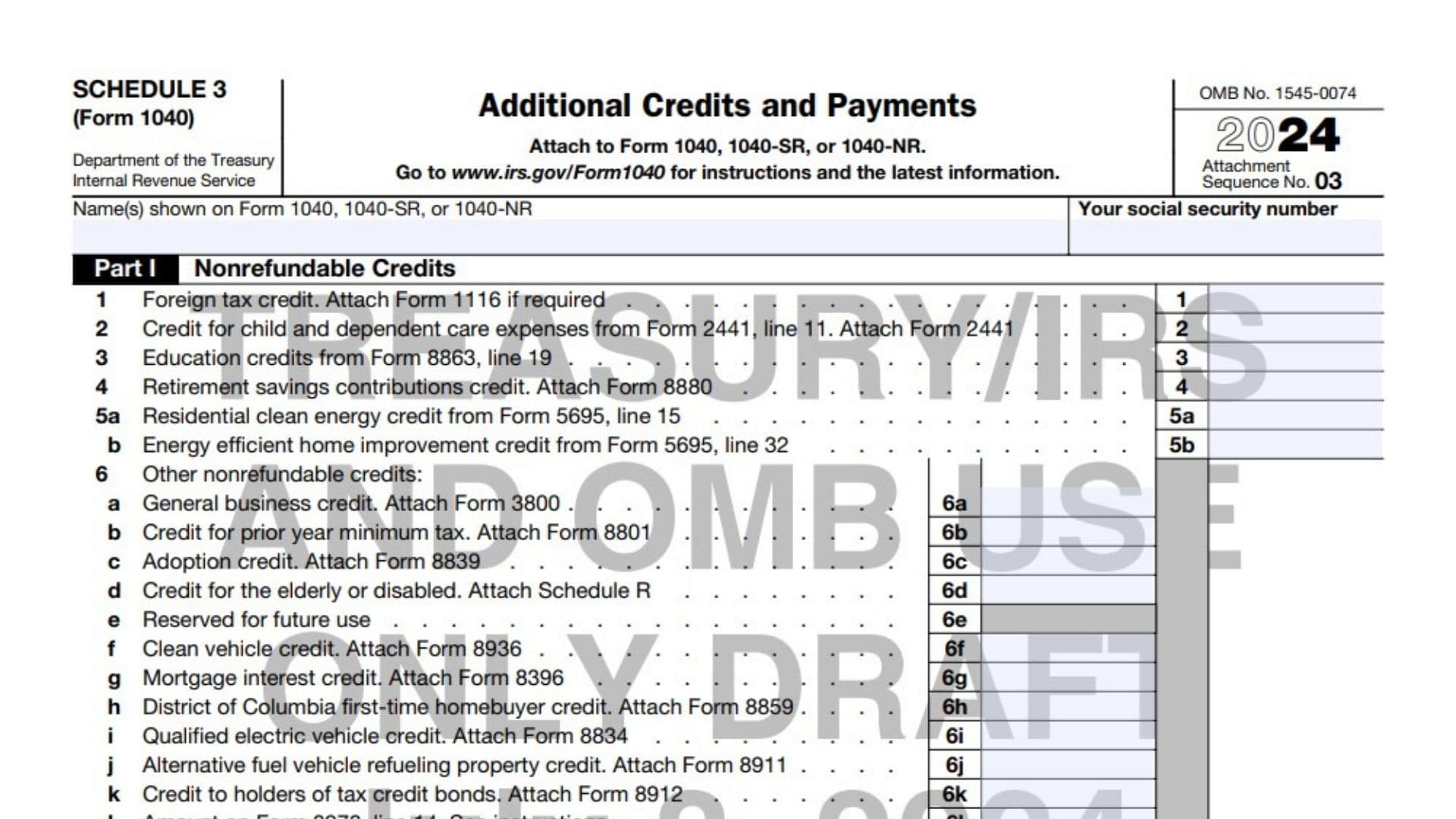

Schedule 3 (Form 1040) is used by taxpayers to report additional credits and payments that are not included directly on Form 1040. This form allows individuals to claim nonrefundable credits, such as the foreign tax credit and education credits, as well as refundable credits and other payments, ensuring that taxpayers can maximize their tax benefits and accurately report their financial obligations to the IRS.

Line-by-Line Instructions for Schedule 3 (Form 1040)

- Part I: Nonrefundable Credits

- Line 1: Enter the amount of your foreign tax credit. If required, attach Form 1116.

- Line 2: Enter the credit for child and dependent care expenses from Form 2441, line 11. Attach Form 2441.

- Line 3: Enter education credits from Form 8863, line 19.

- Line 4: Enter the retirement savings contributions credit. Attach Form 8880.

- Line 5a: Enter the residential clean energy credit from Form 5695, line 15.

- Line 5b: Enter the energy-efficient home improvement credit from Form 5695, line 32.

- Line 6: List any other nonrefundable credits:

- a. General business credit (attach Form 3800)

- b. Credit for prior year minimum tax (attach Form 8801)

- c. Adoption credit (attach Form 8839)

- d. Credit for the elderly or disabled (attach Schedule R)

- e. Reserved for future use

- f. Clean vehicle credit (attach Form 8936)

- g. Mortgage interest credit (attach Form 8396)

- h. District of Columbia first-time homebuyer credit (attach Form 8859)

- i. Qualified electric vehicle credit (attach Form 8834)

- j. Alternative fuel vehicle refueling property credit (attach Form 8911)

- k. Credit to holders of tax credit bonds (attach Form 8912)

- l. Amount on Form 8978, line 14 (see instructions)

- m. Credit for previously owned clean vehicles (attach Form 8936)

- z. Other nonrefundable credits (list type and amount).

- Line 7: Add lines from section 6a to 6z and enter the total.

- Line 8: Add lines 1 through 4, lines 5a and 5b, and line 7; enter this total on Form 1040, line 20.

- Part II: Other Payments and Refundable Credits

- Line 9: Enter net premium tax credit; attach Form 8962.

- Line 10: Enter the amount paid with a request for an extension to file.

- Line 11: Enter any excess social security and tier I RRTA tax withheld.

- Line 12: Enter the credit for federal tax on fuels; attach Form 4136.

- Line 13: List any other payments or refundable credits:

- Line 14: Add lines from section 13a to section 13z.

- Final Calculation: Add lines from sections 9 through 12 and line 14; enter this total on Form 1040, line 31.