Schedule B (Form 1040) is a supplemental form used by taxpayers to report interest and ordinary dividends earned during the tax year. This form is particularly important for individuals who have received significant amounts of interest income from various sources, such as bank accounts, bonds, or other investments, as well as dividends from stocks or mutual funds. Taxpayers must complete Schedule B if their total taxable interest or ordinary dividends exceed $1,500 or if they have foreign accounts or trusts. The form consists of two main parts: Part I focuses on reporting interest income, while Part II is dedicated to ordinary dividends. Additionally, if taxpayers have foreign accounts or received distributions from foreign trusts, they may need to provide further details in Part III. Accurate completion of Schedule B is essential, as it ensures compliance with IRS regulations and helps in correctly calculating overall tax liability.

How to Complete Schedule B (Form 1040)?

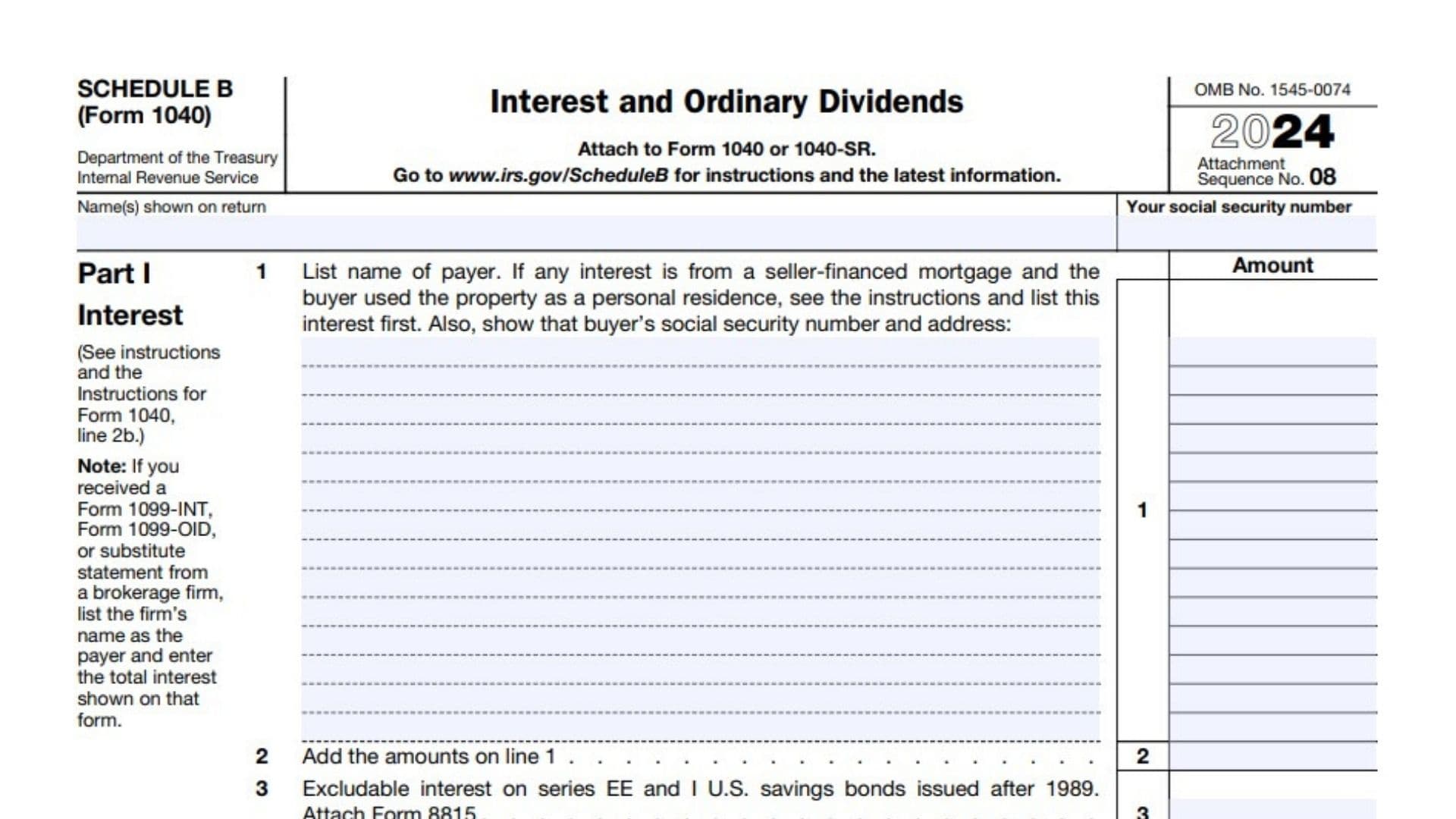

Part I: Interest

- Line 1: List the name of each payer and the amount of interest received. If you received a Form 1099-INT or Form 1099-OID, enter the total interest shown on that form.

- Line 2: Add the amounts reported on Line 1 and enter the total here. This amount will be carried over to Form 1040, Line 2b.

- Line 3: If you have excludable interest from Series EE and I U.S. savings bonds issued after 1989, attach Form 8815 and enter that amount here.

- Line 4: Subtract Line 3 from Line 2 and enter the result here. This is your taxable interest income.

Part II: Ordinary Dividends

- Line 5: List the name of each payer and the amount of ordinary dividends received. If you received a Form 1099-DIV, enter the total dividends shown on that form.

- Line 6: Add the amounts reported on Line 5 and enter the total here. This amount will be carried over to Form 1040, Line 3b.

Part III: Foreign Accounts and Trusts

- Line 7a: Complete this line if you had over $1,500 of taxable interest or ordinary dividends; had a foreign account; or received a distribution from, were a grantor of, or a transferor to a foreign trust. List the name of each foreign account.

- Line 7b: Provide additional details about your foreign accounts if necessary.

- Line 8: If applicable, indicate whether you are required to file FinCEN Form 114 or Form 8938 regarding specified foreign financial assets.