Schedule A (Form 1040) is an essential form for taxpayers who choose to itemize their deductions on their federal income tax return, allowing them to potentially lower their taxable income more effectively than by taking the standard deduction. This form is particularly beneficial for individuals who have incurred significant deductible expenses during the tax year, such as medical costs, mortgage interest, property taxes, and charitable contributions. By detailing these expenses on Schedule A, taxpayers can maximize their deductions, which may lead to a reduced overall tax liability. It is essential for individuals to maintain accurate records and receipts for all claimed deductions, as the IRS may require documentation to substantiate these claims. Completing Schedule A accurately can result in substantial tax savings, making it an important tool for effective tax planning.

How to Complete Schedule A (Form 1040)?

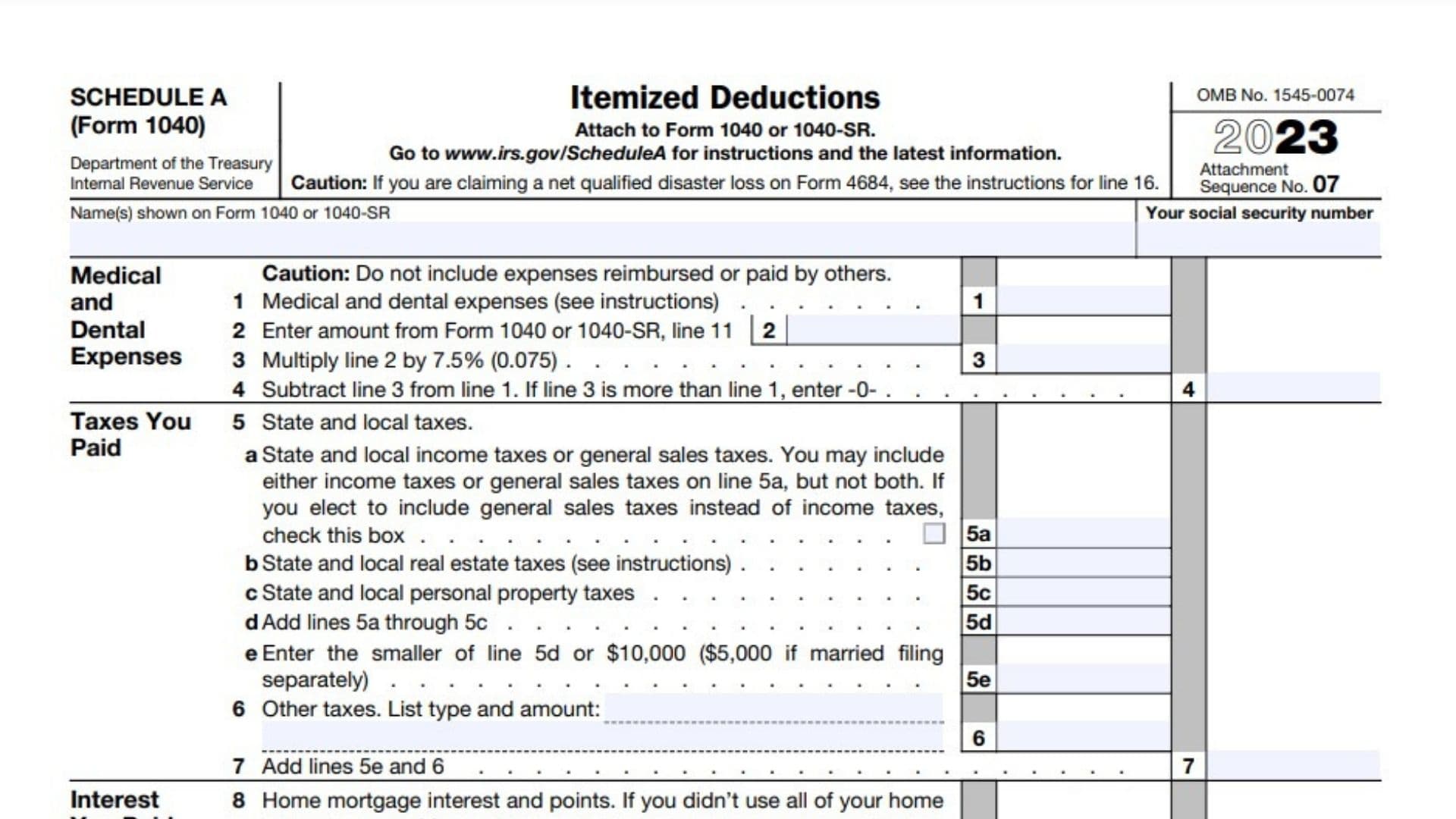

1. Medical and Dental Expenses

- Enter your total qualified medical and dental expenses. Only include the amount that exceeds 7.5% of your adjusted gross income (AGI).

2. Taxes You Paid

- Report state and local income taxes or sales taxes you paid during the year. You can choose between deducting state and local income taxes or sales taxes, but not both. Include real estate taxes and personal property taxes as well. The total deduction for state and local taxes is limited to $10,000 ($5,000 if married filing separately).

3. Interest You Paid

- Report the total mortgage interest you paid during the year, which you can find on Form 1098, as well as any points paid on the purchase of a home.

4. Gifts to Charity

- Enter the total amount of cash or property contributions made to qualified charitable organizations. Ensure you have receipts or documentation for all donations.

5. Casualty and Theft Losses

- Report any losses from federally declared disasters or thefts that are not covered by insurance. You will need to provide details about the loss.

6. Other Itemized Deductions

- Include any other allowable deductions that do not fit into the previous categories, such as unreimbursed employee expenses or tax preparation fees.

7. Total Itemized Deductions

- Add up all amounts from lines 1 through 6 and enter the total here. This total represents your itemized deductions for the year.