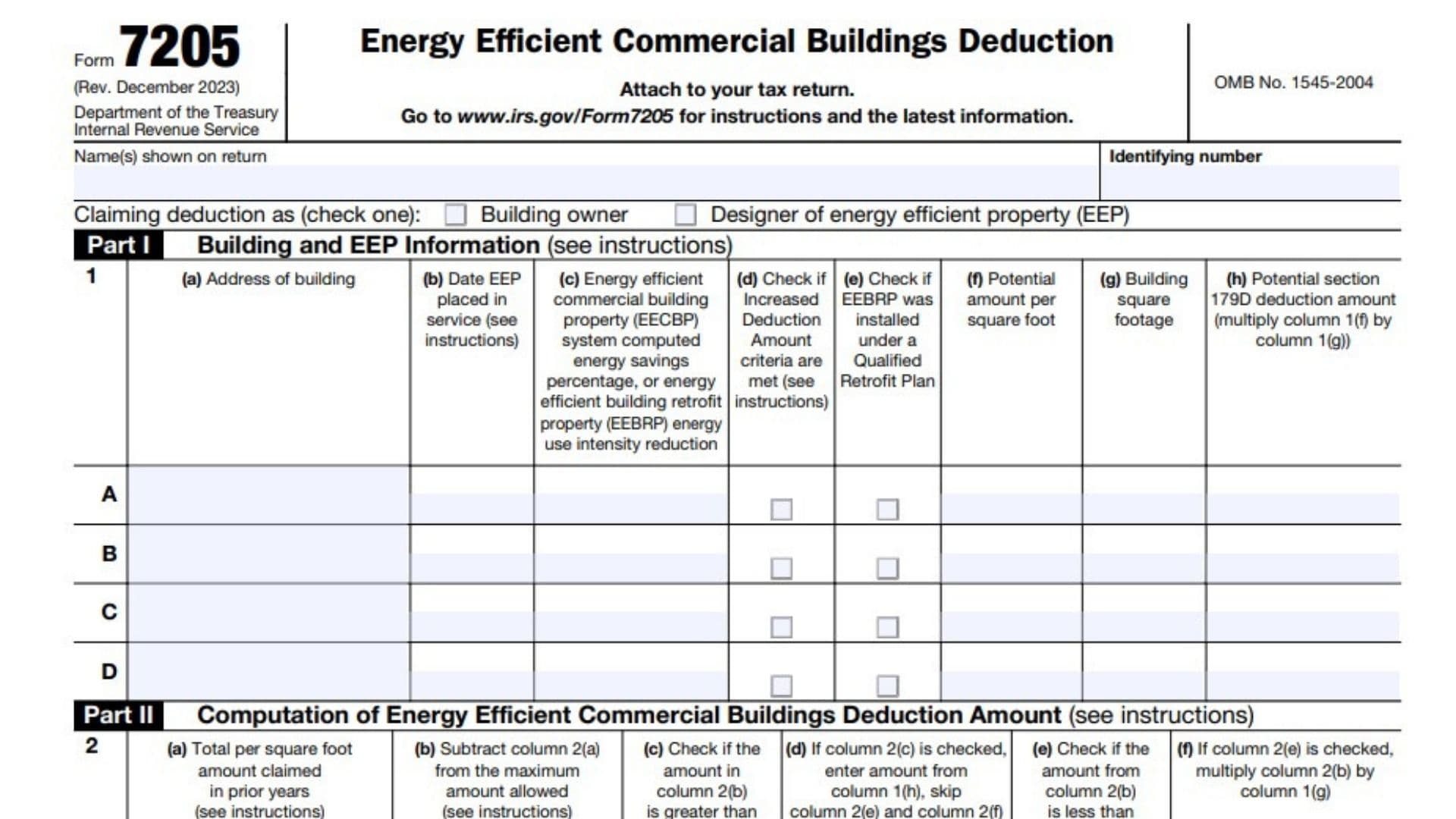

IRS Form 7205, “Energy Efficient Commercial Buildings Deduction,” is used by commercial building owners or designers to claim the Section 179D tax deduction for energy-efficient building property (EEBP) installations. This deduction encourages reducing energy consumption through qualifying property improvements, such as lighting, HVAC, and building envelope systems. The form calculates eligible deductions based on energy efficiency improvements and their respective square footage, providing tax benefits for buildings that meet specific energy savings criteria.

How to Complete Form 7205?

- General Information (Top of the Form):

- Name(s): Enter the name(s) of the individual or entity as shown on the tax return.

- Identifying Number: Input the taxpayer’s identification number (EIN or SSN).

- Claiming Deduction as: Check the box indicating your role, either as the building owner or as the designer of the energy-efficient property (EEP).

- Part I – Building and EEP Information:

- Column 1(a): Enter the building address where the energy-efficient improvements were made.

- Column 1(b): Specify the date when the energy-efficient property (EEP) was placed in service.

- Column 1(c): Enter the calculated energy savings percentage or energy use intensity reduction from the energy-efficient commercial building property (EECBP) system or the energy-efficient building retrofit property (EEBRP).

- Column 1(d): Check this box if the criteria for an increased deduction amount are met according to the form’s instructions.

- Column 1(e): Indicate if the EEBRP was installed under a Qualified Retrofit Plan by checking this box.

- Column 1(f): Enter the potential deduction amount per square foot.

- Column 1(g): Report the building’s square footage.

- Column 1(h): Calculate the potential Section 179D deduction by multiplying the value in column 1(f) by the square footage in column 1(g).

Part II – Computation of Energy Efficient Commercial Buildings Deduction Amount:

- Column 2(a): Enter any per-square-foot deduction amounts previously claimed for this property in prior years.

- Column 2(b): Subtract column 2(a) from the maximum allowable deduction and enter the result here.

- Column 2(c): Check this box if the amount in column 2(b) is equal to or greater than the amount in column 1(f).

- Column 2(d): If column 2(c) is checked, enter the value from column 1(h) here, then skip columns 2(e) and 2(f) and proceed to column 2(g).

- Column 2(e): Check this box if the amount in column 2(b) is less than the amount in column 1(f).

- Column 2(f): If column 2(e) is checked, multiply column 2(b) by column 1(g) and enter the result here.

- Column 2(g): Report the total cost of the EEP placed in service during the tax year. If the building ownership percentage is less than 100%, follow the instructions for additional details.

- Column 2(h): Enter the greater of the amounts in column 2(d) or column 2(f). Refer to instructions if the building ownership percentage is less than 100%.

- Column 2(i): Enter the lesser of the amounts in columns 2(g) or 2(h).

- Column 2(j): For designers, enter the amount of the Section 179D deduction allocated to you as the designer.

- Column 2(k): Calculate the final Section 179D deduction for the building. Designers enter the lesser of column 2(i) or 2(j), while building owners enter the amount from column 2(i).

- Line 3 – Total Section 179D Deduction:

- Add up all amounts from column 2(k) across each building entry and enter the total here. This total is then reported on the appropriate line of the taxpayer’s return as directed in the instructions.

Part III – Certification Information for Each Property Listed in Part I:

- Column 4(a): Provide the name of the Qualified Individual who completed the energy efficiency certification.

- Column 4(b): Enter the certification date.

- Column 4(c): State the employer of the Qualified Individual.

- Column 4(d): Provide the address of the Qualified Individual.

Part IV – Designer Allocation Information for Each Property Listed in Part I (Designer Only):

- This section is completed by designers only.

- Column 5(a): Enter the name of the identified building owner.

- Column 5(b): Record the date of allocation.

- Column 5(c): Enter the name of the building owner’s authorized representative who completed the allocation.

- Column 5(d): Provide the address of the building owner’s authorized representative.