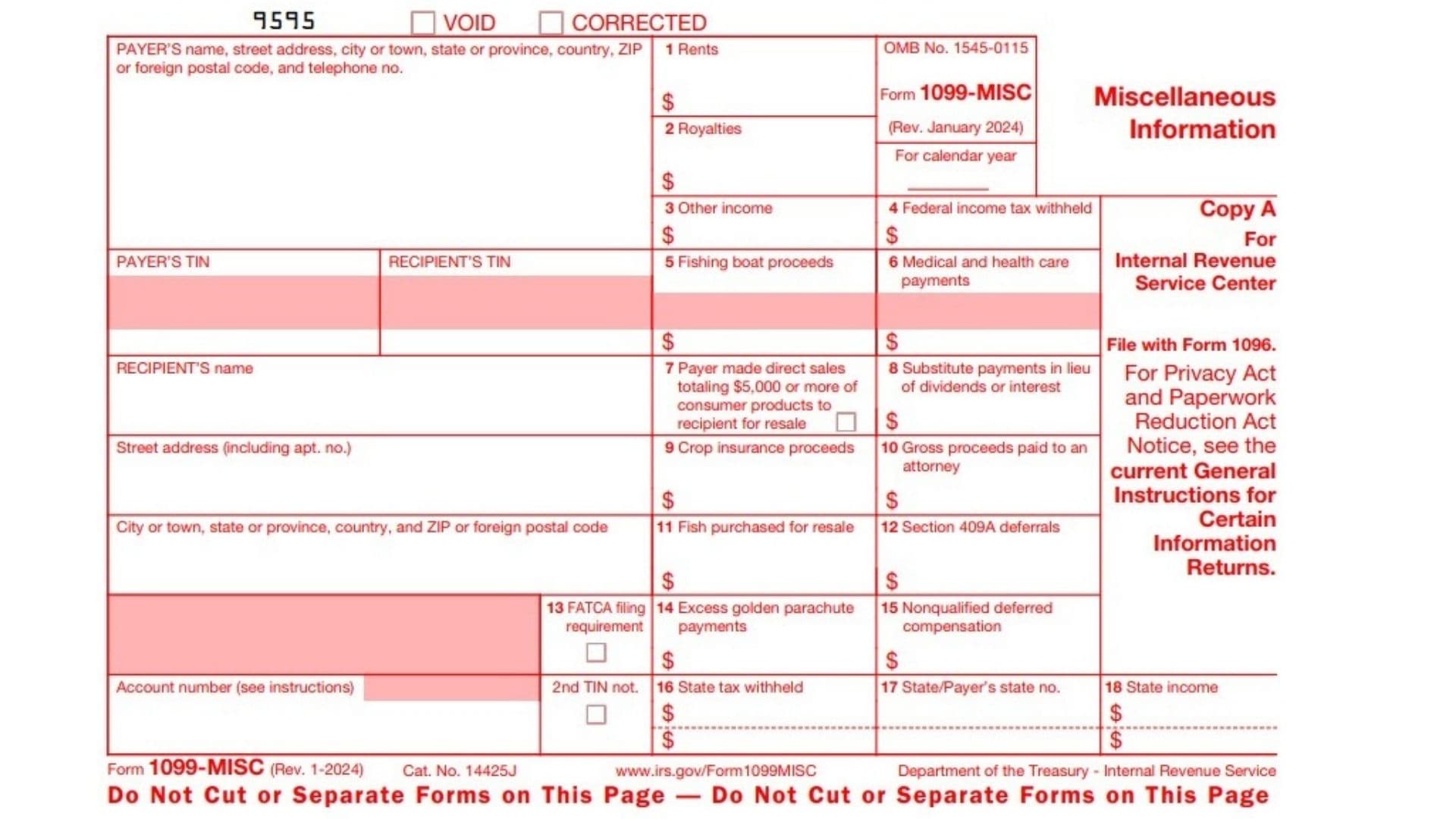

IRS Form 1099-MISC is used to report miscellaneous income paid to individuals or entities who are not employees. This form is essential for businesses and organizations that have made payments that meet certain thresholds during the tax year. Common types of income reported on Form 1099-MISC include rents, royalties, prizes, awards, and other types of non-employee compensation. Generally, businesses must file Form 1099-MISC if they have paid $600 or more to a non-employee in a calendar year. Filing is typically done by January 31 of the year following the payment, and it must be sent to both the IRS and the recipient of the payment.

How to Complete Form 1099-MISC?

Header Information

- Payer’s Name: Enter the full name of the payer (the entity making the payment).

- Payer’s TIN: Provide the Taxpayer Identification Number (TIN) for the payer.

- Payer’s Address: Fill in the complete address of the payer, including street address, city, state, and ZIP code.

- Recipient’s Name: Enter the full name of the recipient (the individual or entity receiving the payment).

- Recipient’s TIN: Provide the TIN for the recipient.

- Recipient’s Address: Fill in the complete address of the recipient, including street address, city, state, and ZIP code.

- Account Number: If applicable, enter an account number assigned by the payer to identify this specific account.

- 2nd TIN Not: If applicable, check this box if the recipient has provided a second TIN.

Income Reporting Boxes

- Box 1 – Rents: Report total rents paid to the recipient during the calendar year.

- Box 2 – Royalties: Report total royalties paid to the recipient during the calendar year.

- Box 3 – Other Income: Report other types of income not specified elsewhere on this form that total $600 or more.

- Box 4 – Federal Income Tax Withheld: Report any federal income tax withheld from payments made to the recipient.

- Box 5 – Fishing Boat Proceeds: Report amounts paid to crew members of fishing boats considered self-employed.

- Box 6 – Medical and Health Care Payments: Report payments made for medical and health care services provided to individuals.

- Box 7 – Direct Sales: Check this box if direct sales totaling $5,000 or more were made to the recipient for resale.

- Box 8 – Substitute Payments: Report substitute payments in lieu of dividends or interest received by a broker on behalf of a client.

- Box 9 – Crop Insurance Proceeds: Report proceeds from crop insurance paid to farmers or agricultural producers.

- Box 10 – Gross Proceeds Paid to an Attorney: Report gross proceeds paid to an attorney in connection with legal services.

- Box 11 – Fish Purchased for Resale: Report amounts received for fish sold by individuals in the fishing business.

- Box 12 – Section 409A Deferrals: Report amounts deferred under a nonqualified deferred compensation plan subject to Section 409A.

- Box 13 – FATCA Filing Requirement: Check this box if reporting is required under FATCA regulations.

- Box 14 – Excess Golden Parachute Payments: Report total compensation subject to excise tax due to excess golden parachute payments.

- Box 15 – Nonqualified Deferred Compensation: Report amounts received as nonqualified deferred compensation not meeting Section 409A requirements.

State Tax Information

- Box 16 – State Tax Withheld: Report any state income tax withheld from payments made to the recipient.

- Box 17 – State/Payer’s State No.: Enter the state identification number for reporting purposes.

- Box 18 – State Income: Report total state income paid to the recipient during the calendar year.