IRS Form 7208 is used to report excise tax on the repurchase of corporate stock. This form is specifically designed for entities that have repurchased their own stock and need to calculate and report any applicable excise taxes to the IRS. It is typically attached to Form 720, which is the general form for reporting various excise taxes.

How To File Form 7208?

To file Form 7208, follow these steps:

- Obtain the Form: Download Form 7208 from the IRS website or use the provided PDF file.

- Complete Header Information: Fill in your name, Employer Identification Number (EIN), and the tax year for which you are filing.

- Fill Out Part I: Report total stock repurchases:

- Enter details for each transaction, including the name of the entity, EIN, type of transaction, stock symbol, class of stock, trading exchange, number of shares repurchased, and total fair market value (FMV) of the repurchased shares.

- If necessary, summarize totals from attachments.

- Complete Part II: Report any exceptions to tax on stock repurchases. This includes transactions that are part of reorganizations or treated as dividends.

- Complete Part III: If applicable, report contributions to employer-sponsored retirement plans related to stock repurchases.

- Complete Part IV: Report any stock issued or provided to employees or affiliates.

- Calculate Tax in Part V:

- Determine the stock repurchases subject to tax by subtracting exceptions and contributions from your total repurchases.

- Calculate the excise tax (1% of the amount subject to tax) and enter this amount.

- Attach to Form 720: Once completed, attach Form 7208 to your Form 720 and submit it according to IRS guidelines.

- Keep Records: Maintain copies of your completed forms and any supporting documentation for your records.

Make sure to review the instructions on the IRS website for any updates or additional requirements specific to your situation before filing.

How to Complete IRS Form 7208?

**** Header Information

- Tax Year: Enter the calendar year or other tax year for which you are filing.

- Name: Provide the name of the entity repurchasing the stock.

- Employer Identification Number (EIN): Enter the EIN associated with the entity.

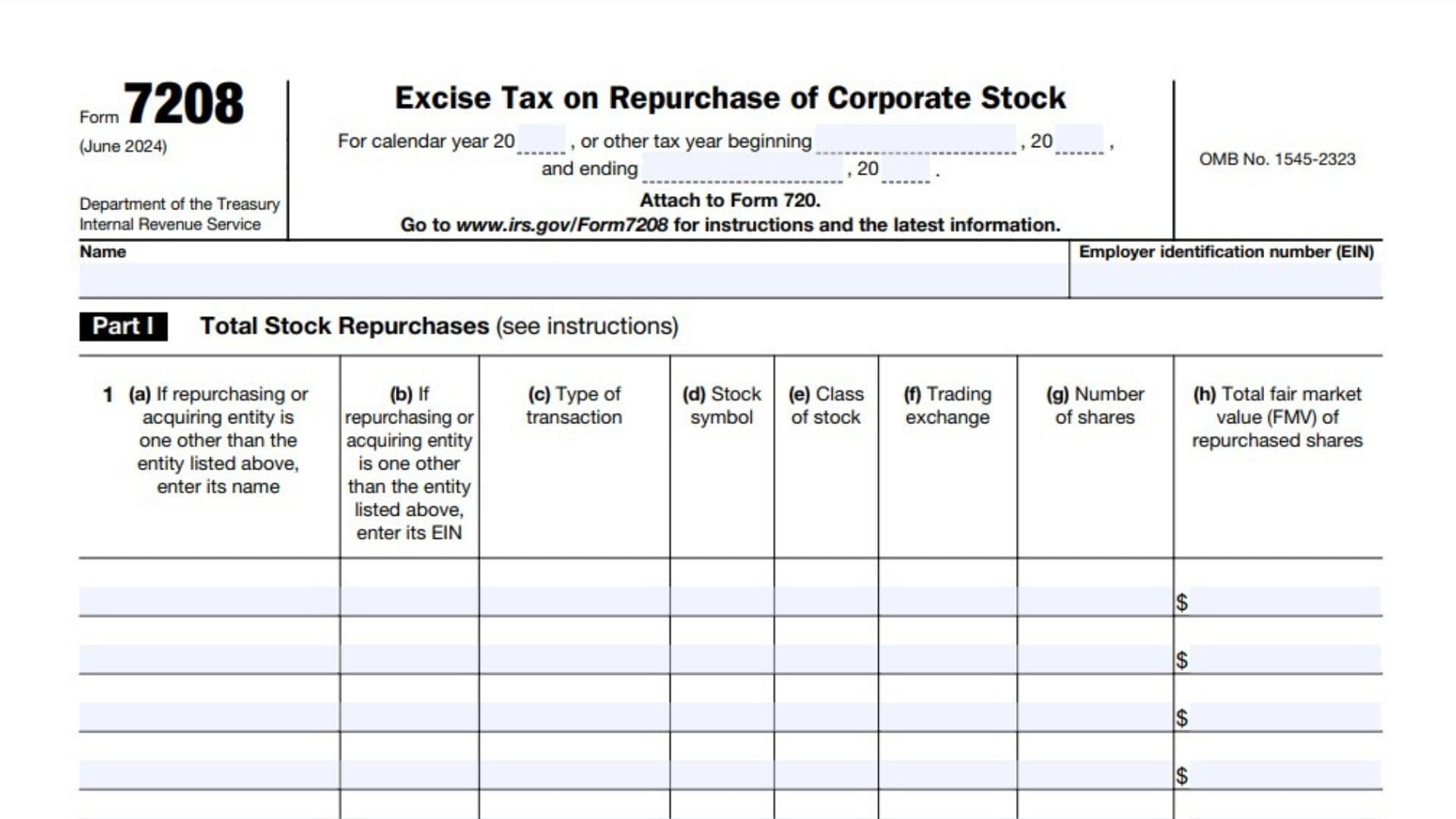

**** Part I: Total Stock Repurchases

- Line 1: Report details of each stock repurchase:

- (a) Name of the entity if different from above.

- (b) EIN of that entity.

- (c) Type of transaction (e.g., purchase, exchange).

- (d) Stock symbol.

- (e) Class of stock (e.g., common, preferred).

- (f) Trading exchange where the stock is listed.

- (g) Number of shares repurchased.

- (h) Total fair market value (FMV) of repurchased shares.

- Line 2: If necessary, summarize totals from attachments.

- Line 3: Add amounts in column (h) and enter the total here. If you are an applicable specified affiliate, refer to instructions.

- Line 4: Answer whether any repurchases were related to an applicable foreign corporation or a covered surrogate foreign corporation.

**** Part II: Exceptions

- Line 5: Report exceptions to tax:

- (a) Stock repurchases as part of a reorganization.

- (b) Stock treated as dividends.

- (c) Reserved for future use.

- (d) Stock repurchases by a dealer in securities.

- (e) Total exceptions: Add lines 5a through 5d.

**** Part III: Contributions to Employer-Sponsored Retirement Plans

- Line 6: Report details about stock repurchases and contributions:

- (a) Class of stock repurchased.

- (b) Number of shares repurchased.

- (c) Aggregate FMV of shares.

- (d) Average price per share.

- (e) Number of shares contributed.

- (f) FMV of contributed shares.

- (g) Total contributions.

- Line 7: If necessary, summarize totals from attachments.

- Line 8: Add amounts in column (i).

**** Part IV: Stock Issued or Provided

- Line 9: Report stock issued or provided:

- (a) To employees.

- (b) To employees of a specified affiliate.

- (c) Stock issued not reported elsewhere.

- (d) Total issuances: Add lines 9a through 9c.

**** Part V: Tax and Payments

- Line 10: Calculate stock repurchases subject to tax by subtracting lines 5e, 8, and 9d from line 3. If zero or less, enter “-0-” and see instructions.

- Line 11: Calculate excise tax on stock repurchases by multiplying line 10 by 1% (0.01). Enter this amount on Form 720 under IRS No. 150.