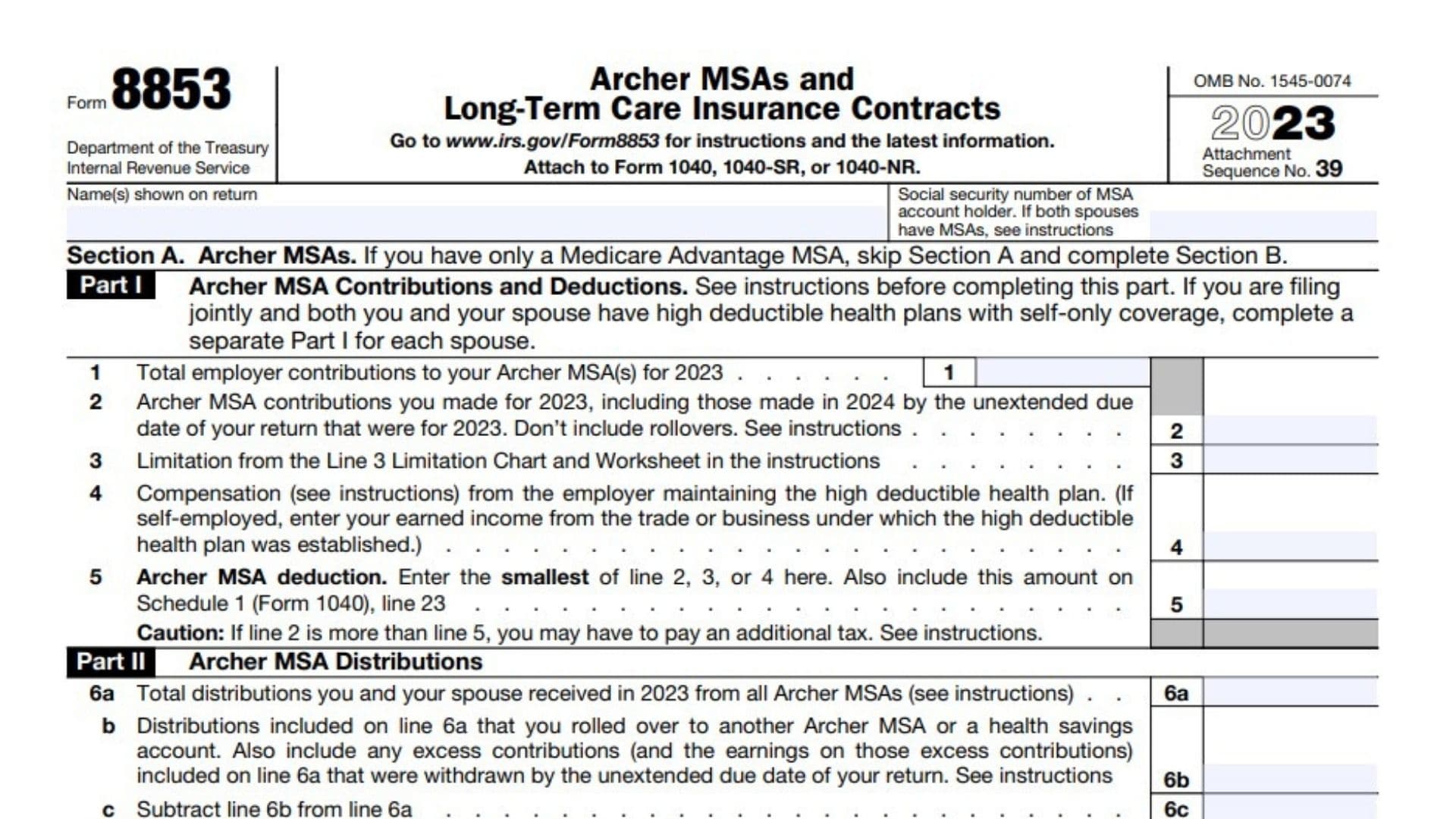

IRS Form 8853 is used to report transactions related to Archer Medical Savings Accounts (MSAs), Medicare Advantage MSAs, and Long-Term Care (LTC) Insurance Contracts. This form is typically attached to Form 1040, 1040-SR, or 1040-NR and is used to calculate taxable distributions, deductions, and potential additional taxes related to these accounts and contracts.

Who Must File Form 8853?

Form 8853 must be filed by individuals who have Archer Medical Savings Accounts (MSAs), Medicare Advantage MSAs, or who receive payments from or make payments for qualified Long-Term Care (LTC) insurance contracts. Specifically, you need to file this form if you (or your spouse, if filing jointly) had any activity in an Archer MSA or Medicare Advantage MSA during the tax year, including contributions, distributions, or earning interest. Additionally, if you received any payments from a qualified LTC insurance contract or if you received any accelerated death benefits from a life insurance policy on a per diem or other periodic basis, you must file Form 8853.

How to File Form 8853?

To file Form 8853, you should complete the relevant sections of the form based on your specific situation. For Archer MSAs, complete Section A; for Medicare Advantage MSAs, complete Section B; and for LTC insurance contracts, complete Section C. Once completed, attach Form 8853 to your Form 1040, 1040-SR, or 1040-NR when you file your tax return. It’s important to note that if you and your spouse both have MSAs or received LTC insurance contract payments, you may need to complete separate forms for each of you. Be sure to include any taxable amounts from Form 8853 on the appropriate lines of your main tax return as indicated in the form instructions.

How to Complete Form 8853?

Here is the Line-by-line instructions for IRS Form 8853:

Section A: Archer MSAs

Part I: Archer MSA Contributions and Deductions

- Line 1: Enter the total employer contributions to your Archer MSA(s) for 2025.

- Line 2: Enter Archer MSA contributions you made for 2025, including those made in 2026 by the unextended due date of your return for 2025. Don’t include rollovers.

- Line 3: Enter the limitation amount from the Line 3 Limitation Chart and Worksheet in the instructions.

- Line 4: Enter compensation from the employer maintaining the high deductible health plan. If self-employed, enter your earned income from the relevant trade or business.

- Line 5: Enter the smallest amount from lines 2, 3, or 4. This is your Archer MSA deduction.Part II: Archer MSA Distributions

- Line 6a: Enter the total distributions you and your spouse received in 2025 from all Archer MSAs.

- Line 6b: Enter distributions included on line 6a that were rolled over to another Archer MSA or health savings account, and any withdrawn excess contributions.Line 6c: Subtract line 6b from line 6a.

- Line 7: Enter unreimbursed qualified medical expenses.

- Line 8: Subtract line 7 from line 6c. If zero or less, enter -0-. This is your taxable Archer MSA distribution.

- Line 9a: Check the box if any distributions on line 8 meet exceptions to the additional 20% tax.

- Line 9b: Enter 20% of the distributions on line 8 subject to the additional 20% tax.Section B: Medicare Advantage MSA Distributions

- Line 10: Enter total distributions received in 2025 from all Medicare Advantage MSAs.

- Line 11: Enter unreimbursed qualified medical expenses.

- Line 12: Subtract line 11 from line 10. If zero or less, enter -0-. This is your taxable Medicare Advantage MSA distribution.

- Line 13a: Check the box if any distributions on line 12 meet exceptions to the additional 50% tax.

- Line 13b: Enter 50% of the distributions on line 12 subject to the additional 50% tax.

Section C: Long-Term Care (LTC) Insurance Contracts

- Line 14a: Enter the name of the insured.

- Line 14b: Enter the Social Security number of the insured.

- Line 15: Check Yes or No to indicate if anyone other than you received payments under a qualified LTC insurance contract or accelerated death benefits for the insured.

- Line 16: Check Yes or No to indicate if the insured was terminally ill.

- Line 17: Enter gross LTC payments received on a per diem or other periodic basis.

- Line 18: Enter the part of the amount on line 17 that is from qualified LTC insurance contracts.

- Line 19: Enter accelerated death benefits received on a per diem or other periodic basis. Don’t include amounts received because the insured was terminally ill.

- Line 20: Add lines 18 and 19.

- Line 21: Multiply $420 by the number of days in the LTC period.

- Line 22: Enter the costs incurred for qualified LTC services provided for the insured during the LTC period.

- Line 23: Enter the larger of line 21 or line 22.

- Line 24: Enter reimbursements for qualified LTC services provided for the insured during the LTC period.

- Line 25: Subtract line 24 from line 23. This is your per diem limitation.

- Line 26: Subtract line 25 from line 20. If zero or less, enter -0-. This is your taxable payments amount. Include this amount in the total on Schedule 1 (Form 1040), line 8e, or for Form 1040-NR filers, on Schedule NEC (Form 1040-NR), line 12. For Form 1040-NR filers, enter “LTC” and the amount on Schedule NEC, line 12.Note: If you checked “Yes” on line 15, refer to the “Multiple Payees” section in the instructions before completing lines 21 through 25. Also, if you received any reimbursements from LTC contracts issued before August 1, 1996, consult the instructions for line 24.