Form 8697, Interest Computation Under the Look-Back Method for Completed Long-Term Contracts, is used by taxpayers to calculate the interest due or to be refunded under the look-back method for long-term contracts that have been completed. Properly managing this form ensures compliance with IRS regulations and accurately computes any interest adjustments required for contracts accounted for under the percentage of completion method. The primary purpose of Form 8697 is to calculate the interest due to the IRS or to be refunded to the taxpayer under the look-back method for completed long-term contracts. The look-back method requires taxpayers to recompute income from long-term contracts based on actual contract costs and completion dates, which can result in additional tax or a refund. By using Form 8697, taxpayers can accurately compute the interest adjustments related to these long-term contracts and ensure that their tax liabilities are correctly adjusted.

Who Must File Form 8697?

Form 8697 must be filed by taxpayers who use the percentage of completion method for long-term contracts and who need to compute interest under the look-back method upon the completion of these contracts. This includes:

- Individuals: Taxpayers filing individual returns (Form 1040) who engage in long-term contracts.

- Businesses: Corporations, partnerships, and other entities filing business returns (Forms 1120, 1065, etc.) with long-term contracts subject to the look-back method.

- Trusts and Estates: Entities that handle long-term contracts and need to compute interest adjustments under the look-back method.

The form should be filed with the taxpayer’s annual income tax return for the year in which the contract is completed.

How To File Form 8697?

Filing Form 8697 involves several steps and requires detailed information to ensure all necessary information is provided. The form must be filed along with the taxpayer’s annual income tax return.

- Obtain Form 8697: The form can be downloaded from the IRS website. Ensure you have the correct version for the tax year in which you are filing.

- Complete the form: Fill out Form 8697 with the required information, including details about the long-term contracts, the interest computation, and the adjustments required.

- Attach supporting documentation: Gather all required documents, such as contracts, cost records, and completion dates, that substantiate the look-back interest computation.

- Submit the form: File Form 8697 with your annual income tax return (Form 1040, Form 1120, etc.). Ensure that the form and all supporting documentation are included in the tax return package.

How to Complete Form 8697?

Here are line-by-line instructions for filling out this IRS form

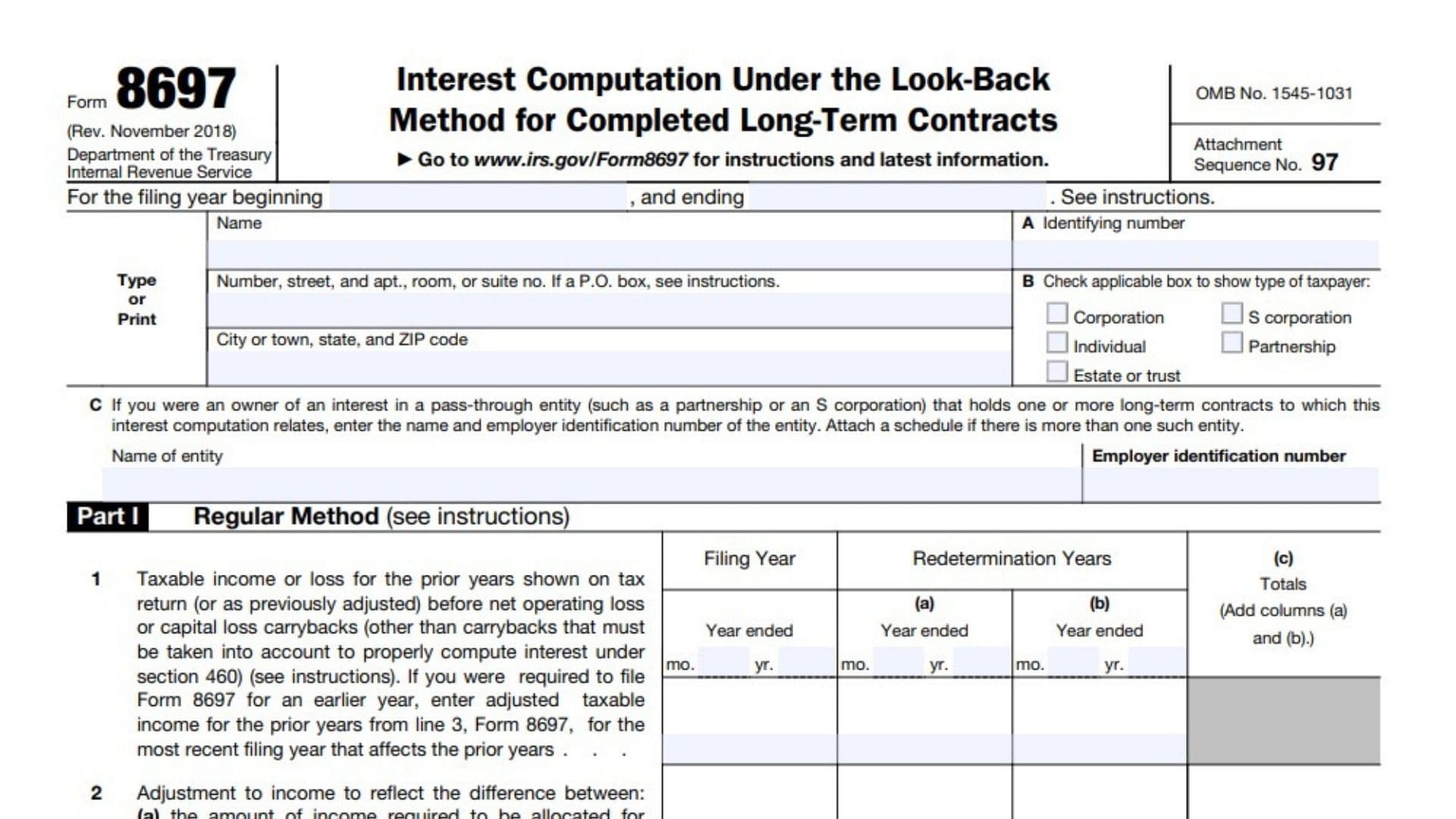

Header Section

- Enter the tax year beginning and ending dates

- Name: Enter the full legal name of the taxpayer

- A Identifying number: Enter your Social Security Number (SSN) or Employer Identification Number (EIN)

- Address: Provide your complete mailing address

- B Check the appropriate box to indicate your type of taxpayer entity

C: If you were an owner in a pass-through entity with long-term contracts related to this interest computation, enter:

- Name of entity

- Employer identification number of the entity

Part I – Regular Method

- Line 1: Enter your taxable income (or loss) for the prior years as shown on your tax return before net operating loss or capital loss carrybacks. If you filed Form 8697 previously, use the adjusted taxable income from line 3 of that form.

- Line 2: Calculate the adjustment to income based on the difference between income allocated for completed or adjusted contracts using actual prices/costs versus estimated prices/costs. Attach a schedule listing each contract unless you’re an owner in a pass-through entity.

- Line 3: Combine lines 1 and 2 to get the adjusted taxable income for look-back purposes.

- Line 4: Calculate the income tax liability on the line 3 amount using tax rates in effect for the prior years.

- Line 5: Enter the income tax liability shown on your return (or as previously adjusted) for the prior years. If you filed Form 8697 previously, use the amount from line 4 of that form.

- Line 6: Subtract line 5 from line 4 to determine the increase (or decrease) in tax for the prior years.

- Line 7: Calculate the interest due on any increase shown on line 6.

- Line 8: Calculate the interest to be refunded on any decrease shown on line 6.

- Line 9: If line 8, column (c) exceeds line 7, column (c), enter the excess. This is the net amount of interest to be refunded to you.

- Line 10: If line 7, column (c) exceeds line 8, column (c), enter the excess. This is the net amount of interest you owe.

Part II – Simplified Marginal Impact Method

- Line 1: Calculate the adjustment to regular taxable income based on the difference between:

- Line 1(a) Income required to be allocated for post-February 1986 contracts completed or adjusted during the tax year based on actual contract price and costs, and

- Line 1(b) Income reported for such contracts based on estimated contract price and costs.

Attach a schedule listing each separate contract unless you’re an owner in a pass-through entity reporting this amount from Schedule K-1 or a similar statement. - Line 2: Calculate the increase or decrease in regular tax for prior years by multiplying line 1 in each column by the applicable regular tax rate for that year.Note: For prior years beginning before 1987, skip lines 3 and 4 and enter the amount from line 2 on line 5.

- Line 3: Calculate the adjustment to alternative minimum taxable income using the same method as line 1, but for alternative minimum tax purposes.Note: For tax years beginning after 2017, the alternative minimum tax for corporations has been repealed.

- Line 4: Calculate the increase or decrease in alternative minimum tax (AMT) for prior years by multiplying line 3 in each column by the applicable AMT rate for that year.

- Line 5: Enter the larger of line 2 or line 4. If either amount is negative, see instructions for special rules.

- Line 6: (Skip for pass-through entities)

For negative amounts on line 5: Enter your total tax liability for the prior year, adjusted for past applications of the look-back method and after applicable loss and credit carryovers/carrybacks.

For positive amounts on line 5: Leave blank and enter the amount from line 5 on line 7. - Line 7: Enter the smaller of line 5 or line 6 (treat both as positive when comparing). Enter as a negative number if applicable.

- Line 8: Calculate the interest due on any increase shown on line 7.

- Line 9: Calculate the interest to be refunded on any decrease shown on line 7.Complete the table at the bottom of Part II with the dates and amounts for each prior year.Remember to consult the full IRS instructions for Form 8697 for detailed information on calculations, special cases, and additional guidance.