Form 8866, Interest Computation Under the Look-Back Method for Property Depreciated Under the Income Forecast Method, is used by taxpayers to compute the interest due or to be refunded as a result of the reallocation of income and expenses for property depreciated under the income forecast method. Properly managing this form ensures compliance with IRS regulations and helps taxpayers adjust their tax liabilities accurately. The primary purpose of Form 8866 is to compute the interest owed or to be refunded due to the application of the look-back method to property depreciated under the income forecast method. This method is used to adjust the timing of income and expense recognition for certain depreciable property, ensuring that the depreciation deductions align more closely with the property’s actual income production.

Who Must File Form 8866?

Form 8866 must be filed by taxpayers who have used the income forecast method for depreciating property and need to apply the look-back method to reallocate income and expenses. This includes:

- Individuals: Taxpayers filing individual returns (Form 1040) who have depreciated property under the income forecast method.

- Corporations: Businesses filing corporate tax returns (Form 1120) that have used the income forecast method for depreciable property.

- Partnerships: Entities filing partnership tax returns (Form 1065) that need to reallocate income and expenses under the look-back method.

- Trusts and Estates: Entities that have depreciated property under the income forecast method and need to apply the look-back method.

How To File Form 8866?

Filing Form 8866 involves several steps and requires detailed information to ensure all necessary information is provided. The form must be filed with the taxpayer’s annual income tax return.

- Obtain Form 8866: The form can be downloaded from the IRS website. Ensure you have the correct version for the tax year in which you are filing.

- Complete the form: Fill out Form 8866 with the required information, including details about the income forecast method depreciation and the look-back method computation.

- Attach supporting documentation: Gather all required documents, such as depreciation schedules and income allocation records, to substantiate the information provided on the form.

- Submit the form: File Form 8866 with your annual income tax return (Form 1040, Form 1120, etc.). Ensure that the form and all supporting documentation are included in the tax return package.

How to Complete Form 8866?

here are line-by-line instructions for filling out this IRS form:

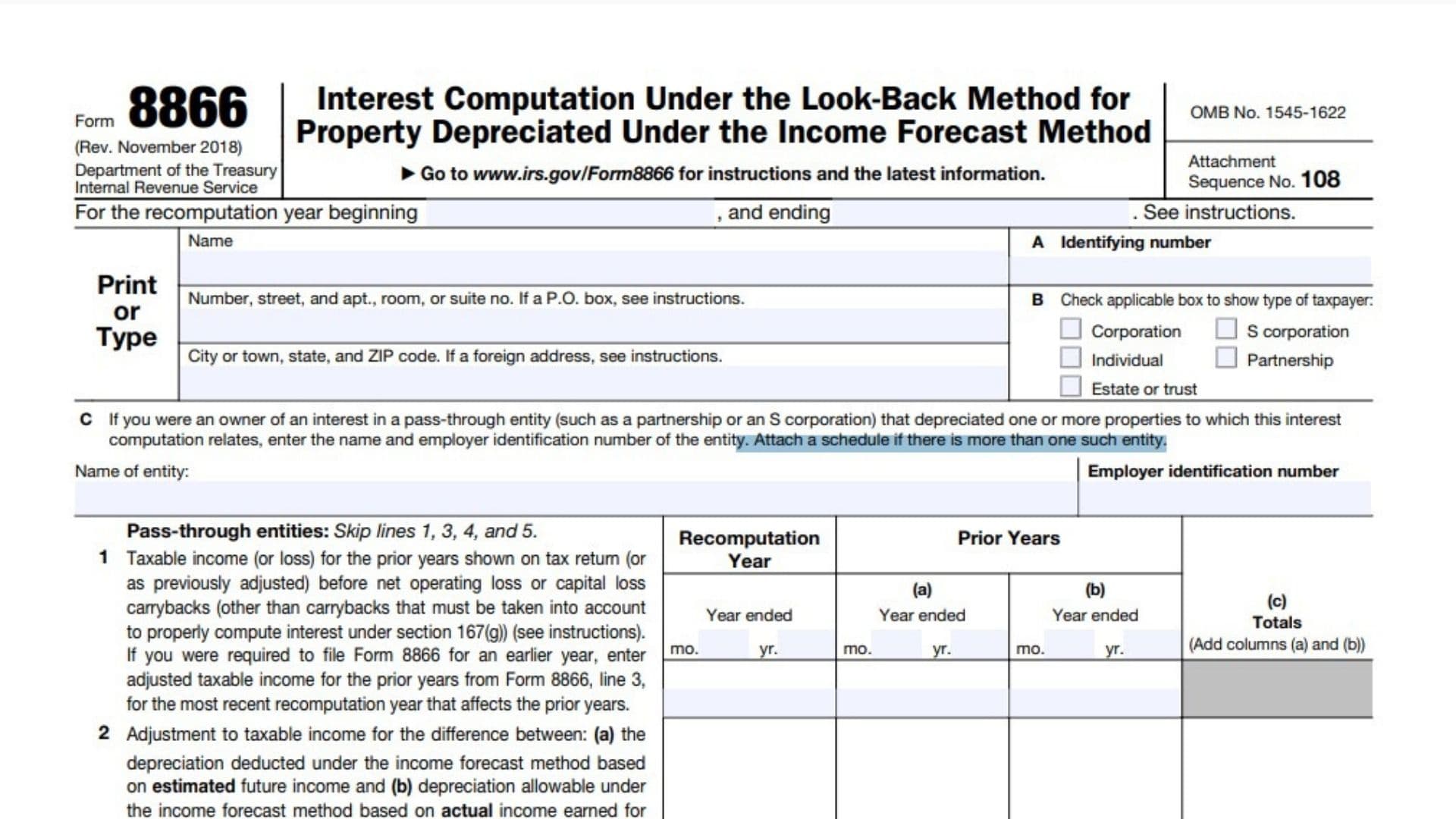

Header Section

- Name: Enter the full legal name of the taxpayer.

- Identifying number: Enter your Social Security Number (SSN) or Employer Identification Number (EIN).

- Address: Provide your complete mailing address.

- Check the appropriate box to indicate your type of taxpayer entity.

C: If you were an owner in a pass-through entity that depreciated properties related to this interest computation, enter:

- Name of entity

- Employer identification number of the entity

Also attach a schedule if there is more than one such entity.

- Line 1: Enter your taxable income (or loss) for the prior years as shown on your tax return before net operating loss or capital loss carrybacks. If you filed Form 8866 previously, use the adjusted taxable income from line 3 of that form.

- Line 2: Calculate the adjustment to taxable income based on the difference between depreciation deducted under the income forecast method using estimated future income and depreciation allowable based on actual income earned. Attach a schedule listing each property unless you’re an owner in a pass-through entity.

- Line 3: Combine lines 1 and 2 to get the adjusted taxable income for look-back purposes.

- Line 4: Calculate the income tax liability on the line 3 amount using tax rates in effect for the prior years.

- Line 5: Enter the income tax liability shown on your return (or as previously adjusted) for the prior years. If you filed Form 8866 previously, use the amount from line 4 of that form.

- Line 6: Subtract line 5 from line 4 to determine the increase (or decrease) in tax for the prior years.

- Line 7: Calculate the interest due on any increase shown on line 6.

- Line 8: Calculate the interest to be refunded on any decrease shown on line 6.

- Line 9: If line 8, column (c) exceeds line 7, column (c), enter the excess. This is the net amount of interest to be refunded to you.

- Line 10: If line 7, column (c) exceeds line 8, column (c), enter the excess. This is the net amount of interest you owe.

Signature Section

- Sign and date the form if filing separately from your tax return.

- If married filing jointly, both spouses must sign.

Paid Preparer Use Only:

To be completed by the paid preparer, if applicable.