The primary purpose of Form W-9S is to collect the taxpayer identification number (TIN) of students or borrowers who receive educational assistance payments or loans. This information is necessary for educational institutions to fulfill their reporting obligations to the Internal Revenue Service (IRS). Students or borrowers who receive certain types of educational assistance payments, such as scholarships, grants, or fellowships, may be required to file Form W-9S. Additionally, borrowers who receive student loans and have interest paid on those loans may also need to submit this form. It is important to note that each educational institution may have its own specific requirements for filing Form W-9S, so individuals should follow the instructions provided by their educational institution.

Which Students Loans Are Reported On W-9S?

The specific student loans that can be reported on Form W-9S include:

- Federal student loans: This includes loans such as Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Federal Perkins Loans.

- Private student loans: Private loans provided by banks, credit unions, or other financial institutions for educational purposes can be reported on Form W-9S.

- Institutional loans: Some educational institutions offer their own loan programs to assist students with funding their education. These loans may be provided directly by the educational institution or through affiliated foundations or organizations.

It’s important to note that Form W-9S is typically used for reporting purposes related to student loan interest. The educational institution may use the information provided on Form W-9S to issue a Form 1098-E, Student Loan Interest Statement, to the student or borrower. This form reports the amount of interest paid on qualifying student loans during the tax year, which may be deductible for federal income tax purposes.

However, it’s essential to consult the specific instructions provided by your educational institution regarding which student loans should be reported on Form W-9S. The institution will provide guidance on their reporting requirements and the types of student loans they consider eligible for reporting purposes.

How to Complete Form W-9S?

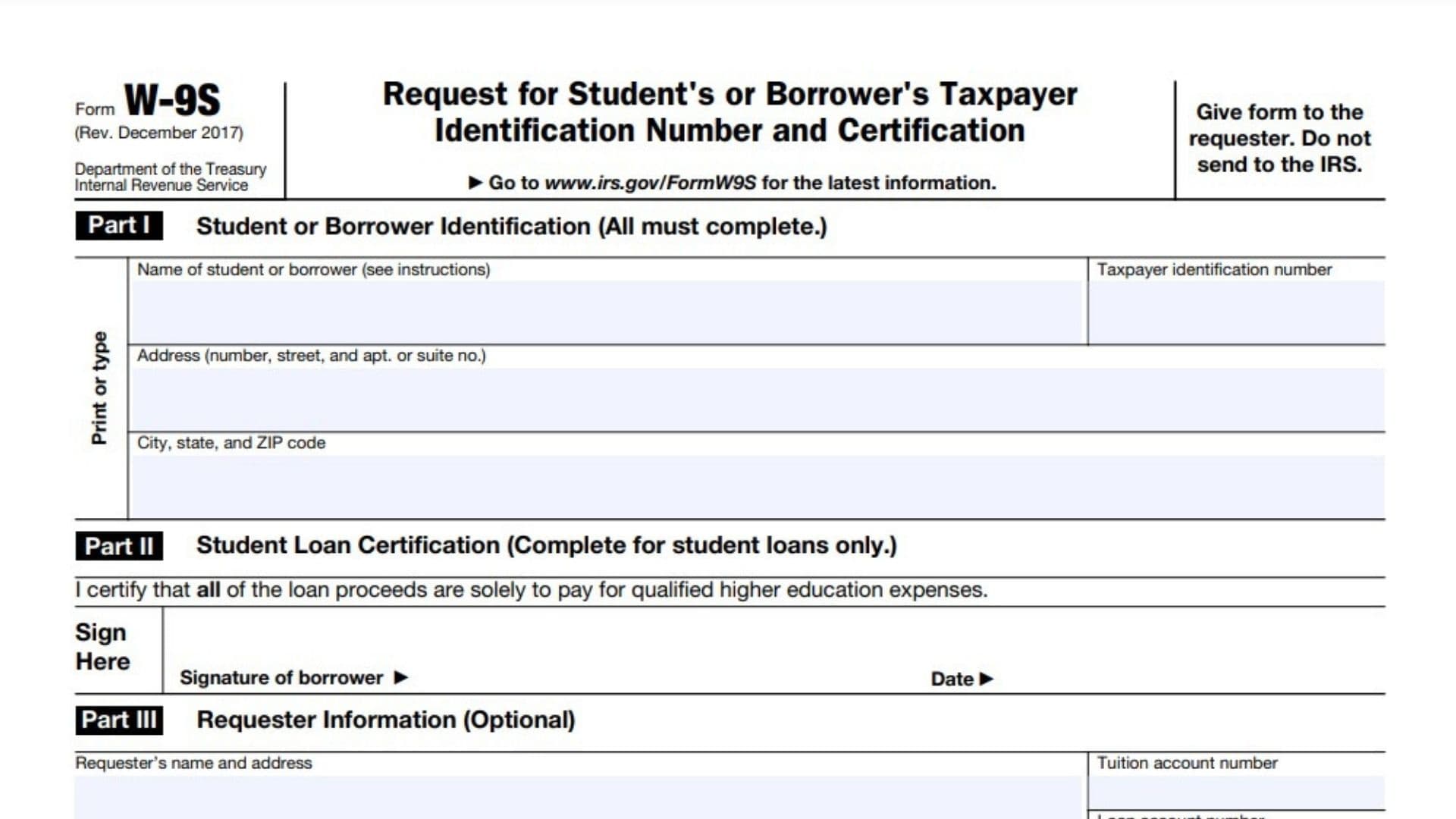

Part I Student or Borrower Identification (All must complete.)

- Enter the name of student or borrower

- Enter TIN

- Enter address

- Enter city, state, and ZIP code

Part II Student Loan Certification (Complete for student loans only.)

- Sign the form (I certify that all of the loan proceeds are solely to pay for qualified higher education expenses).

- Enter signature date

Part III Requester Information (Optional)

- Enter requester’s name and address

- Enter tuition account number

- Enter loan account number