Form 709 must be filed by individuals who make taxable gifts that exceed the annual exclusion amount or who make generation-skipping transfers. Properly filing Form 709 ensures that individuals comply with federal tax laws and accurately report their gifts and transfers. Individuals must file Form 709 if they:

- Made gifts that exceed the annual exclusion amount for the year.

- Made generation-skipping transfers, regardless of the amount.

How to File Form 709?

Filing the IRS Form 709 involves several steps:

- Obtain the Form: Individuals can obtain Form 709 from the IRS website or through tax preparation software.

- Complete the Form: Fill out the form with the required information about the gifts and transfers, including valuations and exclusions.

- Submit to the IRS: Mail the completed form to the appropriate IRS address by the due date.

How to Complete Form 709?

Completing the Form 709 requires detailed information about the gifts and transfers. Here’s how to do it:

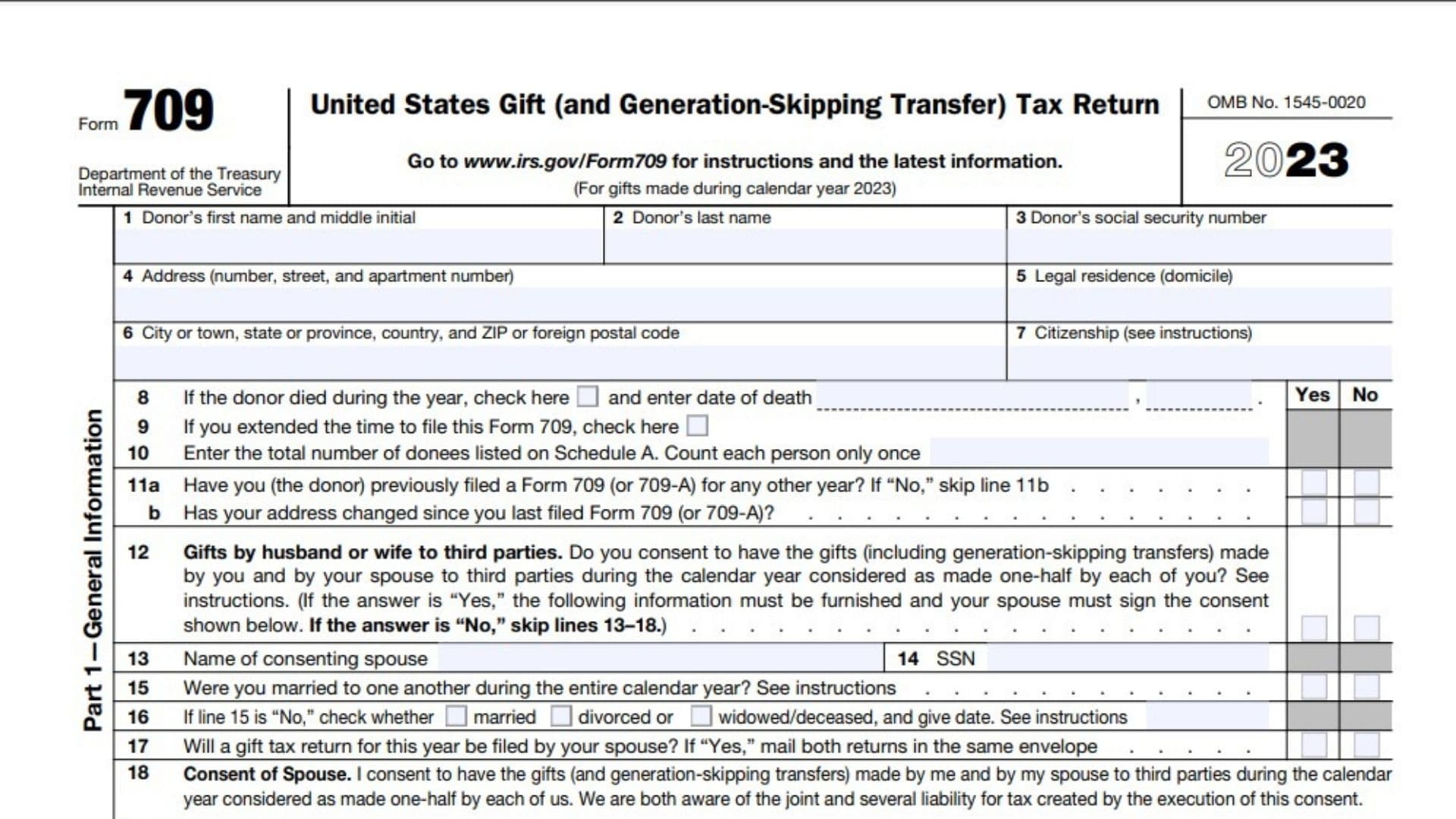

Part 1—General Information

- Donor’s first name and middle initial: Enter your first name and middle initial.

- Donor’s last name: Enter your last name.

- Donor’s social security number: Enter your 9-digit Social Security Number.

- Address: Enter your current mailing address.

- Legal residence (domicile): Enter your legal state of residence.

- City, state, ZIP: Enter your city, state, and ZIP code.

- Citizenship: Enter your country of citizenship.

- If the donor died during the year: Check the box and enter the date of death if applicable.

- If you extended the time to file this Form 709: Check this box if you were granted an extension.

- Enter the total number of donees listed on Schedule A: Count each person only once.

- 11a. Have you previously filed a Form 709 (or 709-A) for any other year?: Check “Yes” or “No”.

11b. Has your address changed since you last filed Form 709 (or 709-A)?: Check “Yes” or “No” if applicable.

12.Gifts by husband or wife to third parties: Check “Yes” or “No” to indicate if you consent to split gifts with your spouse.

13-18. Complete these lines only if you answered “Yes” to line 12:

- 13. Name of consenting spouse

- 14. Spouse’s Social Security Number

- 15. Were you married to one another during the entire calendar year?

- If “No” to line 15, indicate marital status and date

- Will your spouse file a gift tax return for this year?

- Consent of Spouse signature and date

- 19. Have you applied a DSUE amount from a predeceased spouse?: Check “Yes” or “No”.

- 20. Does any gift include a digital asset?: Check “Yes” or “No”.

Part 2—Tax Computation

- Enter the amount from Schedule A, Part 4, line 111.

- Enter the total amount of taxable gifts for prior periods (from Schedule B, line 3, column F of the current year’s return)1.

- Total taxable gifts. Add lines 1 and 21.

- Tax computed on amount on line 3 (see Table for Computing Gift Tax in the instructions)1.

- Tax computed on amount on line 2 (see Table for Computing Gift Tax in the instructions)1.

- Tax on current period gifts (subtract line 5 from line 4)1.

- Maximum unified credit (nonresident aliens, see instructions)1.

- Enter the unified credit against tax allowable for all prior periods (from Schedule B, line 3, column D of the current year’s return)1.

- Balance. Subtract line 8 from line 71.

- Enter available Deceased Spousal Unused Exclusion (DSUE) amount from Schedule C, line 81.

- Enter available Restored Exclusion amount from Schedule C, line 151.

- Add lines 9, 10, and 111.

- Unified credit. Enter the smaller of line 6 or line 121.

- Credit for foreign gift taxes (see instructions)1.

- Total credits. Add lines 13 and 141.

- Balance. Subtract line 15 from line 6. Do not enter less than zero1.

- Generation-skipping transfer taxes (from Schedule D, Part 3, col. G, Total)1.

- Total tax. Add lines 16 and 171.

- Gift and generation-skipping transfer taxes prepaid with extension of time to file1.

- If line 19 is less than line 18, enter balance due. Pay in full with return. Make check or money order payable to “United States Treasury”1.

- If line 19 is greater than line 18, enter amount to be refunded1.

Remember to refer to the official IRS instructions for Form 709 for detailed guidance on each line item, as the calculations can be complex depending on your specific gift-giving situation and tax circumstances.

Frequently Asked Questions

What is the due date for filing Form 709?

- The Form 709 must be filed by April 15 of the year following the year in which the gifts were made. If you cannot file by this date, you can request an extension by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

Can I file Form 709 electronically?

- Currently, Form 709 must be filed on paper and mailed to the IRS.

Are there any penalties for late filing or payment?

- Yes, penalties may apply for late filing or late payment of taxes. The penalty for late filing is typically 5% of the unpaid tax per month, up to a maximum of 25%. The penalty for late payment is generally 0.5% of the unpaid tax per month, up to a maximum of 25%.

What records should I keep to support entries on Form 709?

- Individuals should maintain detailed records to support all entries on Form 709, including valuations, appraisals, and documentation of gifts and transfers. These records should be kept for at least three years from the date the return is filed.

How do I value gifts for Form 709?

- Gifts should be valued at their fair market value as of the date of the gift. In some cases, special valuation rules may apply for certain types of property.

What should I do if I discover an error on a previously filed Form 709?

- If you discover an error on a previously filed Form 709, you should file an amended return to correct the error.

Are there special rules for generation-skipping transfers?

- Yes, there are special rules for generation-skipping transfers, including the allocation of the generation-skipping transfer tax exemption. The IRS provides guidance on these rules in the instructions for Form 709.