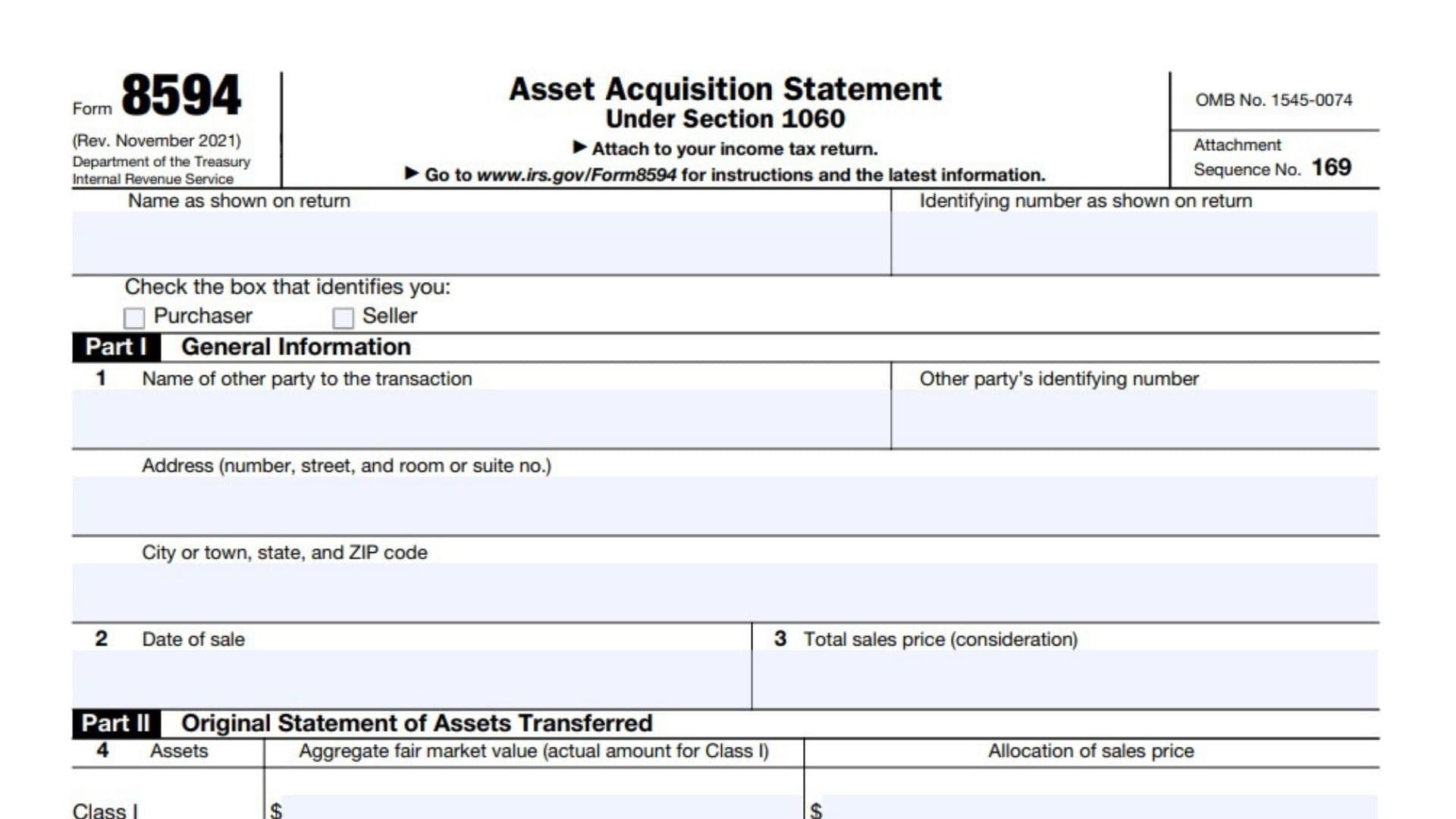

Form 8594, Asset Acquisition Statement Under Section 1060, is an essential document for both buyers and sellers involved in the purchase or sale of a business. Properly managing this form ensures accurate reporting of the transaction and compliance with IRS regulations. The primary purpose of Form 8594 is to report the sale or purchase of a group of assets that make up a trade or business. When a business is sold, the IRS requires that the total purchase price be allocated among the various assets acquired. This allocation affects the buyer’s basis in the assets and the seller’s gain or loss on the sale. Form 8594 provides a standardized method for both parties to report this allocation, ensuring consistency and compliance with Section 1060 of the Internal Revenue Code. By using Form 8594, both the buyer and seller can accurately report the transaction details and avoid potential discrepancies in their tax returns.

Who Must File Form 8594?

Form 8594 must be filed by both the buyer and the seller involved in the sale of a group of assets that constitute a trade or business if the buyer’s basis in the acquired assets is determined wholly or partly by the amount paid for the assets. This includes direct acquisitions of assets as well as certain transfers to corporations or partnerships. The form must be filed with the federal income tax return for the year in which the sale occurred. Additionally, if the buyer and seller subsequently agree to a change in the allocation of the sales price, both parties must file Form 8594 to report the change.

How to File Form 8594?

Filing Form 8594 involves several steps and must be done in conjunction with the federal income tax return for the tax year in which the acquisition occurred. First, both the buyer and the seller must gather all necessary documentation, including the purchase agreement and any relevant financial statements. Then, they must agree on the allocation of the total purchase price among the various classes of assets.

- Obtain Form 8594: The form can be obtained from the IRS website. Ensure you have the correct form for the tax year in which the sale occurred.

- Complete the form: Both the buyer and the seller must complete Form 8594 with the required information, including their names, addresses, and taxpayer identification numbers (TINs). Enter the total purchase price and allocate it among the different classes of assets as specified in Section 1060 and the form’s instructions.

- Attach to tax return: Once completed, each party must attach Form 8594 to their federal income tax return for the year in which the sale occurred. The buyer files the form with their Form 1040, 1120, 1065, or other applicable tax return, while the seller files it with their corresponding return.

- File with the IRS: Submit the completed tax return, including Form 8594, to the IRS by the filing deadline. Ensure that both parties have consistently reported the transaction details to avoid discrepancies.

Asset Classes

- Class I: Cash and general deposit accounts.

- Class II: Actively traded personal property, certificates of deposit, and foreign currency.

- Class III: Accounts receivable, mortgages, and credit card receivables.

- Class IV: Inventory and property held primarily for sale to customers.

- Class V: All other assets that are not included in Classes I, II, III, IV, VI, and VII.

- Class VI: Section 197 intangibles, excluding goodwill and going concern value.

- Class VII: Goodwill and going concern value.

How to Complete Form 8594?

Filling out Form 8594 requires accurate and detailed information about the asset acquisition and the allocation of the purchase price. The form is divided into several parts, each addressing different aspects of the transaction.

Part I: General Information

Line 1: Name of Reporting Person

- Enter the name of the person or entity responsible for reporting the sale or acquisition of assets.

Line 2: Identifying Number of Reporting Person

- For individuals, enter the Social Security Number (SSN), and for businesses, enter the Employer Identification Number (EIN).

Line 3: Address of Reporting Person

- Provide the complete mailing address of the reporting person.

Line 4: Date of Sale

- Enter the date of the sale or the date the ownership of assets was transferred from the seller to the buyer. Use MM/DD/YYYY format.

Line 5: Total Consideration

- Enter the total purchase price for the assets, also referred to as the consideration. This is the total amount the buyer paid for the assets in the transaction.

Line 6: Check Box if Amended Statement

- Check this box if you are filing an amended Form 8594. You will file an amended form if there have been any changes in the purchase price or allocation after the initial filing.

Part II: Amount Allocated to Each Class of Assets

Form 8594 divides assets into seven classes, with specific tax rules applying to each class. You need to allocate the total consideration (purchase price) to the different asset classes listed below.

Line 7: Class I Assets

- Cash and General Deposits: This includes cash or cash equivalents. Enter the portion of the total consideration that was allocated to Class I assets (cash and deposits). Most business transactions involve some cash assets.

Line 8: Class II Assets

- Actively Traded Personal Property: This refers to marketable securities, such as stocks, bonds, or other actively traded financial instruments. Allocate the portion of the sales price for this class if any.

Line 9: Class III Assets

- Accounts Receivable and Debt Instruments: This includes accounts receivable, mortgages, and other short-term debt that the buyer assumes from the seller.

Line 10: Class IV Assets

- Inventory: Enter the portion of the purchase price allocated to inventory. This covers raw materials, work-in-progress, or finished goods that are part of the sale.

Line 11: Class V Assets

- Tangible Personal Property: This includes tangible assets such as furniture, machinery, vehicles, and equipment used in the business, but not including real estate. Allocate the price for any such assets here.

Line 12: Class VI Assets

- Intangible Assets (Excluding Goodwill and Going Concern Value): This refers to intangible assets such as patents, trademarks, copyrights, licenses, and customer lists. Enter the amount allocated to these assets.

Line 13: Class VII Assets

- Goodwill and Going Concern Value: Allocate the portion of the consideration that was for goodwill or going concern value. Goodwill represents the value of the business beyond its tangible and identifiable intangible assets.

Part III: Supplemental Information

In Part III, the IRS requires both the buyer and seller to provide additional details regarding the sale or acquisition. This part helps clarify the transaction and ensure proper reporting by both parties.

Line 14: Name of Other Party

- Enter the name of the other party involved in the transaction (either the buyer or the seller, depending on who is reporting).

Line 15: Identifying Number of Other Party

- Provide the SSN or EIN of the other party involved in the transaction.

Line 16: Address of Other Party

- Provide the mailing address of the other party.

- Filing Deadline: Form 8594 should be filed with the buyer’s and seller’s tax return for the year in which the sale occurred.

- Consistency: The buyer and seller must agree on the allocation of the total consideration to the various asset classes and report this information consistently on their respective tax returns.

- Amended Filing: If there are any changes to the purchase price or asset allocation after the initial form is filed, you must submit an amended Form 8594 to reflect the changes.

Allocation of Purchase Price: The total purchase price must be allocated among these classes of assets in a specific order. This allocation is crucial because it determines the buyer’s basis in the acquired assets and the seller’s gain or loss on the sale. The IRS requires this allocation to be based on the fair market value of each asset class.

Subsequent Changes: If the buyer and seller agree to a change in the allocation of the purchase price after the initial filing, they must file an amended Form 8594 to report the change. This amended form must be filed with the IRS and attached to the amended tax returns for the year of sale.

Record Keeping: Maintain accurate records of the purchase agreement, allocation of purchase price, and any subsequent changes. Proper record-keeping helps ensure accurate reporting and can be crucial in case of an IRS audit.

Compliance with Section 1060: Section 1060 of the Internal Revenue Code outlines the requirements for reporting asset acquisitions and the allocation of purchase price. Compliance with this section is essential to avoid potential tax issues and discrepancies in reporting the transaction.

By familiarizing yourself with these concepts and properly managing Form 8594, you can ensure compliance with IRS regulations, accurately report the asset acquisition, and optimize your tax situation. Understanding the different classes of assets and their tax implications can significantly impact your financial planning and tax liability.