Form 8949 is used to report the sale or exchange of capital assets, including stocks, bonds, real estate, and other investment properties. This form helps taxpayers calculate the amount of capital gain or loss from these transactions, which must be reported on their tax return. Properly filing Form 8949 ensures that all gains and losses are accurately reported, which can affect the taxpayer’s overall tax liability. Taxpayers must file Form 8949 if they:

- Sell or exchange stocks, bonds, or other securities.

- Sell or exchange real estate.

- Sell or exchange personal property used for investment or business purposes.

- Report capital gains and losses on Schedule D of Form 1040.

This form is typically filed with the taxpayer’s annual tax return.

How to File Form 8949?

Filing the IRS Form 8949 involves several steps:

- Taxpayers can obtain Form 8949 from the IRS website or through tax preparation software.

- Fill out the form with the required information about the sale or exchange of capital assets.

- Attach the completed form to your annual tax return (Schedule D of Form 1040).

- File your tax return along with Form 8949 by the regular tax filing deadline, typically April 15th for most individuals.

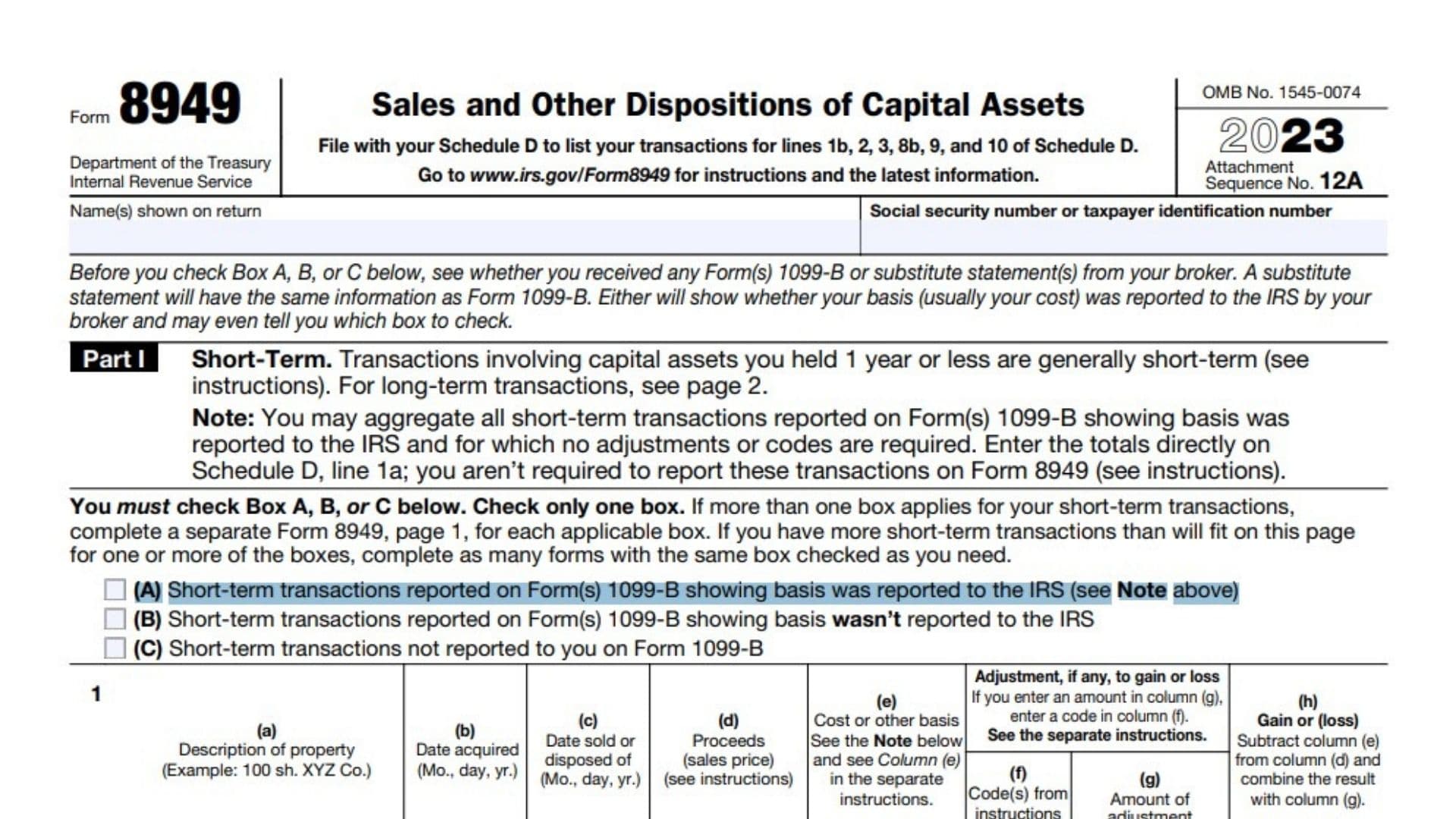

How to Complete Form 8949?

Completing Form 8949 requires detailed information about the capital assets sold or exchanged and the resulting gain or loss. Here’s how to do it:

- Part I: Short-Term Transactions:

- Report short-term capital gains and losses from the sale or exchange of assets held for one year or less.

- Enter the description of the property, the date acquired, the date sold, the sales price, and the cost or other basis.

- Calculate the total short-term gain or loss from each transaction.

- Part II: Long-Term Transactions:

- Report long-term capital gains and losses from the sale or exchange of assets held for more than one year.

- Enter the description of the property, the date acquired, the date sold, the sales price, and the cost or other basis.

- Calculate the total long-term gain or loss from each transaction.

- Adjustments:

- Make any necessary adjustments to the gain or loss, such as for wash sales or reported on Form 1099-B with incorrect basis information.

Review all entries for accuracy and completeness before attaching the form to your tax return.

Where to Mail Form 8949?

Form 8949 should be attached to your Schedule D of Form 1040 and mailed to the appropriate IRS address based on your location. The IRS provides specific addresses for different regions, which are listed in the form’s instructions. Taxpayers can also file electronically using the IRS e-file system.

Due Dates

The Form 8949 must be filed by the regular tax filing deadline for your annual tax return, typically April 15th. If you cannot file by this date, you can request an extension by filing Form 4868, which grants an additional six months to file the return. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Frequently Asked Questions

Can I use Form 8949 for personal property sales?

- No, Form 8949 is only used to report the sale or exchange of capital assets. Personal property sales are reported differently.

What is a wash sale, and how does it affect my tax liability?

- A wash sale occurs when you sell a security at a loss and repurchase the same or substantially identical security within 30 days. The loss is disallowed for tax purposes and must be reported as a wash sale.

Do I need to file Form 8949 if I only have capital gains?

- Yes, you must report all capital gains and losses on Form 8949 and Schedule D, regardless of whether you have a net gain or loss.

Properly filing the IRS Form 8949 ensures that taxpayers accurately report capital gains and losses from the sale or exchange of capital assets, which affects their overall tax liability. By following the guidelines and understanding the requirements, taxpayers can ensure compliance with federal tax laws and accurately reflect their financial transactions.