Form 5558, Application for Extension of Time to File Certain Employee Plan Returns, is used by plan administrators and certain employers to request an extension of time to file employee plan returns. Properly managing this form ensures compliance with IRS regulations and provides additional time to accurately complete required filings for employee benefit plans. The primary purpose of Form 5558 is to allow plan administrators and certain employers to request an extension of time to file specific employee plan returns. These returns include Form 5500 series, Form 5330, and Form 8955-SSA. By using Form 5558, filers can avoid late filing penalties and ensure that they have sufficient time to gather necessary information and complete their filings accurately.

How To File Form 5558?

Filing Form 5558 involves several steps and requires detailed information to ensure all necessary details are provided. The form must be filed with the IRS before the original due date of the return you are seeking to extend.

- Obtain Form 5558: The form can be downloaded from the IRS website. Ensure you have the correct version for the tax year in which you are filing.

- Complete the form: Fill out the form with details of the plan, including the type of return for which the extension is requested and the plan’s identifying information.

- Submit the form: File Form 5558 with the IRS before the original due date of the return. Ensure that the form is signed and dated by an authorized representative.

How to Complete Form 5558?

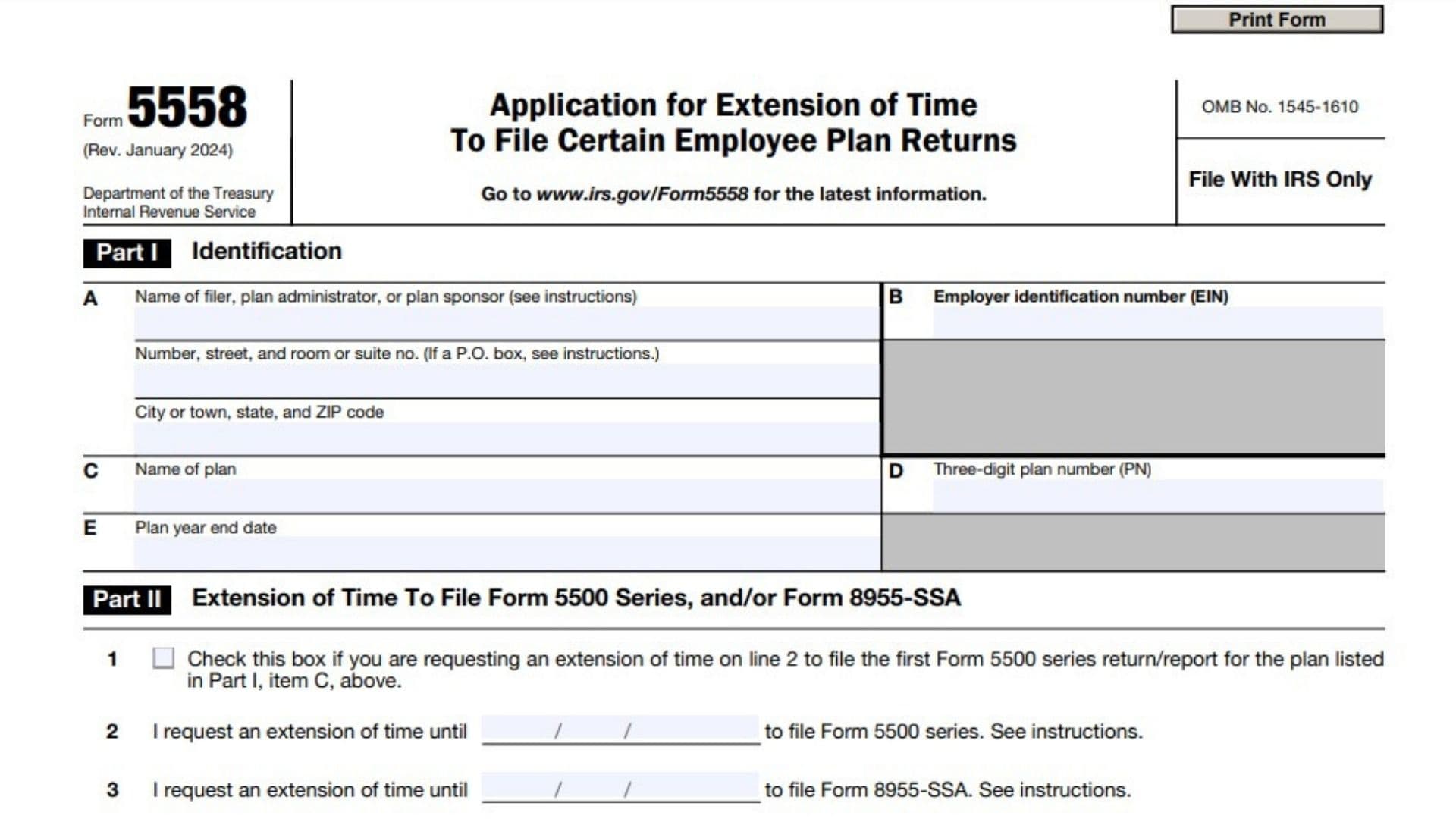

Part I: Identification

A. Name of Filer, Plan Administrator, or Plan Sponsor

- Enter the full legal name of the filer, whether it’s the plan administrator, plan sponsor (usually the employer), or any authorized individual requesting the extension.

Address

- Provide the street address, city, state, and ZIP code of the filer. If using a P.O. Box, include that instead of the street address, as applicable.

B. Employer Identification Number (EIN)

- Enter the Employer Identification Number (EIN) associated with the filer. This must be a nine-digit number in the format XX-XXXXXXX. If the filer does not have an EIN, one must be obtained by applying online at IRS.gov/EIN.

C. Name of Plan

- Write the formal name of the plan as it is registered. This should match the plan name on previous filings or related documents.

D. Three-Digit Plan Number (PN)

- Each plan is assigned a unique three-digit Plan Number. If this is the first filing for the plan, use “001.” Plans must be consecutively numbered for each new filing.

E. Plan Year End Date

- Enter the plan year-end date in the format MM/DD/YYYY. This indicates the end of the plan’s reporting period (fiscal year).

Part II: Extension of Time to File Form 5500 Series and/or Form 8955-SSA

1. Check this box if you are requesting an extension of time to file the first Form 5500 series return/report

- Check this box if this is the first time you are filing a Form 5500 series return/report for the plan listed in Part I, item C. If the plan has filed before, leave this box unchecked.

2. I request an extension of time until [MM/DD/YYYY] to file Form 5500 series

- Enter the new requested due date (in MM/DD/YYYY format) for filing the Form 5500 series. This requested extension cannot be later than the 15th day of the third month after the original due date of the return. For example, if the original due date is July 31, the extended due date would be October 15.

3. I request an extension of time until [MM/DD/YYYY] to file Form 8955-SSA

- If requesting an extension for Form 8955-SSA, enter the new requested due date (in MM/DD/YYYY format). Similar to line 2, this date cannot extend beyond the 15th day of the third month after the normal due date.

Key Notes for Part II

- Automatic Approval: The extension is automatically approved as long as the form is properly completed, and filed by the normal due date of the return/report for which the extension is requested. The new due date should not extend beyond the allowed period.

- Separate Form for Each Plan: A separate Form 5558 must be filed for each plan for which an extension is requested (e.g., a defined benefit plan and a profit-sharing plan). However, you can use a single form to extend the filing time for both Form 5500 series and Form 8955-SSA for the same plan.

Where to File Form 5558?

- File Form 5558 with the IRS at the following address: Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0045 - Private Delivery Services (PDSs): If using a private delivery service, ensure it’s one of the IRS-approved services. Private delivery services cannot deliver to P.O. boxes. Visit IRS.gov/PDS for more information on approved services and alternate delivery addresses.

General Instructions

- Filing Deadlines: To be automatically approved, the extension request must be filed on or before the original due date of the relevant form (Form 5500 series or Form 8955-SSA).

- Automatic Approval: If filed timely and correctly, the request will automatically grant an extension to the 15th day of the third month after the original due date.

- Plan Number: Once assigned, the plan number must be used consistently for all future filings, even after the plan terminates.

- Privacy and Paperwork Reduction Act: The information provided on this form is used to determine whether the filer is entitled to an extension of time to file. Providing incorrect or false information may result in penalties.