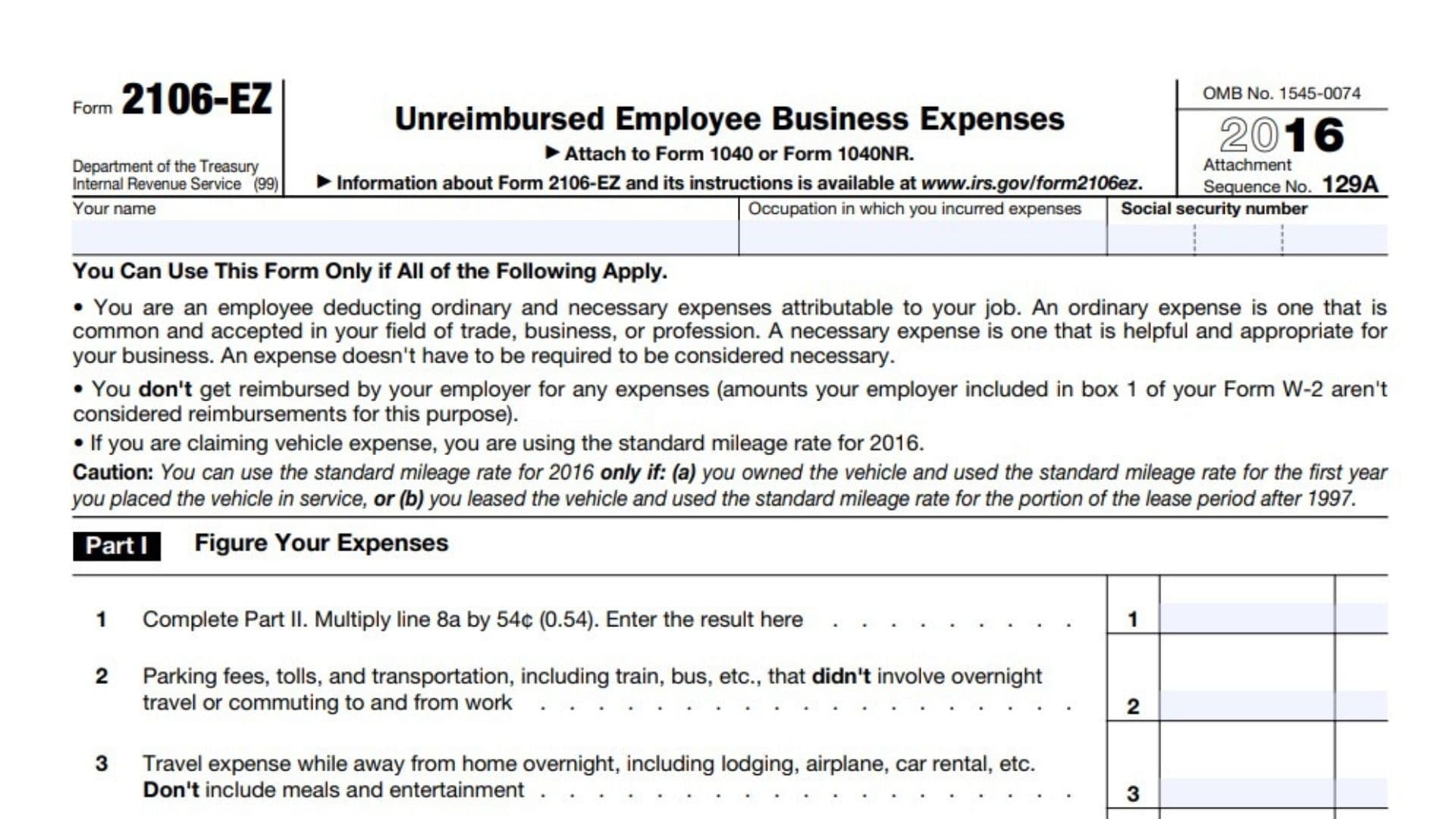

Form 2106-EZ, Unreimbursed Employee Business Expenses, is an essential document for employees who incur work-related expenses that are not reimbursed by their employer. Properly managing this form ensures accurate reporting of expenses and compliance with IRS regulations. The primary purpose of Form 2106-EZ is to allow employees to claim deductions for unreimbursed business expenses incurred while performing their job duties. These expenses can include travel, transportation, meals, and other necessary expenses. The form simplifies the process of reporting these expenses, enabling employees to reduce their taxable income by the amount of these deductible expenses. By using Form 2106-EZ, employees can ensure that they are not paying more taxes than necessary and can accurately report their work-related expenses.

Who Must File Form 2106-EZ?

Form 2106-EZ must be filed by employees who are not reimbursed for their business expenses by their employer and wish to claim these expenses as deductions on their tax return. To qualify for using Form 2106-EZ, you must meet the following criteria:

- You are an employee deducting ordinary and necessary expenses incurred during your job.

- You are not reimbursed by your employer for these expenses, or the reimbursement was included in your taxable income.

- You use the standard mileage rate for vehicle expenses.

- You do not receive any reimbursement under an accountable plan.

It is important to note that beginning with the 2018 tax year, the Tax Cuts and Jobs Act (TCJA) suspended the deduction for unreimbursed employee business expenses for most employees. However, certain categories of employees, such as Armed Forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses, may still be able to claim these deductions.

How to File Form 2106-EZ?

Filing Form 2106-EZ involves several steps and must be done in conjunction with your federal income tax return. First, gather all necessary documentation, including receipts, mileage logs, and any other records of your unreimbursed business expenses. Download Form 2106-EZ from the IRS website. Complete the form by entering your personal information, details of your expenses, and any other relevant information. Once completed, attach Form 2106-EZ to your federal tax return (Form 1040).

- Obtain Form 2106-EZ: The form can be obtained from the IRS website or ordered directly from the IRS. Ensure you have the correct form for the tax year being reported.

- Complete the form: Fill out Form 2106-EZ with the required information, including your name, social security number, and details of your unreimbursed business expenses.

- Calculate your expenses: Use the instructions provided with Form 2106-EZ to calculate the total amount of your deductible expenses.

- Attach to your tax return: Once completed, attach Form 2106-EZ to your federal tax return (Form 1040).

How to Complete Form 2106-EZ?

Here’s a line-by-line breakdown of IRS Form 2106-EZ:

Part I: Figure Your Expenses

Line 1:

- Complete Part II before filling this in.

- Multiply the number of business miles driven (entered in Line 8a) by 54 cents ($0.54).

- Enter the result here.

Line 2:

- Enter parking fees, tolls, and other transportation costs (like train or bus fare) that didn’t involve overnight travel or commuting.

Line 3:

- Enter your travel expenses incurred while away from home overnight (e.g., lodging, airplane fare, car rental).

- Do not include meals and entertainment here.

Line 4:

- Enter any other business expenses not covered in lines 1-3. Examples include business gifts or education costs.

- Do not include meals, entertainment, taxes, or interest.

Line 5:

- Enter your total meals and entertainment expenses. Multiply the total by 50% (0.50) and enter the result.

- If you’re subject to the Department of Transportation (DOT) hours of service limits (e.g., truck drivers, airline pilots), multiply by 80% (0.80) instead.

Line 6:

- Add lines 1 through 5. This is your total business expenses.

- Enter the total on this line and also on Schedule A (Form 1040), line 21 (or on Schedule A (Form 1040NR), line 7).

- If you are an Armed Forces reservist, fee-basis government official, qualified performing artist, or a person with disabilities, follow special instructions provided for entering amounts elsewhere.

Part II: Information on Your Vehicle

Line 7:

- Enter the date when you first started using the vehicle for business purposes (month, day, year).

Line 8:

- For this section, enter the total number of miles driven in 2016 and break them down into:

- 8a (Business): Enter the number of miles driven specifically for business purposes.

- 8b (Commuting): Enter the number of miles driven commuting between home and work.

- 8c (Other): Enter miles driven for personal purposes other than commuting.

Line 9:

- Was your vehicle available for personal use during off-duty hours? Check “Yes” or “No.”

Line 10:

- Do you (or your spouse) have another vehicle available for personal use? Check “Yes” or “No.”

Line 11:

- 11a: Do you have evidence (such as logs or receipts) to support your mileage deduction? Check “Yes” or “No.”

- 11b: If “Yes,” is the evidence written (rather than oral)? Check “Yes” or “No.”