When dealing with proceeds from broker and barter exchange transactions, accurate reporting is crucial for both tax compliance and financial planning. Form 1099-B, Proceeds From Broker and Barter Exchange Transactions, plays a vital role in ensuring that these transactions are properly documented and reported to the IRS. This form is used to report gains and losses from securities transactions, including stocks, bonds, commodities, and other financial instruments, as well as barter exchange transactions. By understanding and correctly managing Form 1099-B, taxpayers can ensure they meet IRS requirements and accurately report their income, thus avoiding potential penalties and ensuring their financial records are up-to-date.

The primary purpose of Form 1099-B is to report the proceeds from broker and barter exchange transactions to the IRS and the taxpayer. This form provides detailed information about the transactions, including the type of security or property sold, the date of the transaction, the gross proceeds, and any related cost or basis information. By using Form 1099-B, brokers and barter exchanges help taxpayers calculate their capital gains or losses for the tax year, which is essential for accurately determining their tax liability.

Who Must File Form 1099-B?

Form 1099-B must be filed by brokers and barter exchanges that facilitate transactions involving the sale or exchange of securities, commodities, and other financial instruments. This includes:

- Brokers: Financial institutions and individuals who are in the business of buying and selling securities on behalf of their clients.

- Barter Exchanges: Organizations that facilitate the exchange of goods and services between members without using cash.

Brokers and barter exchanges must file Form 1099-B for each person for whom they have conducted transactions during the tax year. The form must be filed with the IRS and a copy must be provided to the taxpayer.

How To File Form 1099-B?

Filing Form 1099-B involves several steps and must be done accurately to ensure compliance with IRS regulations. The form can be filed electronically or by mail, depending on the volume of forms being submitted.

- Obtain Form 1099-B: The form can be downloaded from the IRS website or obtained from a supply vendor. Ensure you have the correct version for the tax year in which you are filing.

- Complete the form: Fill out Form 1099-B with the required information, including details about the transactions, the taxpayer, and the broker or barter exchange.

- Submit the form to the IRS: File the completed Form 1099-B with the IRS by the due date. If filing electronically, use the IRS’s FIRE (Filing Information Returns Electronically) system. If filing by mail, send the form to the address provided in the instructions.

- Provide a copy to the taxpayer: Send Copy B of Form 1099-B to the taxpayer by February 15 of the year following the calendar year in which the transactions occurred.

How to Complete Form 1099-B?

Form 1099-B is used to report proceeds from the sale of securities, bartering transactions, and certain other financial activities. Brokers and barter exchanges use this form to report transactions to the IRS, which the recipient uses to file their taxes.

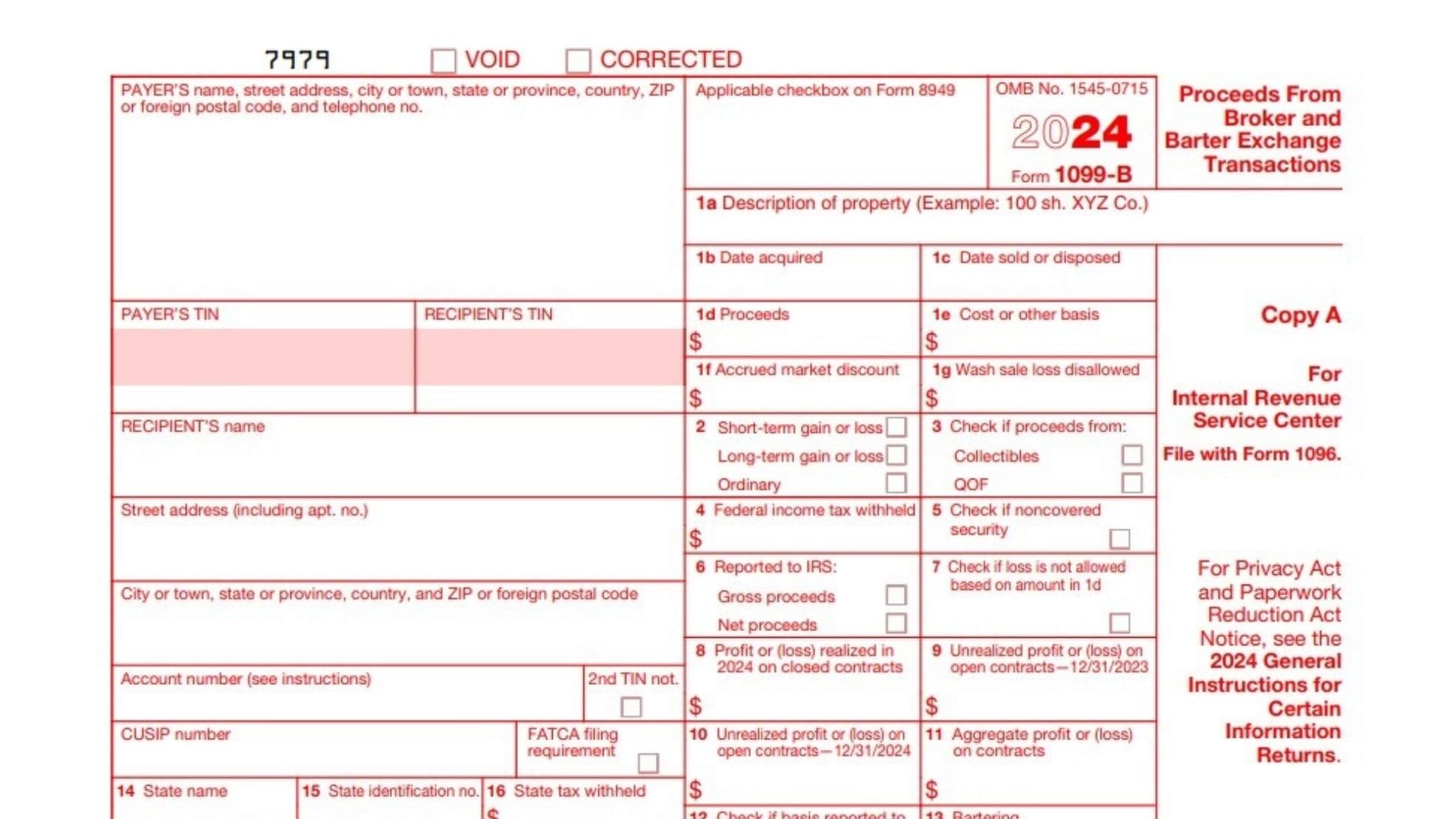

Below is a line-by-line guide for completing Form 1099-B.

Payer and Recipient Information

- PAYER’S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no.:

Enter the payer’s (broker or barter exchange) complete legal name, address, and phone number. - PAYER’S TIN:

Enter the payer’s Taxpayer Identification Number (TIN). This is typically the broker’s or barter exchange’s EIN (Employer Identification Number). - RECIPIENT’S TIN:

Enter the recipient’s (taxpayer’s) TIN. For individuals, this is typically the Social Security Number (SSN); for businesses, it’s the EIN. - RECIPIENT’S name:

Enter the recipient’s full legal name. - Street address (including apt. no.):

Provide the recipient’s street address, including apartment number if applicable. - City or town, state or province, country, and ZIP or foreign postal code:

Fill in the complete city, state, and postal code for the recipient’s address. - Account number (see instructions):

Enter the account number for the broker or barter exchange account, if applicable. This is especially useful if the recipient has multiple accounts. - CUSIP number:

If applicable, enter the CUSIP number (Committee on Uniform Securities Identification Procedures) for the security being reported. - FATCA filing requirement:

Check this box if the Foreign Account Tax Compliance Act (FATCA) filing requirement applies to the account being reported. - Applicable checkbox on Form 8949:

Check the box indicating where the transaction should be reported on Form 8949 (Sale and Other Dispositions of Capital Assets).

Part I: Transaction Details

- 1a. Description of property (Example: 100 sh. XYZ Co.):

Describe the property sold or exchanged. For example, enter the number of shares and the stock’s ticker symbol (e.g., “100 sh. XYZ Co.”). - 1b. Date acquired:

Enter the date the security or property was originally acquired. If it was acquired on multiple dates, this box may be left blank. - 1c. Date sold or disposed:

Provide the date the property was sold or disposed of. For short sales, enter the date the security was delivered to close the short sale. - 1d. Proceeds:

Enter the gross cash proceeds from the sale, reduced by commissions or transfer taxes. This amount is typically the sale price. - 1e. Cost or other basis:

Enter the cost or basis of the property. If the security was acquired through a non-compensatory option or as a gift, make sure to adjust the basis accordingly. - 1f. Accrued market discount:

Report any accrued market discount at the time of the sale, if applicable. Market discount applies to certain bonds bought at a discount. - 1g. Wash sale loss disallowed:

If any part of the loss from the sale is disallowed due to a wash sale (repurchase of the same security within 30 days), report that amount here.

Part II: Gain/Loss Classification

- 2. Gain or loss:

Indicate whether the gain or loss is short-term, long-term, or ordinary.- Short-term gain or loss: For property held for one year or less.

- Long-term gain or loss: For property held for more than one year.

- Ordinary: For transactions subject to special rules, such as contingent payment debt instruments.

Part III: Additional Information

- 3. Check if proceeds from collectibles or Qualified Opportunity Fund (QOF):

Check this box if the proceeds are from the sale of collectibles (such as art or antiques) or investments in a Qualified Opportunity Fund (QOF). - 4. Federal income tax withheld:

If federal income tax was withheld on the transaction (for example, due to backup withholding), report the amount here. - 5. Check if noncovered security:

Check this box if the security sold is a noncovered security (securities acquired before the IRS cost basis reporting rules were implemented). This will affect the information reported to the IRS. - 6. Reported to IRS:

Indicate whether the gross proceeds or net proceeds were reported to the IRS. - 7. Check if loss is not allowed based on amount in 1d:

Check this box if a loss on the transaction cannot be taken (for example, certain losses on wash sales or transactions involving changes in corporate control).

Part IV: Futures Contracts and Options

- 8. Profit or (loss) realized on closed contracts:

Report the total profit or loss on regulated futures contracts or foreign currency contracts closed during the tax year. - 9. Unrealized profit or (loss) on open contracts—12/31/2023:

Enter any unrealized profit or loss on open contracts as of the previous year’s end. - 10. Unrealized profit or (loss) on open contracts—12/31/2024:

Report the unrealized profit or loss on open contracts at the end of the current tax year. - 11. Aggregate profit or (loss) on contracts:

Combine all realized and unrealized profits and losses on contracts for the year and report the aggregate amount.

Part V: Bartering and State Information

- 12. Check if basis reported to IRS:

Check this box if the basis of the securities was reported to the IRS. - 13. Bartering:

If bartering transactions are being reported, enter the fair market value (FMV) of property or services received in exchange for the barter. - 14. State name:

Enter the name of the state for which state income taxes may apply to the transaction. - 15. State identification no.:

Provide the state identification number associated with the transaction, if applicable. - 16. State tax withheld:

Enter any state tax withheld from the transaction.

Final Steps

Once all relevant information is completed, File Form 1099-B with the IRS and provide copies to the recipient. Be sure to adhere to any relevant deadlines, typically by the end of January for providing recipient copies and by February for filing with the IRS.