Form 4868, also known as the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, allows taxpayers to extend their tax filing deadline by six months. This extension applies to the filing date only, not the payment deadline. Therefore, taxpayers must estimate and pay any owed taxes by the original deadline to avoid interest and penalties. Properly filing the 4868 Form can provide the necessary time to accurately prepare and submit your tax return without the rush and stress often associated with the tax season. By understanding the requirements and process for filing this form, you can ensure a smooth and compliant tax filing experience

Who Must File Form 4868?

Taxpayers who are unable to complete their individual income tax returns by the April 15th deadline should file Form 4868. This form can be used by anyone who needs more time to gather their tax documents, resolve complex tax issues, or for other reasons that delay the timely filing of their return. Both U.S. citizens and resident aliens who require extra time for their federal tax returns can utilize this form. However, it is important to note that this extension only applies to the filing deadline and not to the payment of taxes owed. Taxpayers must still estimate and pay their taxes by the original due date to avoid penalties.

How to File Form 4868?

Filing the IRS Form 4868 can be done either electronically or by paper. To file electronically, taxpayers can use the IRS e-file service, available through the IRS website or authorized e-file providers. This method is quick and provides instant confirmation of receipt. Alternatively, taxpayers can complete a paper version of the form and mail it to the appropriate IRS address, which varies depending on their location. When filing, taxpayers must provide their estimated tax liability, the total payments made, and the amount they are paying with the extension request. It’s crucial to ensure the form is filed by the original tax filing deadline, typically April 15th.

How to Complete Form 4868?

Completing the Form 4868 involves several key steps:

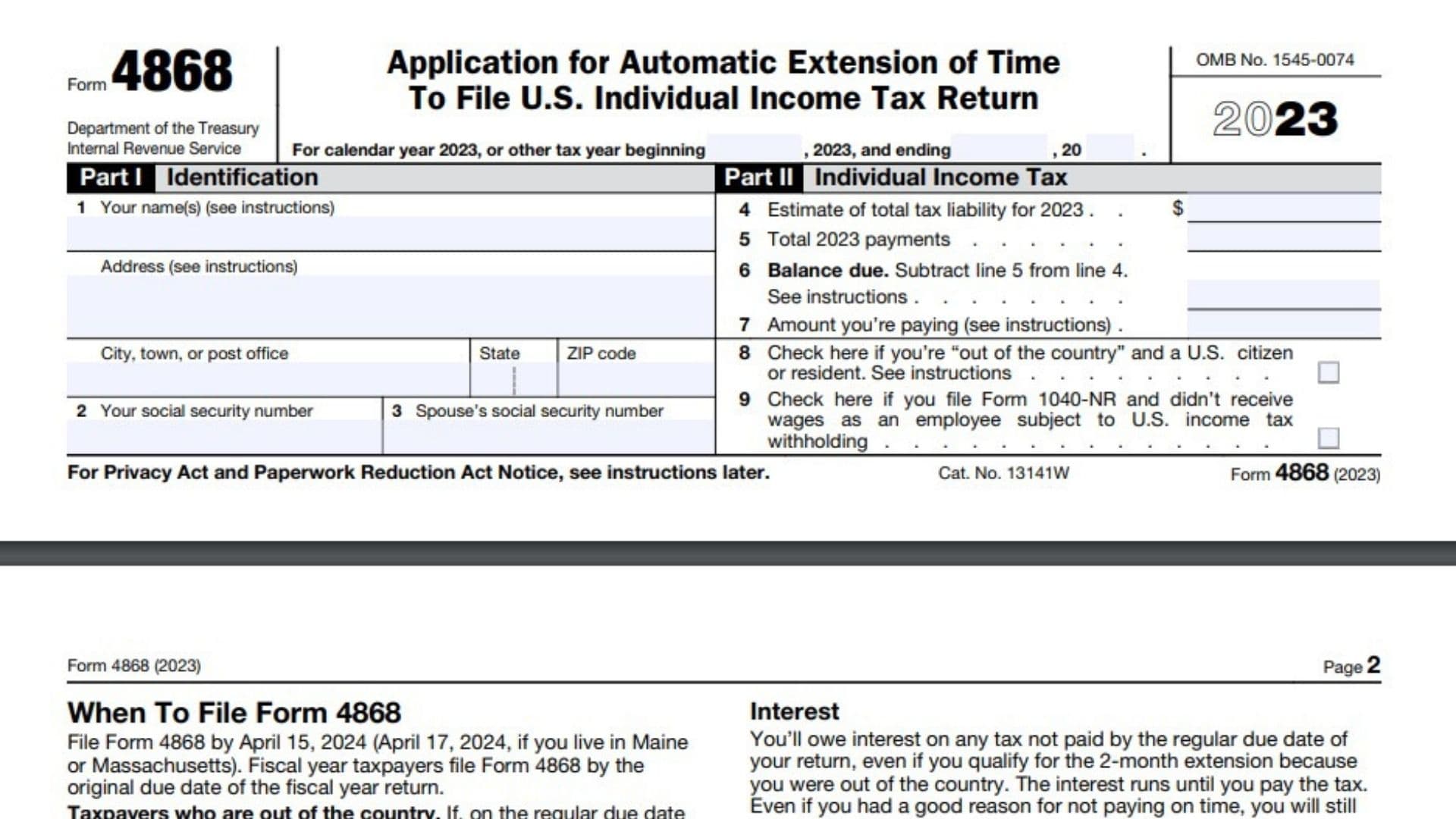

- Personal Information: Enter your name, address, and Social Security number. If filing jointly, include your spouse’s information as well.

- Estimated Tax Liability: Calculate and enter your estimated total tax liability for the year.

- Total Payments: Enter the total amount of tax payments you have already made for the year, including withholding and estimated tax payments.

- Balance Due: Subtract your total payments from your estimated tax liability to determine the balance due. This is the amount you need to pay with your extension request.

- Amount You Are Paying: Indicate the amount you are paying with the extension request. This payment should cover any balance due to avoid penalties and interest.

- Signature: Sign and date the form if you are filing by paper. Electronic filings will require following the e-file service’s signature process.

Ensure all information is accurate to avoid delays or complications with your extension request.

Where to Mail Form 4868?

If you choose to file a paper Form 4868, the mailing address depends on your location and whether you are including a payment with the form. The IRS provides specific addresses for different regions and situations, which are listed in the form’s instructions. Always use the most current IRS instructions to find the correct mailing address. For those paying by check or money order, include your payment with the form and mail it to the appropriate address. If filing electronically, you do not need to mail a physical copy but should keep a copy for your records.

Due Dates

The Form 4868 must be filed by the regular tax filing deadline, typically April 15th. This extension grants an additional six months, extending the filing deadline to October 15th. It is important to remember that while the filing deadline is extended, any taxes owed are still due by the original April 15th deadline. Failure to pay the estimated taxes by this date can result in interest and penalties. To avoid these, make sure to accurately estimate your tax liability and make the necessary payments when submitting your extension request.