Form 5498, officially titled IRA Contribution Information, is a document used by financial institutions to report contributions to individual retirement arrangements (IRAs) and certain other types of retirement accounts to the IRS. This form provides essential information to both the account holder and the IRS regarding contributions made to traditional IRAs, Roth IRAs, SEP-IRAs, and SIMPLE IRAs during a specific tax year. The primary purpose of Form 5498 is to report contributions made to IRA accounts, including rollover contributions, recharacterizations, and Roth IRA conversions. It serves as a record of the total contributions made by or on behalf of an individual taxpayer to their retirement account(s) for the tax year in question.

Financial institutions, such as banks, mutual fund companies, and other entities that manage IRA accounts, are responsible for providing Form 5498 to IRA owners by May 31st of each year. Additionally, a copy of this form is sent to the IRS to report the contributions made by taxpayers for tax compliance purposes.

How to File Form 5498?

Financial institutions file Form 5498 directly with the IRS and provide a copy to the IRA account holder. Taxpayers do not need to attach Form 5498 to their tax return but should keep it for their records to verify IRA contributions when filing taxes.

How to Complete Form 5498?

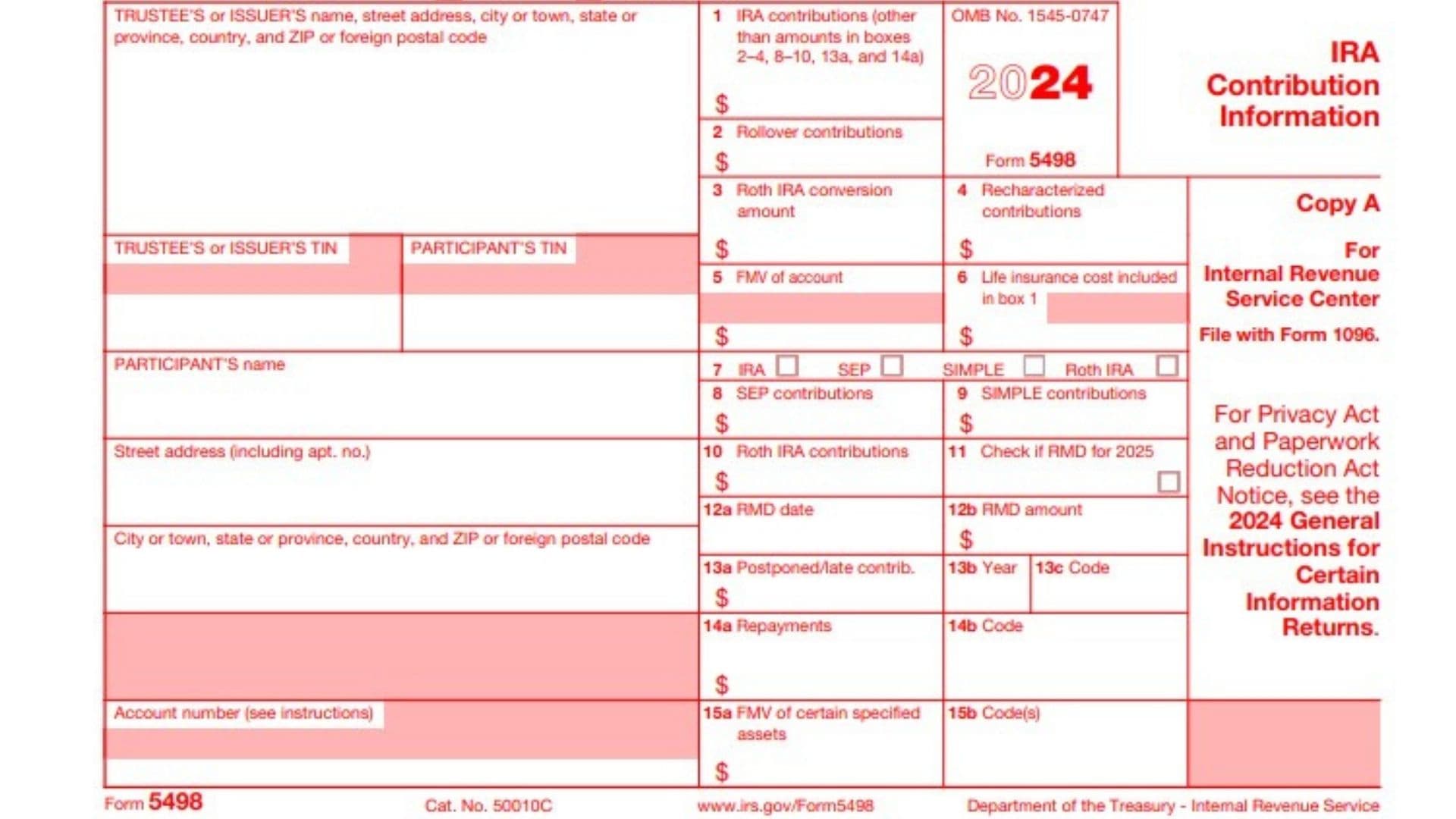

Boxes 1 to 6: Contribution Information

Box 1: IRA Contributions (Other Than Amounts in Boxes 2-4)

Enter the total amount of IRA contributions made for the tax year. This includes:

- Regular contributions to Traditional IRAs.

- Catch-up contributions for taxpayers aged 50 or older.

Note: Do not include rollover, conversion, or recharacterized contributions here.

Box 2: Rollover Contributions

Enter the amount of rollover contributions made to the IRA during the year. This includes rollovers from:

- Qualified plans (e.g., 401(k), 403(b)).

- Other IRAs.

- Direct rollovers and 60-day rollovers.

Box 3: Roth IRA Conversion Amount

Report the total amount converted from a Traditional IRA to a Roth IRA. This includes:

- Conversions of pre-tax contributions and earnings from Traditional IRAs to Roth IRAs.

Box 4: Recharacterized Contributions

Enter the total amount of contributions that were recharacterized from one type of IRA to another. For example:

- Contributions made to a Roth IRA that were later recharacterized as a Traditional IRA contribution.

Box 5: Fair Market Value of Account

This box shows the fair market value (FMV) of the IRA as of December 31 of the tax year. The FMV helps determine the total value of the IRA for reporting and tax purposes.

Box 6: Life Insurance Cost Included in Box 1

If any portion of the contributions reported in Box 1 was used to pay premiums for life insurance under an IRA, enter that amount here. Typically, this is rare and applies to specific types of plans.

Boxes 7 to 11: IRA Types and Other Reporting

Box 7: IRA Type

Check the appropriate box to indicate the type of IRA for which contributions were made:

- SEP: If contributions were made to a Simplified Employee Pension (SEP) IRA.

- SIMPLE: If contributions were made to a Savings Incentive Match Plan for Employees (SIMPLE IRA).

- Roth: If the account is a Roth IRA.

Box 8: SEP Contributions

Report the total amount of SEP contributions made to the IRA. This includes contributions made by an employer under a SEP plan.

Box 9: SIMPLE Contributions

Enter the total amount of contributions made to a SIMPLE IRA by an employer under a SIMPLE plan. SIMPLE IRAs are typically used by small businesses.

Box 10: Roth IRA Contributions

Report the total amount of Roth IRA contributions made during the year (excluding rollovers and conversions). This includes:

- Regular Roth IRA contributions.

- Catch-up contributions for those aged 50 or older.

Box 11: RMD (Required Minimum Distribution)

Check this box if the IRA holder is required to take a required minimum distribution (RMD) for the following tax year (i.e., they have reached age 73 in the tax year or will in the next year). The RMD rules apply to Traditional IRAs, SEP IRAs, and SIMPLE IRAs, but not Roth IRAs.

Things to Know About Form 5498

Eligibility: Form 5498 is relevant for taxpayers who contribute to IRAs, including those who may qualify for tax deductions based on their contributions.

Extensions: While Form 5498 is generally due to the IRA holder by May 31st, extensions may apply for certain circumstances, such as corrections or updates to the reported information.

Deductions and Credits: Taxpayers may be eligible for deductions or credits based on their IRA contributions, which can impact their taxable income for the year.

Penalties for Non-Compliance: Failure to report IRA contributions accurately or to meet the required minimum distributions (RMDs) can result in penalties from the IRS.