Form 8281, Information Return for Publicly Offered Original Issue Discount Instruments, is used by issuers of publicly offered debt instruments that have original issue discount (OID) to report the terms of the instruments. Properly managing this form ensures compliance with IRS regulations and helps the IRS track and verify the OID amounts that investors must include in their taxable income. The primary purpose of Form 8281 is to provide the IRS with detailed information about publicly offered debt instruments that have OID. This form helps the IRS monitor the issuance and terms of these instruments to ensure that OID is reported and taxed correctly. Issuers must report the OID terms so that investors can accurately include OID income in their tax returns.

Who Must File Form 8281?

Form 8281 must be filed by:

- Issuers of Publicly Offered Debt Instruments: Any entity that issues publicly offered debt instruments with OID is required to file this form. This includes corporations, partnerships, and other entities that issue such instruments.

How To File Form 8281?

Filing Form 8281 involves several steps and requires detailed information to ensure all necessary details are provided. The form must be filed with the IRS by the issuer of the debt instrument.

- Obtain Form 8281: The form can be downloaded from the IRS website. Ensure you have the correct version.

- Complete the form: Fill out the form with details of the debt instrument, including the terms and conditions related to the OID.

- Submit the form: File Form 8281 with the IRS within 30 days after the issuance of the publicly offered debt instrument. Ensure that the form is complete and accurate.

How To Fill Out Form 8281?

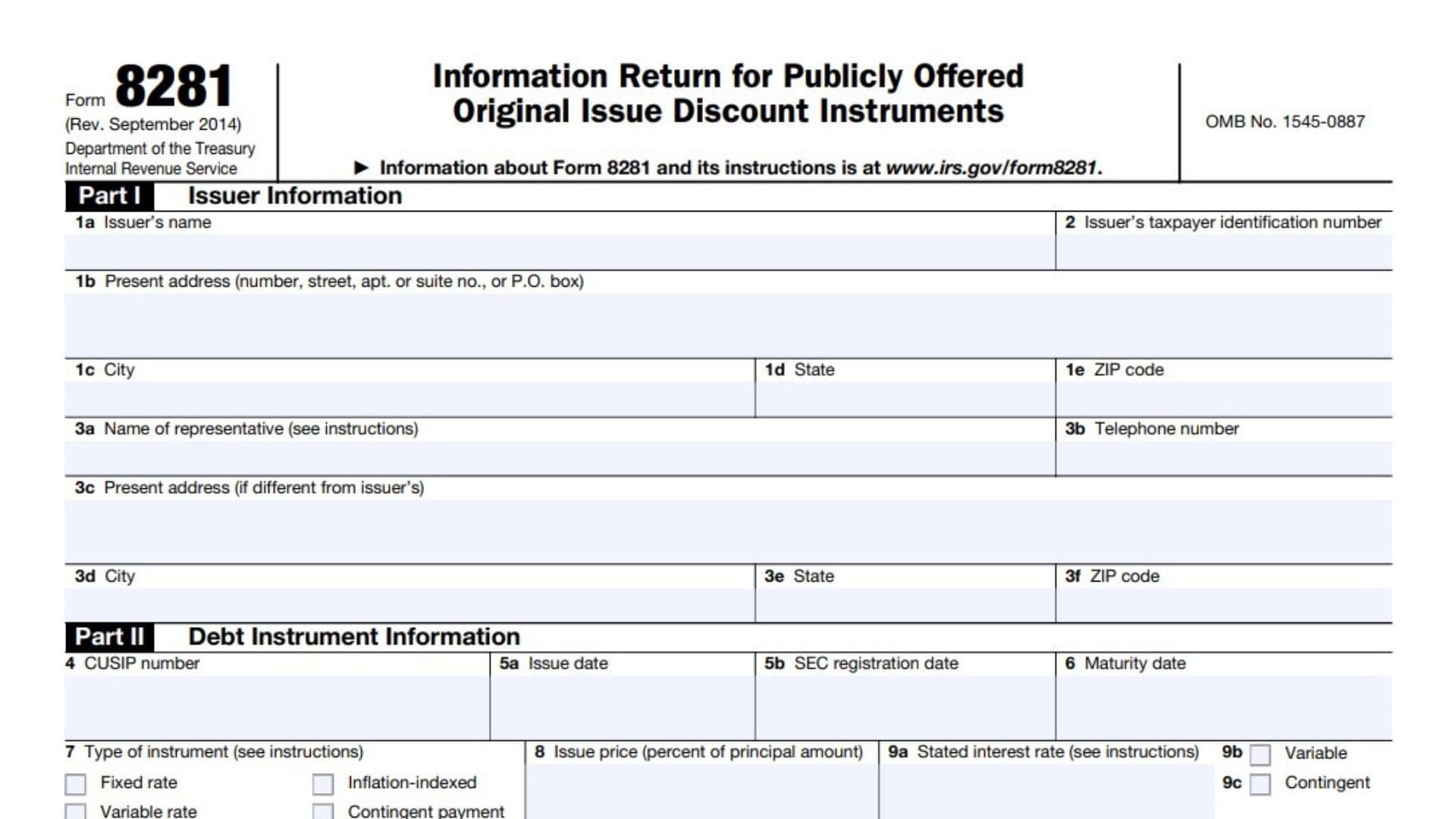

Filling out Form 8281 requires accurate and comprehensive information about the debt instrument and its terms. The form is divided into several parts, each addressing different aspects of the debt instrument and the OID.

Part I: Issuer Information (Lines 1-3)

- 1a. Issuer’s Name: Enter the full legal name of the issuing entity.

- 1b. Present Address: Provide the mailing address of the issuer, including street, apartment or suite number, or P.O. box.

- 1c. City: Enter the city where the issuer is located.

- 1d. State: Enter the two-letter state abbreviation.

- 1e. ZIP Code: Enter the ZIP code of the issuer’s address.

- 2. Issuer’s Taxpayer Identification Number (TIN): Enter the issuer’s Employer Identification Number (EIN) or TIN.

- 3a. Name of Representative: Provide the name of the official or representative responsible for handling this form.

- 3b. Telephone Number: Enter the phone number where the representative can be reached.

- 3c-3f. Representative’s Address: If different from the issuer’s address, provide the representative’s address, including the street, city, state, and ZIP code.

Part II: Debt Instrument Information (Lines 4-15)

- 4. CUSIP Number: Enter the CUSIP number (Committee on Uniform Security Identification Procedures), which uniquely identifies the debt instrument.

- 5a. Issue Date: Enter the date the issue was first sold to the public.

- 5b. SEC Registration Date: Enter the date the debt instrument was registered with the Securities and Exchange Commission (SEC) if applicable.

- 6. Maturity Date: Enter the date the debt instrument will mature.

- 7. Type of Instrument: Check the appropriate box to indicate the type of instrument:

- Fixed rate

- Variable rate

- Inflation-indexed

- Contingent payment

- 8. Issue Price: Enter the issue price as a percentage of the principal amount (e.g., if the bond was issued at 90% of its face value, enter “90”).

- 9a. Stated Interest Rate: Enter the stated interest rate of the debt instrument. If the interest rate is fixed, write it here.

- 9b. Variable Rate: Check the box if the interest rate is variable.

- 9c. Contingent: Check the box if the interest rate is contingent.

- 10. Interest Payment Dates: Enter the dates on which interest payments are made.

- 11. Amount of OID for Entire Issue: Enter the total amount of Original Issue Discount (OID) for the entire issue. This is the difference between the issue price and the stated redemption price at maturity.

- 12. Yield to Maturity: Enter the yield to maturity as a percentage, rounded to two decimal places (e.g., 9.58%).

- 13. Stated Redemption Price at Maturity: Enter the stated redemption price of the entire issue. If the redemption price of each debt instrument is other than $1,000, specify the stated redemption price per instrument.

- 14. Description of Debt Instruments: Provide a description of the debt instruments, including any features like put or call options that could affect the payment schedule.

- 15. Schedule of OID: Attach a schedule showing the OID per $1,000 of the principal amount for the life of the instrument. This schedule should be based on a 6-month accrual period and should show the daily portion of OID for each accrual period and the total OID for each calendar year.

Part III: Signature

After completing the form, the issuer or representative must:

- Sign the form in the designated area.

- Provide Title: The title of the person signing on behalf of the issuer.

- Date: Enter the date of signing.

Once completed, two copies of Form 8281 (including attachments) must be sent within 30 days after the issuance of the debt instrument or SEC registration to:

- Department of the Treasury

- Internal Revenue Service

- Ogden, UT 84201-0209

Things to Consider When Filing Form 8281

Understanding the specific rules and implications of filing Form 8281 is essential for issuers of publicly offered debt instruments to ensure compliance with IRS regulations and accurately report the terms of their instruments.

Accurate Reporting: Ensure that all information reported on Form 8281 is accurate and complete. Incorrect or incomplete information can lead to penalties and delays in processing by the IRS.

Supporting Documentation: Maintain thorough and detailed records of the terms and conditions of the debt instrument. This includes documentation of the issue price, stated redemption price, and any other relevant terms.

Timely Filing: Ensure that Form 8281 is filed within 30 days after the issuance of the publicly offered debt instrument. Late filing can result in penalties and additional interest charges.

Record Keeping: Maintain accurate records of all transactions and supporting documents related to the issuance of the debt instrument. Proper record-keeping helps ensure compliance and can be crucial in case of an IRS audit.

Professional Assistance: Due to the complexity of OID reporting and the specific requirements of Form 8281, consider seeking assistance from a tax professional. A qualified advisor can help ensure that Form 8281 is completed accurately and submitted on time and can provide guidance on the implications of OID reporting.

Legal and Financial Implications: Understand the legal and financial implications of issuing debt instruments with OID. Ensure that you comply with IRS regulations and meet all reporting and payment obligations.