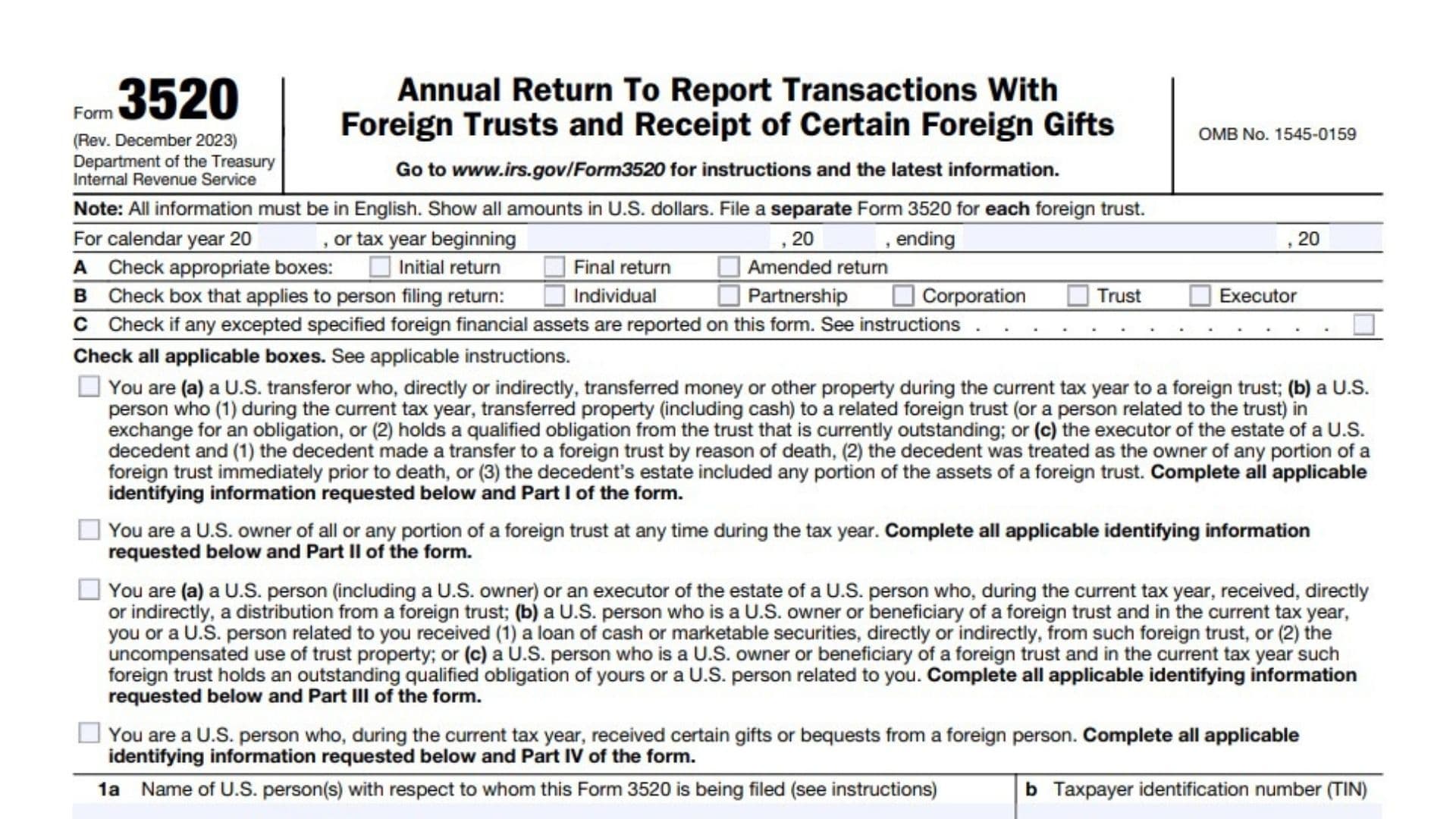

Form 3520 is used to report various transactions with foreign trusts and large foreign gifts, providing the IRS with information necessary to enforce tax compliance for U.S. persons with foreign financial interests. Properly filing Form 3520 ensures that taxpayers disclose required information about their foreign transactions and avoid potential penalties for non-compliance.

U.S. persons must file Form 3520 if they:

- Are responsible for reporting certain transactions with foreign trusts, including the creation of a foreign trust, transfers to a foreign trust, and receipt of distributions from a foreign trust.

- Receive large gifts or bequests from foreign persons (more than $100,000 from a non-resident alien individual or foreign estate, or more than $16,388 from foreign corporations or foreign partnerships).

This form is typically filed annually.

How to File Form 3520?

Filing the IRS Form 3520 involves several steps:

- Obtain the Form: Taxpayers can obtain Form 3520 from the IRS website or through tax preparation software.

- Complete the Form: Fill out the form with the required information about the foreign trusts and foreign gifts or bequests.

- Submit to the IRS: Mail the completed form to the IRS by the due date.

How to Complete Form 3520?

Completing the Form 3520 requires detailed information about foreign trusts and foreign gifts or bequests. Here’s how to do it:

- Part I: General Information:

- Provide the taxpayer’s name, address, and taxpayer identification number (TIN).

- Answer questions about the nature of the foreign transactions and ownership of foreign trusts.

- Part II: Reporting of Foreign Trusts:

- Report information about the foreign trust, including the name and address of the trust, the value of the trust, and details about any transfers to or distributions from the trust.

- Part III: Receipt of Foreign Gifts or Bequests:

- Report the receipt of foreign gifts or bequests, including the name and address of the donor, the date and amount of the gift or bequest, and the nature of the gift or bequest.

Review all entries for accuracy and completeness before submitting the form to the IRS.

Additional Considerations for Form 3520

- Foreign Trusts: U.S. persons must report certain transactions with foreign trusts, including the creation of a foreign trust, transfers to a foreign trust, and receipt of distributions from a foreign trust.

- Foreign Gifts: U.S. persons must report the receipt of large gifts or bequests from foreign persons if the total amount received exceeds the applicable threshold.

- Penalties: Failure to file Form 3520 or accurately report foreign transactions can result in significant penalties, including a penalty equal to 35% of the gross value of the transaction.

Where to Mail Form 3520?

Form 3520 should be mailed to the IRS at the following address:

Department of the Treasury

Internal Revenue Service Center

P.O. Box 409101

Ogden, UT 84409

Taxpayers should ensure that the form is mailed to the correct address to avoid processing delays.

Due Dates

The Form 3520 must be filed by the due date of the taxpayer’s income tax return, including extensions. For most individuals, this is typically April 15th. If you cannot file by this date, you can request an extension by filing Form 4868.

Frequently Asked Questions

- Do I need to file Form 3520 if I only received a small gift from a foreign person?No, Form 3520 is only required if the total amount of gifts or bequests received from foreign persons exceeds the applicable threshold.

- What types of transactions with foreign trusts must be reported on Form 3520?Transactions that must be reported include the creation of a foreign trust, transfers to a foreign trust, and receipt of distributions from a foreign trust.

- Can I be penalized for not filing Form 3520?Yes, failure to file Form 3520 or accurately report foreign transactions can result in significant penalties, including a penalty equal to 35% of the gross value of the transaction.