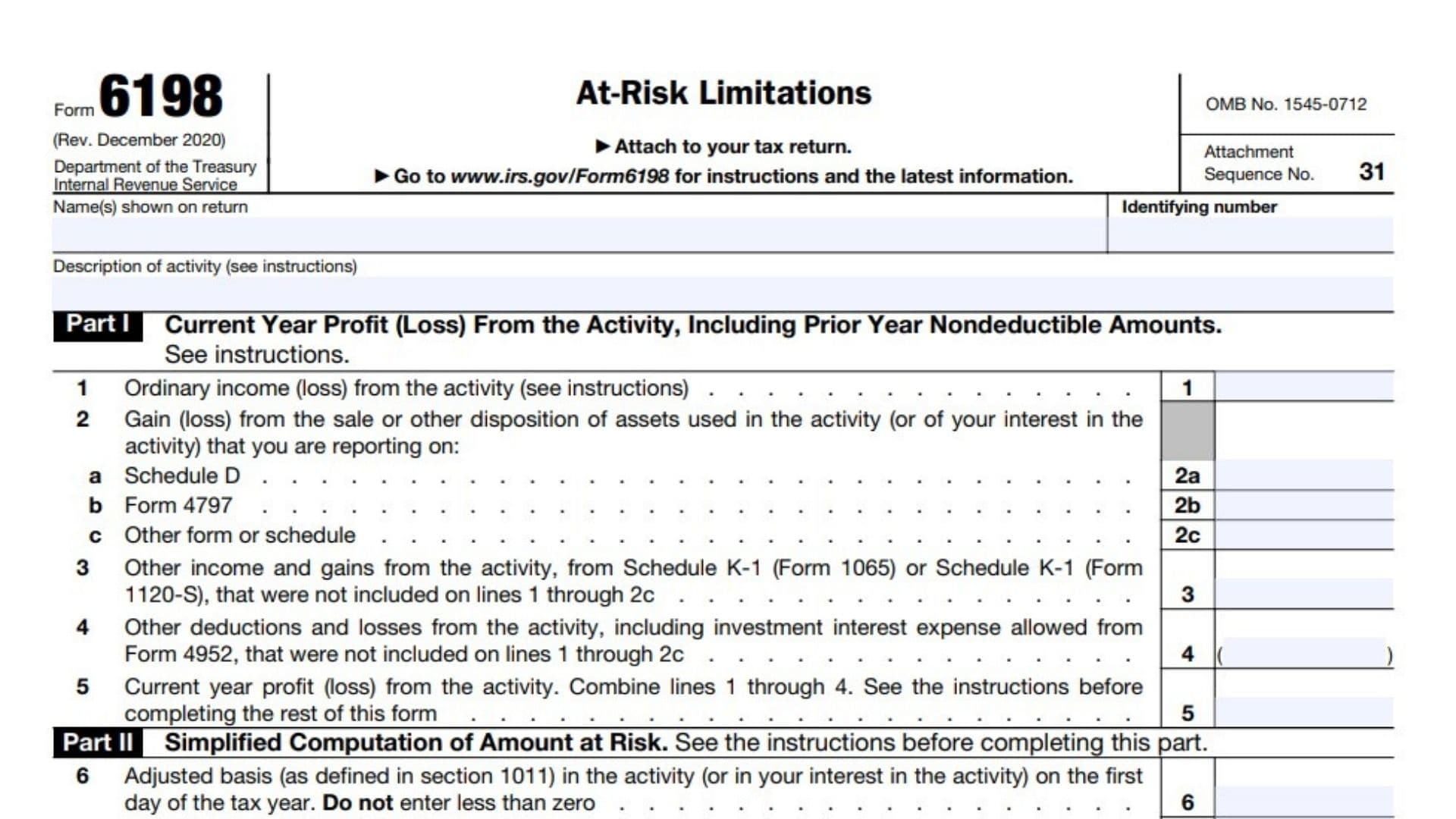

Form 6198, At-Risk Limitations, is a crucial document for taxpayers with investments in business activities that could limit their deductible losses. Properly completing this form ensures compliance with IRS regulations and helps prevent disallowed deductions. The primary purpose of Form 6198 is to limit the amount of loss a taxpayer can claim on their tax return to the amount they have “at risk” in the business or investment activity. The IRS requires this form to be filed by individuals who have investments in certain activities where their financial exposure may be limited to the amount they have invested or pledged as collateral. The at-risk rules are designed to prevent taxpayers from claiming losses that exceed their actual financial risk in the activity. By completing Form 6198, taxpayers can determine the maximum allowable loss they can deduct, ensuring that only legitimate economic losses are claimed.

Who Must File Form 6198?

Form 6198 must be filed by individuals, partnerships, estates, trusts, and S corporations engaged in an activity for which they are subject to the at-risk rules. This typically includes activities carried out as a trade or business, or for the production of income, where the taxpayer’s investment is at risk. If you have invested in a business or activity and have loans secured by property used in the activity, or if you are otherwise protected from loss, you must file this form. The at-risk rules apply to most business activities and certain income-producing investments, including farming, equipment leasing, oil and gas exploration, and real estate activities. If your losses from these activities exceed your at-risk amount, Form 6198 is necessary to determine the allowable loss.

How to File Form 6198?

Filing Form 6198 involves several steps and should be done in conjunction with your annual tax return. First, gather all necessary documentation, including records of your investments, loans, and any other financial commitments related to the at-risk activity. Download Form 6198 from the IRS website. Complete the form by entering the relevant information about your investment and any income or losses incurred. The form will guide you through calculating your at-risk amount and determining the deductible loss. Once completed, attach Form 6198 to your federal tax return (Form 1040 for individuals, Form 1065 for partnerships, or Form 1120-S for S corporations). If filing electronically, tax software will guide you through the process. Ensure all forms are submitted by the filing deadline to avoid penalties and delays in processing your deductions.

How to Fill out Form 6198?

Filling out Form 6198 requires careful attention to detail and a thorough understanding of your at-risk investments. The form is divided into several sections, each addressing different aspects of the at-risk rules.

- Part I – Information About the Activity: Provide details about the activity for which you are subject to the at-risk rules. This includes the name, description, and whether the activity is passive or non-passive.

- Part II – At-Risk Investment: Enter your total at-risk investment in the activity at the beginning of the tax year. This includes money and the adjusted basis of property contributed to the activity.

- Part III – Adjustments for Current Year: Calculate any adjustments to your at-risk amount for the current tax year. This includes income from the activity, additional investments, and reductions such as withdrawals or distributions.

- Part IV – Deductible Loss: Determine the deductible loss for the activity based on your at-risk amount. If your loss exceeds your at-risk amount, you can only deduct the portion up to your at-risk limit. Any excess loss is carried forward to future years.