Filing Form 2290, also known as the Heavy Highway Vehicle Use Tax Return, is crucial for any business using heavy vehicles on public highways. These vehicles, typically weighing 55,000 pounds or more, are subject to this tax to help fund highway maintenance and infrastructure. Properly filing this form involves calculating the tax due based on the vehicle’s weight and the number of miles it travels annually. It’s important to keep detailed records of each vehicle’s mileage and ensure that all necessary information is included to avoid penalties or delays in processing. Compliance with this tax requirement supports the upkeep of the nation’s highways, which are vital for commerce and transportation.

Who Must File Form 2290?

You must file Form 2290 if you have a heavy highway vehicle registered in your name with a taxable gross weight of 55,000 pounds or more. This form is required for any business or individual who operates such vehicles on public highways. The tax period runs from July 1 to June 30, and the form must be filed by the end of the month following the month of the vehicle’s first use. For example, if you first use the vehicle in July, you must file Form 2290 by August 31. This form must be filed annually, and timely filing is critical to ensure compliance with IRS regulations.

How to File Form 2290?

To file Form 2290, follow these steps

- Download Form 2290 from the IRS website or use tax preparation software.

- Pay the tax due via Electronic Federal Tax Payment System (EFTPS), credit or debit card, check, or money order.

- You can file electronically, which is mandatory for businesses reporting 25 or more vehicles, or mail the form to the IRS at the address specified in the instructions.

- After the IRS processes your payment and form, they will send you a stamped Schedule 1, which serves as proof of payment and is necessary for vehicle registration.

How to Complete Form 2290?

Filling out Form 2290 requires detailed information about each vehicle. Follow these steps to ensure accuracy:

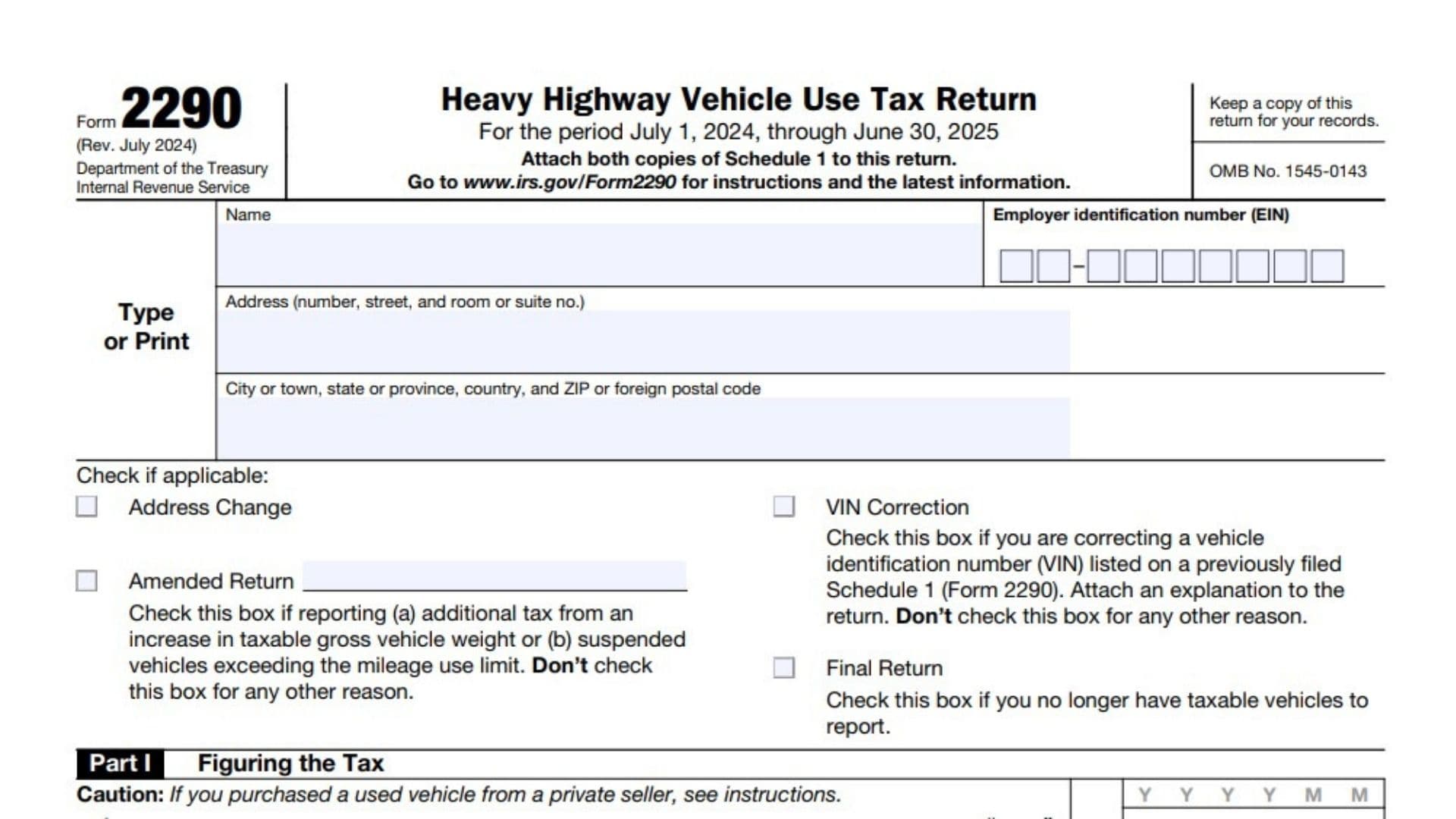

- Begin by providing your name, address, and Employer Identification Number (EIN). Ensure all information matches your IRS records to avoid delays.

- For each vehicle, enter the Vehicle Identification Number (VIN), taxable gross weight, and the first month of use. Accurate VINs are critical as errors can lead to processing delays.

- Use the tax computation section to calculate the tax based on the vehicle’s weight and mileage. The form provides a table to assist with this calculation. If your vehicle qualifies for a suspension of tax, you must indicate the expected mileage for the tax year.

- Sign and date the form. Unsigned forms will not be processed, which can lead to penalties.

- Submit the completed form electronically if you are reporting 25 or more vehicles. For fewer vehicles, you can mail the form to the address listed in the instructions. Electronic filing is recommended for quicker processing and confirmation of receipt.

- Once the IRS processes your form and payment, they will send you a stamped Schedule 1. This is required for vehicle registration and should be kept in your records.

Eligibility: Vehicles with a taxable gross weight of 55,000 pounds or more used on public highways must file Form 2290.

Due Date: File by the last day of the month following the month of the vehicle’s first use. For most, this is August 31.

Extensions: No formal extensions, but if you cannot file on time, you may avoid penalties by submitting as soon as possible and attaching a statement explaining the delay.

Penalties: Failure to file or pay on time may result in penalties and interest. Penalties are generally 4.5% of the total tax due, assessed monthly for up to five months, and 0.5% of the unpaid tax, plus interest.