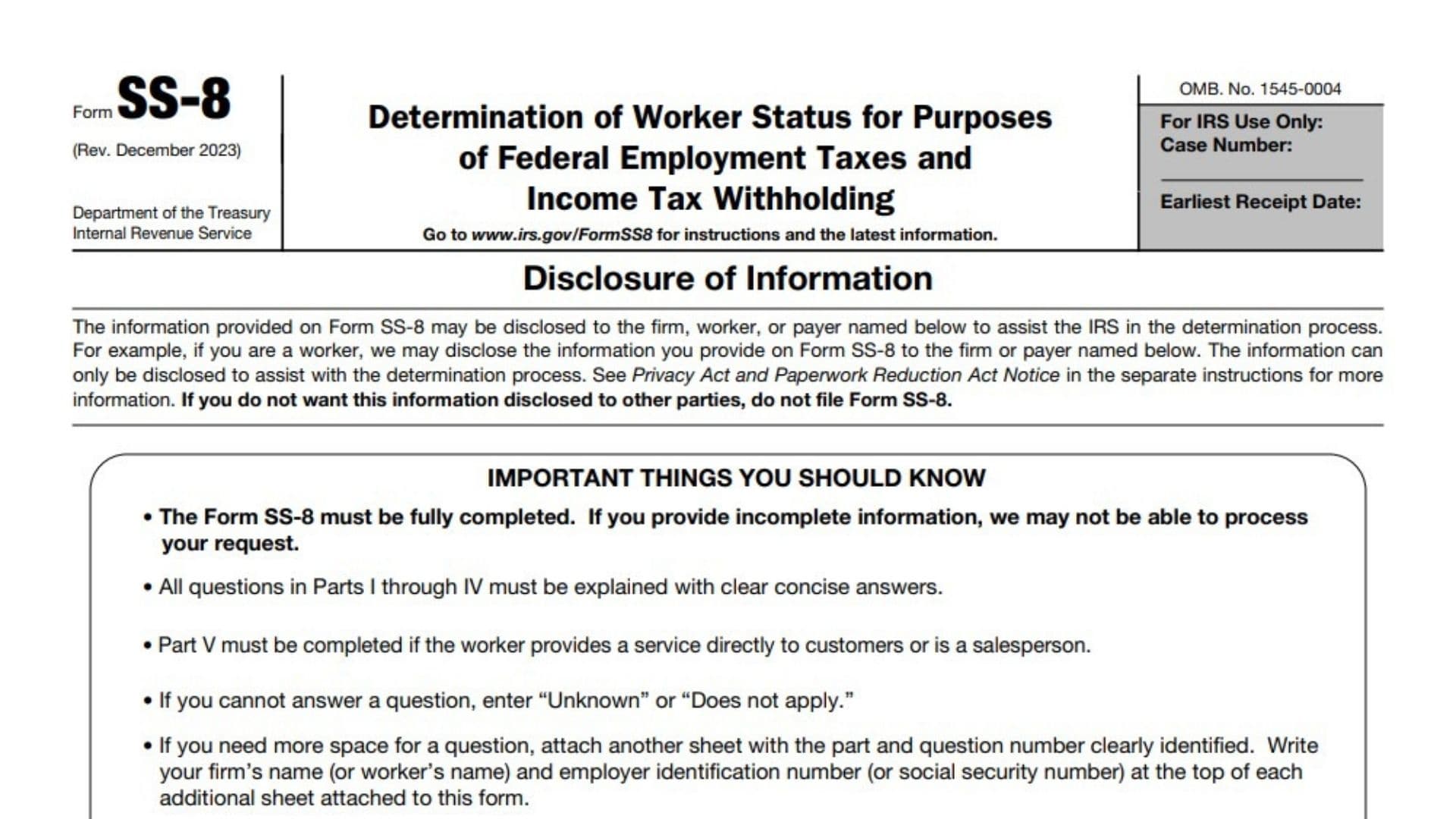

Worker classification—whether a worker is an employee or an independent contractor—has significant tax implications for both the worker and the employer. Misclassification can lead to substantial tax liabilities, penalties, and interest. Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, allows workers and employers to request a determination from the IRS regarding the correct classification of a worker. Understanding the requirements, eligibility, and steps to complete Form SS-8 is crucial for ensuring compliance with federal tax laws.

Who Must File Form SS-8?

Form SS-8 can be filed by either the worker or the employer when there is uncertainty or disagreement about the worker’s classification. Situations where Form SS-8 might be filed include:

- If a worker believes they have been misclassified as an independent contractor rather than an employee.

- If an employer wants to ensure that they are correctly classifying a worker and complying with federal employment tax laws.

- In some cases, third parties such as payroll providers or tax advisors may file the form on behalf of the worker or employer.

How to File Form SS-8?

Form SS-8 can be filed by mailing the completed form to the IRS. The IRS will review the information provided and issue a determination regarding the worker’s status. This process can take several months, so it’s important to file the form as soon as possible if there is uncertainty about worker classification.

How to Complete Form SS-8?

Completing Form SS-8 involves several detailed steps to provide the IRS with sufficient information to determine the worker’s status. Here are the steps to complete the form:

- Enter the name, address, and Social Security number (or EIN) of the person or entity filing the form. Indicate whether you are the worker, the firm, or a third party.

- Provide the name and Social Security number of the worker whose status is in question.

- Provide the name, address, and EIN of the firm that hired the worker.

- Describe the relationship between the worker and the firm, including the type of work performed, the method of payment, and the level of control the firm has over the worker’s activities.

- Provide detailed information about the behavioral control the firm has over the worker, including instructions, training, and evaluation methods.

- Describe the financial control the firm has over the worker, including the method of payment, reimbursement of expenses, and the worker’s investment in tools and equipment.

- Provide information about the type of relationship between the worker and the firm, including written contracts, employee benefits, and the permanency of the relationship.

- Sign and date the form to certify that the information provided is accurate.

Requesting a determination of worker status using Form SS-8 can provide significant benefits by clarifying the correct classification and ensuring compliance with federal tax laws. Key benefits include:

- Ensures that workers are correctly classified as employees or independent contractors, reducing the risk of tax liabilities and penalties.

- Helps employers comply with federal employment tax laws and avoid potential audits and penalties.

- Provides workers with clarity about their classification and rights, ensuring they receive appropriate benefits and protections.

Common Problems With Form SS-8

Taxpayers may face several challenges when completing Form SS-8, including:

- Providing detailed information about the relationship between the worker and the firm can be complex. Taxpayers should maintain detailed records and consult with tax professionals if needed.

- The IRS review process for Form SS-8 can take several months. Filing the form as soon as possible can help expedite the determination.

- If there is a disagreement between the worker and the firm about classification, both parties should provide as much detailed information as possible to support their position.