Form 1120 is specifically designed for domestic corporations or associations that are subject to federal income tax. Corporations, including certain organizations such as banks, insurance companies, and other financial institutions, must file Form 1120 to report their annual income, deductions, gains, losses, and credits to the Internal Revenue Service (IRS). Form 1120 must be filed by domestic corporations, including both C corporations and S corporations that did not elect to be treated as an S corporation. A C corporation is a separate legal entity from its owners and is subject to corporate income tax on its profits. On the other hand, S corporations are pass-through entities that do not pay taxes at the corporate level; instead, the profits and losses flow through to the shareholders, who report them on their individual tax returns.

Certain organizations are exempt from filing Form 1120, including tax-exempt organizations, foreign corporations, and corporations that qualify for special tax treatment under specific sections of the Internal Revenue Code.

How to File Form 1120?

Before beginning the filing process, corporations should collect relevant financial records, including income statements, balance sheets, and supporting documents for deductions, credits, and other transactions.

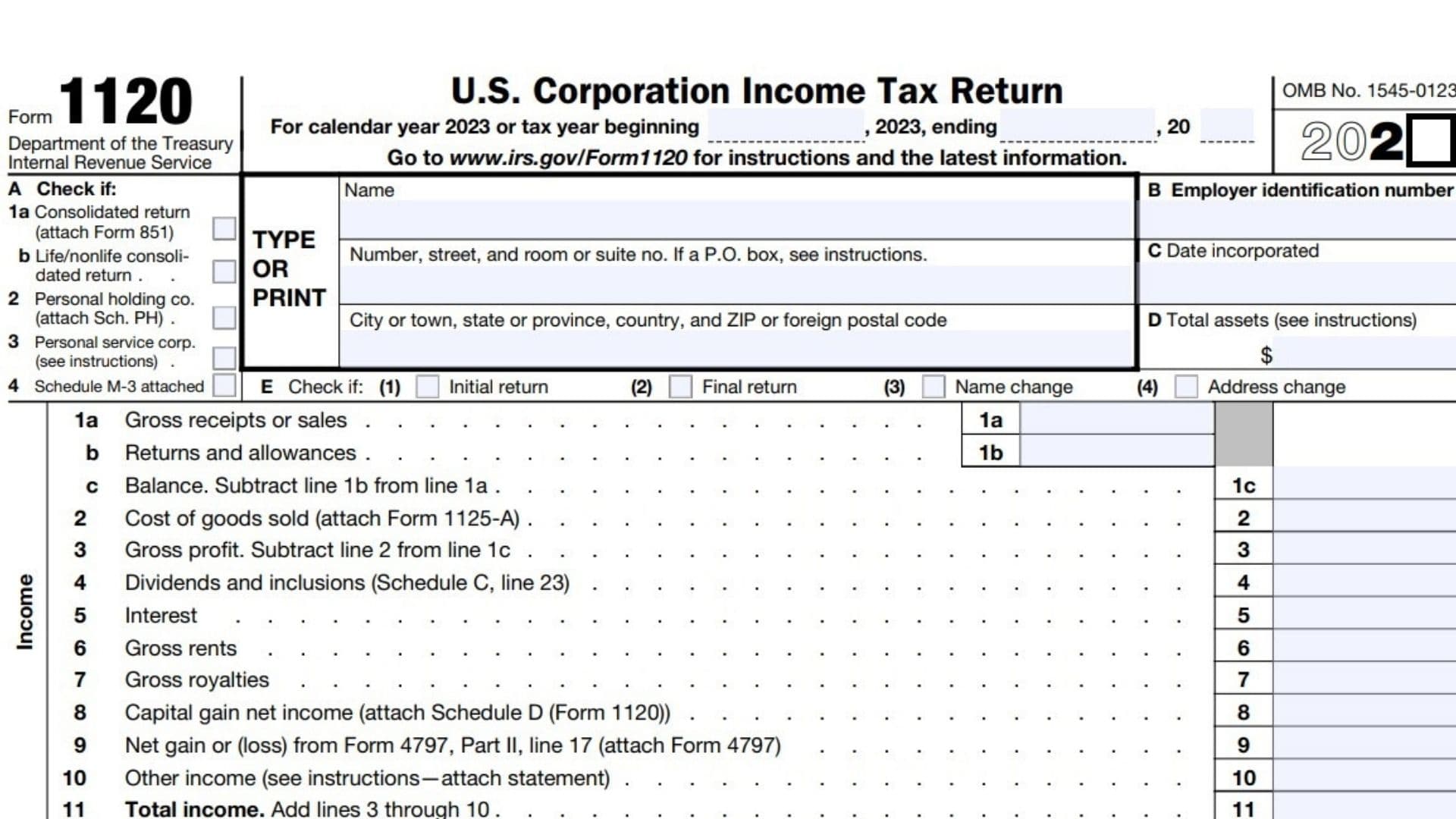

Fill out the basic information section, including the corporation’s name, address, Employer Identification Number (EIN), fiscal year, and principal business activity. Then proceed to report income, deductions, and credits based on the specific instructions provided by the IRS.

Additional schedules may be required to report specific information in detail depending on the corporation’s activities and transactions. Common schedules include Schedule C for corporate dividends and Schedule L for balance sheet details.

How to Complete Form 1120?

INCOME

Line 1a: Enter gross receipts or sales

Line 1b: Enter returns and allowances

Line 1c: Subtract line 1b from line 1a to figure your balance.

Line 2: Cost of goods sold. Attach Form 1125-A.

Line 3: Subtract line 2 from line 1c to figure your gross profit.

Line 4: Enter dividends and inclusions (Schedule C, line 23)

Line 5: Enter interest

Line 6: Enter gross rents

Line 7: Enter gross royalties

Line 8: Capital gain net income. Attach Schedule D (Form 1120)

Line 9: Net gain or (loss) from Form 4797, Part II, line 17. Attach Form 4797.

Line 10: Enter other income

Line 11: Add lines 3 through 10 to figure your total income.

DEDUCTIONS

Line 12: Enter compensation of officers

Line 13: Enter salaries and wages

Line 14: Repairs and maintenance

Line 15: Bad debts

Line 16: Rents

Line 17: Taxes and licenses

Line 18: Interest (see instructions)

Line 19: Charitable contributions

Line 20: Depreciation from Form 4562 not claimed on Form 1125-A or elsewhere on return (attach Form 4562)

Line 21: Depletion

Line 22: Advertising

Line 23: Pension, profit-sharing, etc., plans

Line 24: Employee benefit programs

Line 25: Reserved for future use

Line 26: Other deductions.

Line 27: Add lines 12 through 26. This is your total deductions.

Line 28: Subtract line 27 from line 11 to figure your taxable income before net operating loss deduction and special deductions.

Line 29a: Enter net operating loss deduction

Line 29b: Enter any special deductions (Schedule C, line 24)

Line 29c: Add Line 29a and Line 29b

TAX, REFUNDABLE CREDITS, and PAYMENTS

Line 30: Subtract line 29c from line 28 to figure your taxable income.

Line 31: Total tax (Schedule J, Part I, line 11)

Line 32: ——-

Line 33: Enter total payments and credits (Schedule J, Part III, line 23)

Line 34: Estimated tax penalty. Attach Form 2220.

Line 35: If line 33 < the total of lines 31 and 34, enter the amount owed.

Line 36: If line 33 > the total of lines 31 and 34, enter the amount overpaid.

Line 37: Enter amount from line 36 you want: Credited to 2023 estimated tax / Refunded

SIGN THE FORM.