Form W-4, Employee’s Withholding Certificate, is used by employees to inform their employers of their tax situation. The primary purpose of the W-4 Form is to determine the correct amount of federal income tax to withhold from an employee’s wages. Properly completing this form ensures that the right amount of tax is deducted, helping to avoid large tax bills or significant refunds when filing the annual Federal Income Tax Return.

All employees must complete a Form W-4 when they start a new job or whenever their personal or financial situation changes significantly, such as getting married, having a child, or taking on a second job. Employers use this form to calculate the amount of federal income tax to withhold from employees’ paychecks. If an employee fails to submit a W-4 Form, the employer must withhold taxes as if the employee is single with no adjustments, which could result in higher withholding.

How to File Form W-4?

Filing the Form W-4 involves the following steps:

- Obtain the Form: Employees can obtain Form W-4 from their employer, the IRS website, or online tax preparation services.

- Complete the Form: Fill out the form accurately based on current tax situations, including multiple jobs, dependents, and other income.

- Submit to Employer: Once completed, the form should be submitted to the employer, not the IRS. Employers will use the information to adjust withholding amounts.

- Review Regularly: Employees should review their W-4 Form annually or when their financial situation changes to ensure correct withholding.

How to Complete Form W-4?

Completing the Form W-4 accurately ensures appropriate tax withholding. Follow these detailed steps:

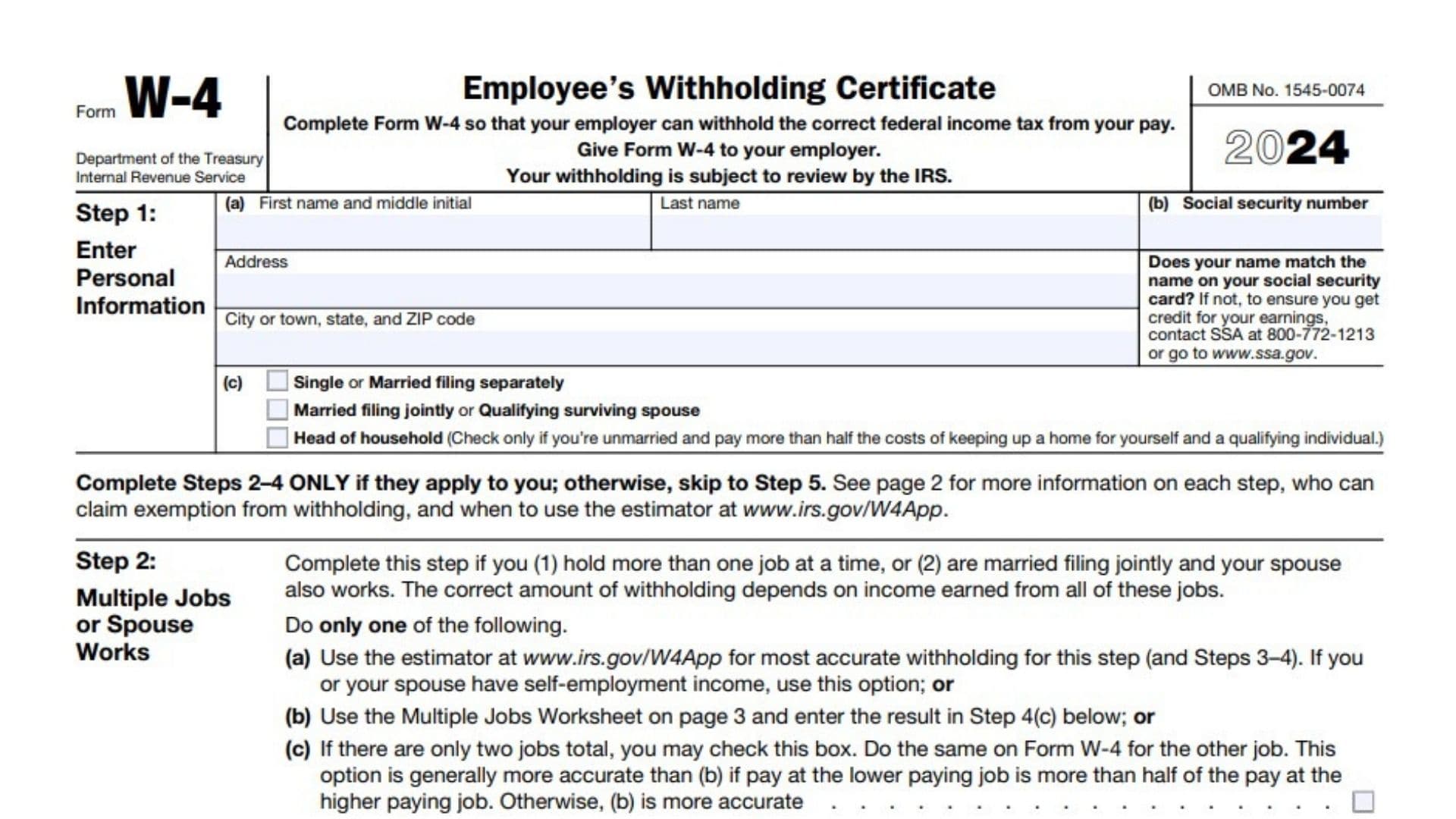

- Personal Information: Enter your name, address, Social Security number, and filing status.

- Multiple Jobs or Spouse Works: If you have multiple jobs or your spouse works, use the provided worksheets or the IRS withholding estimator to ensure accurate withholding.

- Claim Dependents: Enter the number of qualifying children under age 17 and other dependents. Multiply the number of qualifying children by $2,000 and other dependents by $500.

- Other Adjustments: Include any additional income not from jobs, itemized deductions exceeding the standard deduction, and any extra amount you want withheld each pay period.

- Sign and Date: Sign and date the form to certify the information is accurate.

Review each section carefully and consider using the IRS Tax Withholding Estimator tool for additional guidance.

Important tips on filing a Form W-4

When handling the W-4 Form Employee’s Withholding Certificate, keep these tips in mind:

- Ensure all information is correct to avoid over or under-withholding.

- Review and update your W-4 Form annually or when your financial situation changes.

- Utilize the IRS Tax Withholding Estimator for precise calculations.

- Submit the updated form promptly to your employer to adjust withholding amounts.

- Retain a copy of the completed form for your records.

What are the Penalties for Incorrect or Incomplete Form W-4?

Providing incorrect or incomplete information on Form W-4 can lead to significant consequences. Employees might face under-withholding, resulting in a large tax bill and potential penalties when filing their annual return. Over-withholding means less take-home pay throughout the year, though this usually results in a refund when taxes are filed. It is crucial to complete the form accurately and update it as necessary to reflect any changes in financial circumstances.

Where to Submit Form W-4?

The completed Form W-4 should be submitted to the employer, not the IRS. Employers will use the information on the form to determine the amount of federal income tax to withhold from the employee’s paychecks. It is important to submit any updates promptly to ensure the correct amount of tax is withheld.

What are the Different Variants of Form W-4?

The W-4 Form has undergone changes over the years to simplify and improve its accuracy. While the current form is standardized for most employees, there are some variants and related forms:

- Form W-4: The standard form used by most employees to determine federal income tax withholding.

- Form W-4P: Used to determine federal income tax withholding from pensions and annuities.

- Form W-4S: Used to request federal income tax withholding from sick pay.

- Form W-4V: Voluntary withholding request form for certain government payments, including unemployment compensation and Social Security benefits.

Each variant serves specific purposes related to different types of income and withholding needs.