Form 990 is an annual information return filed by tax-exempt organizations with the Internal Revenue Service (IRS). The purpose of Form 990 is to provide the IRS with information about the organization’s finances, activities, and governance. The specific version of Form 990 that must be filed depends on the size and type of the tax-exempt organization. Failure to file Form 990 or filing an incomplete or inaccurate form can result in penalties. It may put the organization’s tax-exempt status at risk. As such, it is important for tax-exempt organizations to understand their filing requirements and to accurately and timely file Form 990.

How to Complete Form 990?

Filling out Form 990 is a complex process. The specific steps will depend on the nature of the tax-exempt organization and the information it needs to report. However, here is a general overview of the process for filling out Form 990:

- The first step in filling out Form 990 is to gather all the necessary information. This includes financial statements, such as the organization’s balance sheet and income statement, as well as information on the organization’s activities and programs.

- There are different versions of Form 990, such as Form 990-EZ and Form 990-PF, depending on the size and type of the tax-exempt organization. Determine which form is appropriate for the organization.

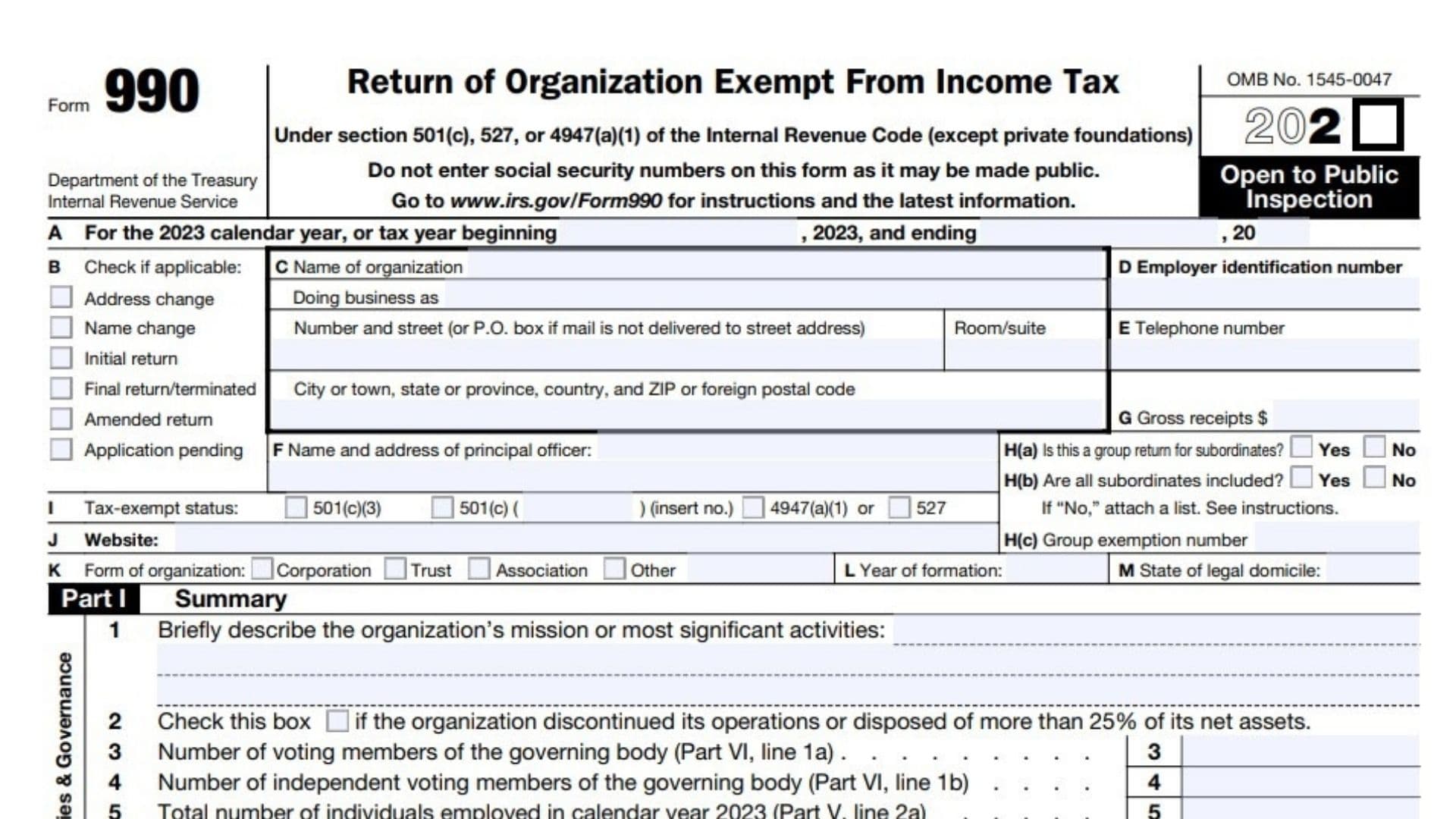

- The header section of Form 990 includes basic information about the organization, such as its name, address, and employer identification number (EIN). This information must be accurate and up to date.

- Part I of Form 990 includes questions about the organization’s mission, programs, and activities. This section helps the IRS determine whether the organization is operating for a tax-exempt purpose.

- Part II of Form 990 includes questions about the organization’s finances, including revenue, expenses, and assets. Depending on the size and type of the organization, additional financial information may need to be reported on separate schedules.

- Depending on the specific version of Form 990 being used, additional parts and schedules may need to be completed. For example, Form 990-EZ requires the completion of Schedule A, which reports on the organization’s public support and revenue.

- Once all the required sections and schedules have been completed, review the form for accuracy and completeness. Submit the form to the IRS by the appropriate deadline, either by mail or electronically.

It’s important to note that tax-exempt organizations may also need to file state tax forms and Form 990. Additionally, some organizations may seek a tax professional’s assistance to ensure that the form is completed accurately and on time.