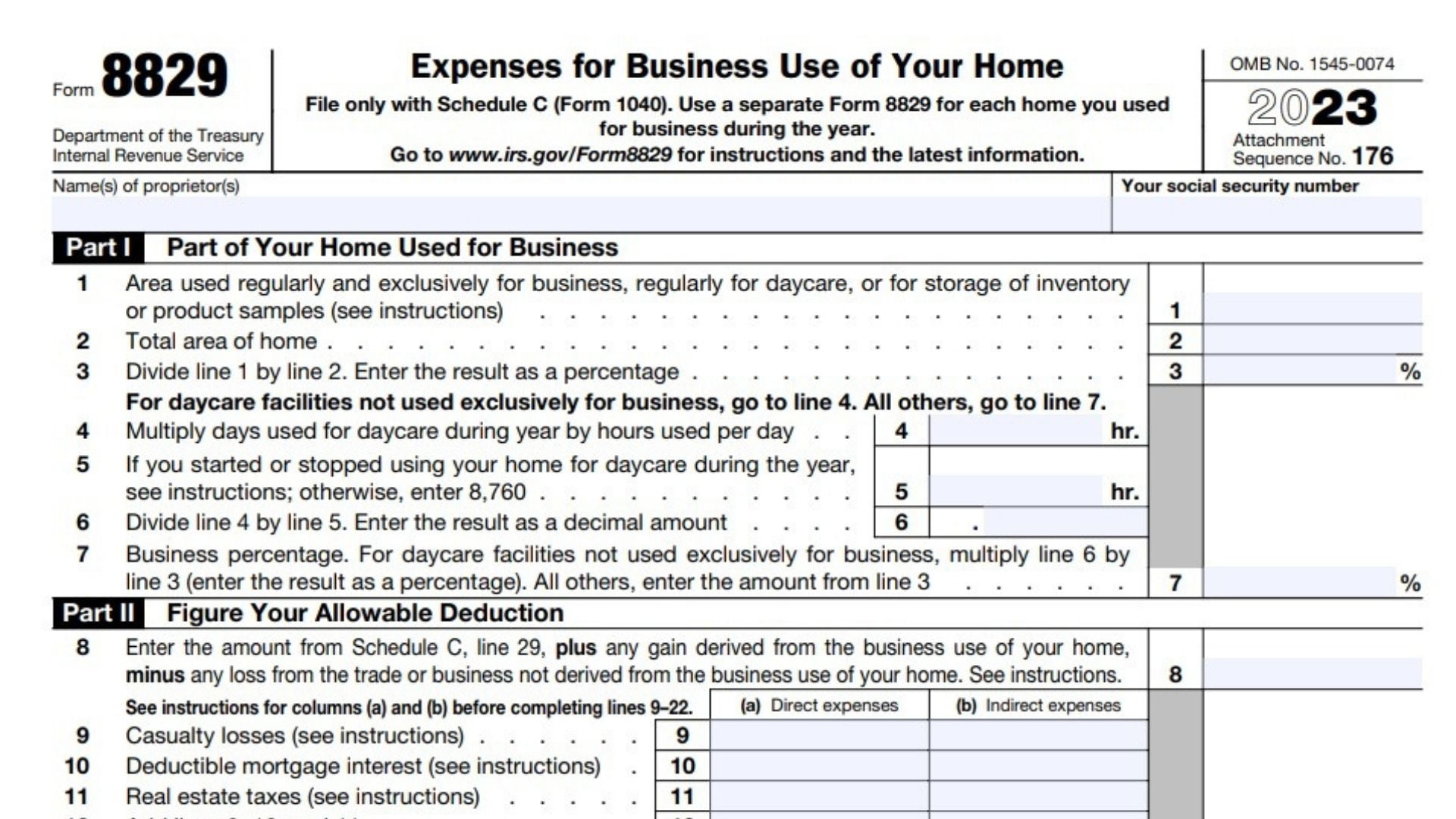

IRS Form 8829, Expenses for Business Use of Your Home, allows self-employed individuals and small business owners to claim a deduction for the portion of their home used exclusively for business purposes. This form helps calculate eligible expenses such as rent, utilities, insurance, mortgage interest, and depreciation, which can be deducted based on the percentage of your home used for business. To qualify, the space must be used regularly and exclusively for business, such as a home office or storage area for inventory. Properly filling out Form 8829 ensures that taxpayers can maximize their deductions while staying compliant with IRS rules regarding home office deductions.

How to Complete Form 8829?

- Enter name and SSN

Part I Part of Your Home Used for Business

Line 1:

- Area used regularly and exclusively for business,

- Regularly for daycare,

- Or for storage of inventory or product samples

Line 2: Enter total area of home.

Line 3: Line 1 / Line 2. Enter the result here and as a percentage.

Line 4: Days used for daycare during year X Hours used per day

Line 5: Enter 8,760 or see the IRS Instructions if you started or stopped using your home for daycare during the year.

Line 6: Line 4 / Line 5. Enter the result here as a decimal amount.

Line 7: Line 6 X Line 3 for daycare facilities not used exclusively for business. Enter the result here as a percentage. All others, enter the amount from line 3. This is your business percentage.

Part II – Figure Your Allowable Deduction

Line 8: Schedule C, Line 29 amount plus (+) any gain derived from the business use of your home minus (-) any loss from the trade or business not derived from the business use of your home.

Line 9: Enter casualty losses

Line 10: Enter deductible mortgage

Line 11: Enter Real estate taxes amount

Line 12: Line 9 + Line 10 + Line 11. Enter the result here.

Line 13: Multiply line 12, column (b), by line 7. Enter the result here.

Line 14: Add Line 12, column (a) and Line 13. Enter the result here.

Line 15: Subtract line 14 from line 8. Enter the result here. If the result is zero or less, enter -0-.

Line 16: Enter excess mortgage interest amount

Line 17: Enter excess real estate taxes

Line 18: Enter insurance

Line 19: Enter rent.

Line 20: Enter repairs and maintenance

Line 21: Enter utilities expenses

Line 22: Enter other expenses

Line 23: Add lines 16 through 22. Enter the result here.

Line 24: Multiply line 23, column (b), by line 7

Line 25: Carryover of prior year operating expenses

Line 26: Line 23, column (a) + Line 24, and line 25. Enter the result here.

Line 27: Enter the smaller of line 15 or line 26. This is your allowable operating expenses.

Line 28: Subtract line 27 from line 15. This is your Limit on excess casualty losses and depreciation.

Line 29: Enter excess casualty losses

Line 30: Enter depreciation of your home from line 42 below

Line 31: Enter carryover of prior year excess casualty losses and depreciation

Line 32: Add lines 29 through 31. Enter the result here.

Line 33: Enter the smaller of line 28 or line 32. This is your allowable excess casualty losses and depreciation amount.

Line 34: Add lines 14, 27, and 33. Enter the amount here.

Line 35: Casualty loss portion, if any, from lines 14 and 33. Carry amount to Form 4684.

Line 36: Allowable expenses for business use of your home. Subtract line 35 from line 34. Enter here and on Schedule C, line 30. If your home was used for more than one business, see the IRS instructions.

Part III – Depreciation of Your Home

Line 37: Enter the smaller of your home’s adjusted basis or its fair market value

Line 38: Line 37, value of land amount.

Line 39: Subtract line 38 from line 37 to figure basis of building.

Line 40: Multiply line 39 by line 7 to figure business basis of building.

Line 41: Depreciation percentage

Line 42: Multiply line 40 by line 41. Enter the result here and on line 30 above. (Depreciation allowable amount)

Part IV – Carryover of Unallowed Expenses to 2023

Line 43: Operating expenses. Subtract line 27 from line 26. If less than zero, enter -0-.

Line 44: Excess casualty losses and depreciation. Subtract line 33 from line 32 and enter the result here. If it’s less than zero enter -0-.