Using an HSA (health savings account) for your health expenses is a great way to keep track of medical costs. But if you want to take advantage of the tax benefits of these accounts, you must file IRS Form 8889. This form allows you to report any contributions or distributions from your account. It’s also where all of the information from forms 1099-SA and 5498-SA comes together — the data that appears on these forms is used to fill out 8889. The data on this form then carries over as deduction information on your main tax return.

How to Complete Form 8889?

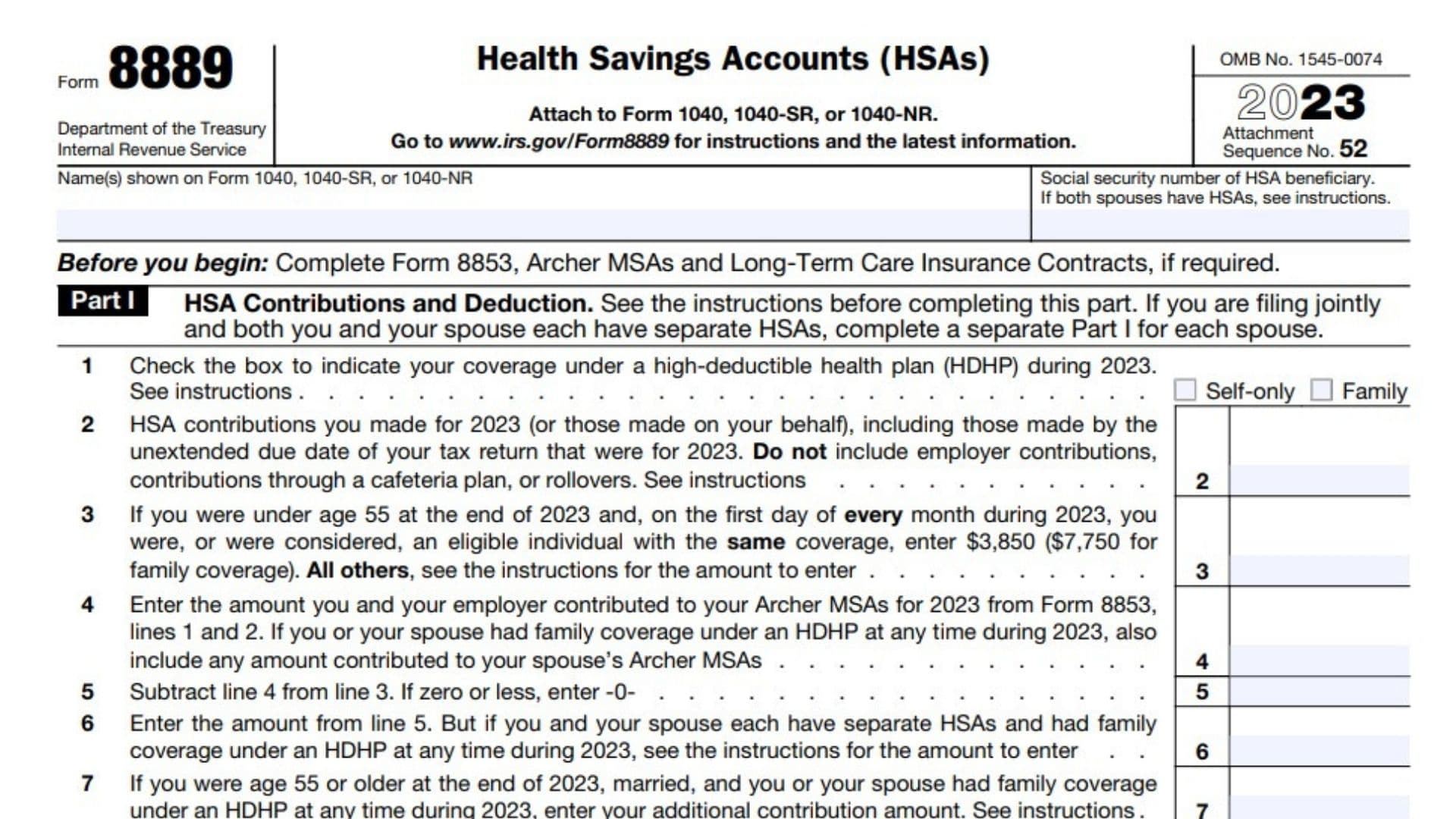

Part I – HSA Contributions and Deduction

Line 1: Check the box to indicate your coverage of HDHP during 2023.

Line 2: Enter HSA contributions for the tax year 2023, including those made by the unextended due date of your tax return that were for 2023. Don’t include the following:

- Employer contributions

- Contributions through a cafeteria plan

- Rollovers

Line 3: Enter $3,850 ($7,750 for family coverage)IF

- You were under age 55 at the end of 2023

- On the first day of every month during 2023, you were, or were considered, an eligible individual with the same coverage

Line 4: Enter the amount you and your employer contributed to your Archer MSAs for 2023 from Form 8853, lines 1 and 2.

Line 5: Subtract line 4 from line 3. Enter “0” if you get zero or less.

Line 6: Enter the amount from line 5

Line 7: Enter your additional contribution amount IF;

- You were age 55 or older at the end of 2023, married, and you or your spouse had family coverage under an HDHP at any time during 2023.

Line 8: Add lines 6 and 7. Enter the amount here.

Line 9: Enter your employer contributions made to 2023 HSAs.

Line 10: Enter qualified HSA funding distributions.

Line 11: Add lines 9 and 10

Line 12: Subtract line 11 from line 8. If zero or less, enter -0

Line 13: . Enter the smaller of line 2 or line 12 here and on Schedule 1 (Form 1040), Part II, line 13. This is your HSA deduction amount. : If line 2 is more than line 13, you may have to pay an additional tax

Part II – HSA Distributions

- Complete a separate part II for each spouse if you and your spouse are filing jointly.

Line 14: Enter Total distributions amount you received in 2023 from all HSAs.

Line 15: Qualified medical expenses paid using HSA distributions

Line 16: Subtract line 15 from line 14c. If zero or less, enter -0-. This is your Taxable HSA distributions amount. You also must include this amount in the total on Schedule 1 (Form 1040), Part I, line 8f.

Line 17: Check here if any of the distributions on line 16 meet any of the Exceptions to the Additional 20% Tax

Part III – Income and Additional Tax for Failure To Maintain HDHP Coverage

Line 18: Enter last-month rule amount

Line 19: Enter Qualified HSA funding distribution amount here

Line 20: Add lines 18 and 19. Include this amount on Schedule 1 (Form 1040), Part I, line 8f. This is your Total Income.

Line 21: Multiply line 20 by 10% (0.10). Include this amount in the total on Schedule 2 (Form 1040), Part II, line 17d. This is the additional tax you must pay.