Montana Form AB-27 is an authorization form used to grant or deny the Department of Revenue’s property valuation staff access to a property for conducting an on-site review for property tax purposes. The form ensures that property owners are aware of their rights to either allow or refuse access to their property, which is needed for accurate property valuation assessments. By granting access, the property owner agrees to allow Department staff to inspect the property as part of the revaluation process. If access is denied, the Department will estimate the property’s value, and this estimated value cannot be adjusted by the county tax appeal board or the Montana Tax Appeal Board until access is granted or a fee appraisal is provided.

How to File Montana Form AB-27

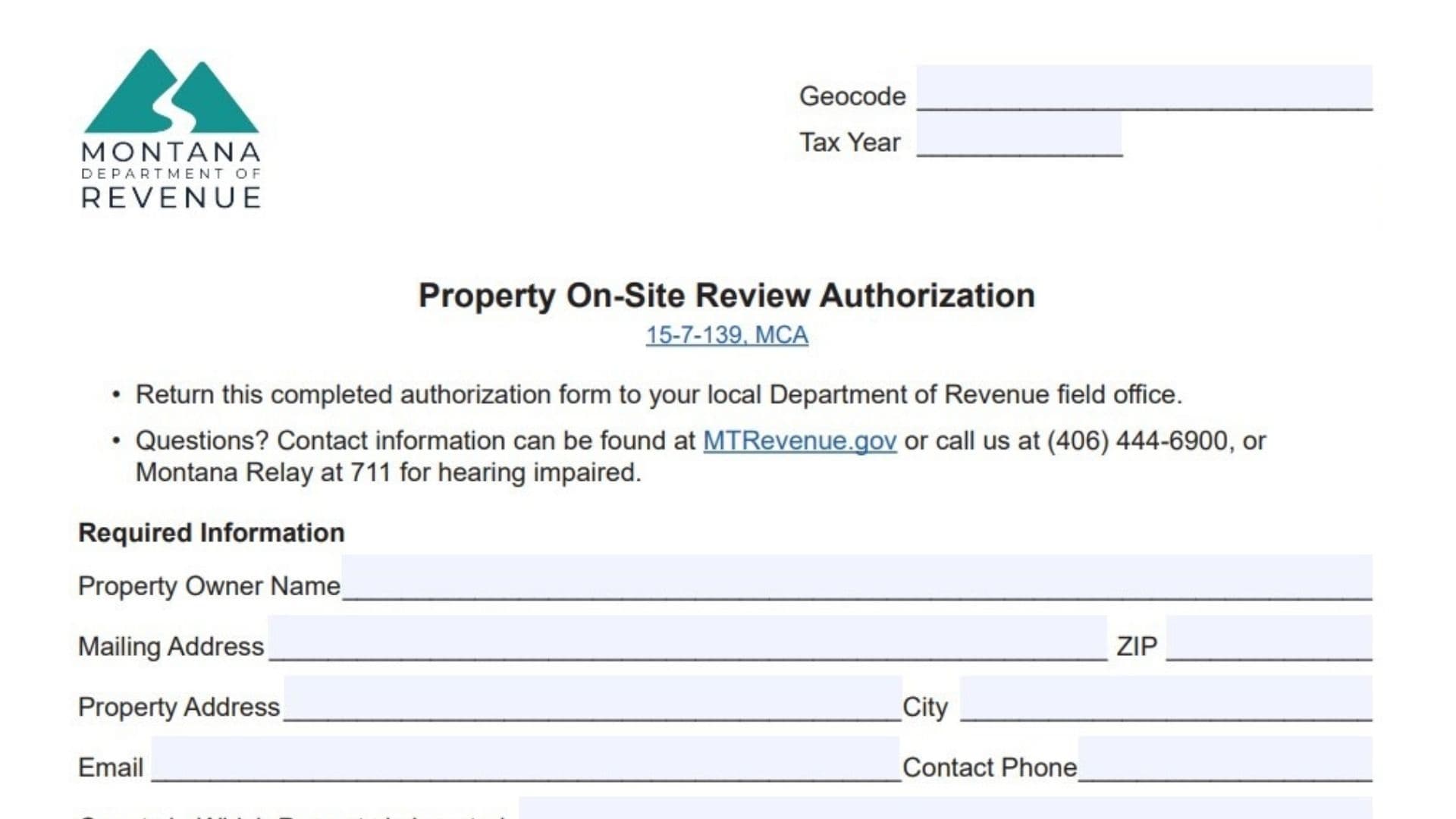

To file Montana Form AB-27, the property owner must complete all required information on the form and return it to the local Department of Revenue field office. The form can be submitted via mail or in person. Ensure that the correct box is checked based on whether or not you wish to grant access to your property for the on-site review. Keep in mind that if you deny access, the Department will estimate your property’s value, which may affect your ability to appeal or adjust the value in the future.

How to Complete Montana Form AB-2

Required Information Section

- Property Owner Name: Enter the full name of the property owner.

- Mailing Address: Provide the mailing address where you would like to receive correspondence related to this form.

- ZIP: Enter the ZIP code for the mailing address.

- Property Address: Enter the physical address of the property that is being reviewed for tax purposes.

- City: Specify the city in which the property is located.

- Email: Include your email address for any necessary follow-up communication.

- Contact Phone: Provide a phone number where you can be reached for scheduling or questions regarding the on-site review.

- County in Which Property is Located: Specify the county where the property is located.

Access Granting Section

- Grant Access: Check the box indicating that you want to be present when the Department of Revenue staff conducts the on-site review of your property. By checking this option, you are agreeing to allow the Department staff to visit and conduct the review during normal business hours, and the local field office will contact you to schedule an appointment before the visit occurs.

- No Access: If you do not want to grant access, check the box to deny access. By denying access, you acknowledge that the Department will estimate the value of your property for tax purposes. Keep in mind that the local county tax appeal board and the Montana Tax Appeal Board cannot adjust the estimated value until access is granted or a fee appraisal is submitted.

Additional Notes

- You may change your authorization at any time by contacting your local Department of Revenue field office.

- The authorization will remain in effect until you decide to change it.

Signature Section

- Property Owner Signature: Sign the form to indicate your agreement with the information provided.

- Date: Enter the date on which you are signing the form.

- Printed Name: Print your name for clarity.