For Montana’s craft beverage producers, sourcing high-quality ingredients often means looking beyond state lines. The Montana Form ASA-1 is the mandatory authorization document for distilleries and breweries that need to import bulk spirits for manufacturing purposes. Whether you are blending imported rum into a signature cocktail base or fortifying a beer with a specific spirit, you cannot simply order these bulk liquids like standard supplies. The state strictly regulates the movement of bulk alcohol to ensure tax compliance and public safety. This form serves as a three-way agreement between you (the requester), your out-of-state supplier, and the Montana Department of Revenue. It requires detailed information about the product—down to the proof and container type—and must be signed by all parties before any shipment takes place. The process is unique because it involves a “permission first” workflow: you initiate the request, your supplier confirms the details, and only then does the Department of Revenue grant the final green light for the shipment to proceed. Failing to use this form can result in the seizure of your shipment and regulatory penalties.

What Is Montana Form ASA-1

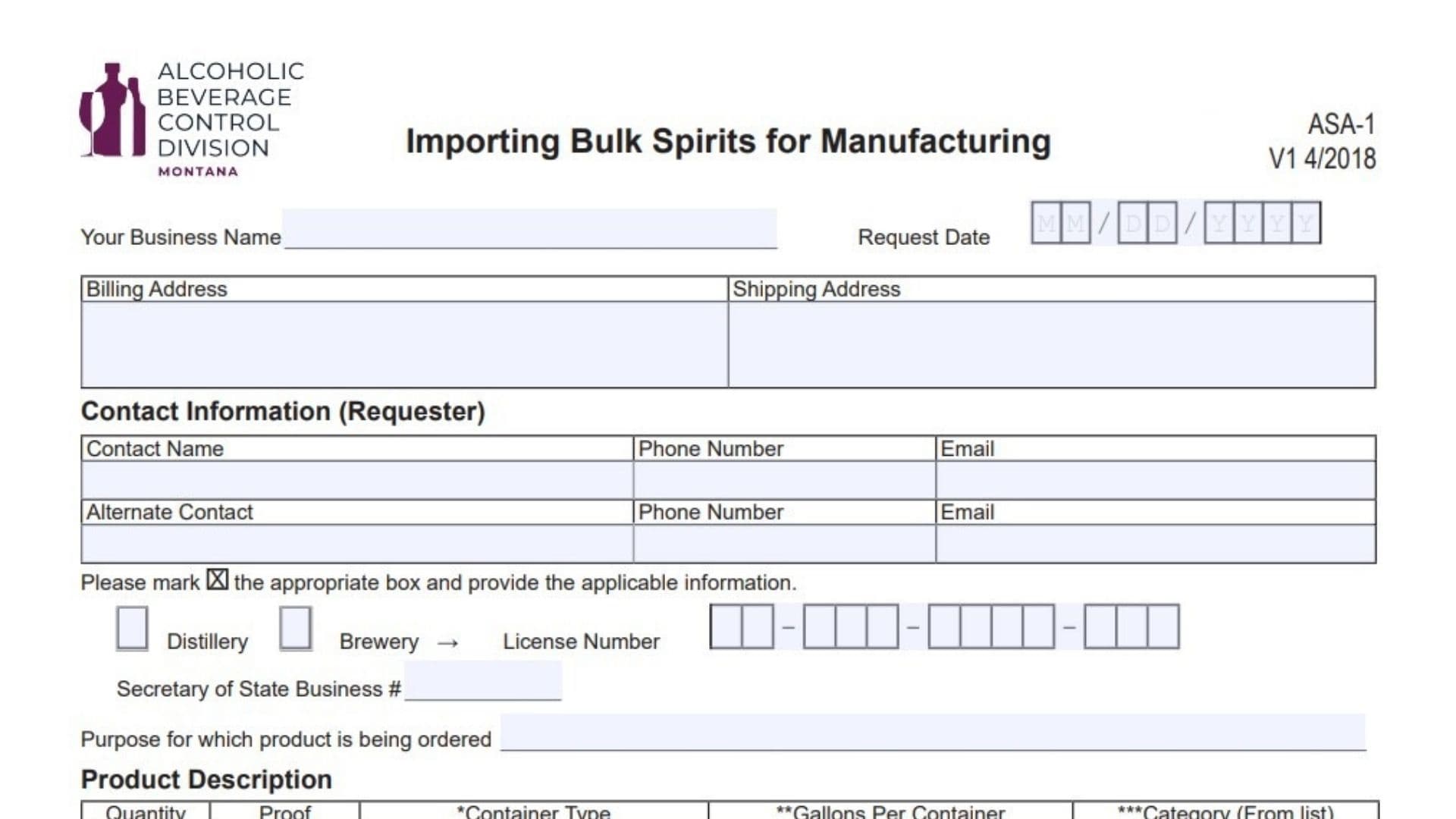

The Montana Form ASA-1 is titled “Importing Bulk Spirits for Manufacturing.” It is a specialized request form used exclusively by licensed Montana distilleries and breweries. Its primary function is to obtain prior authorization from the Alcoholic Beverage Control Division to bring bulk quantities of distilled spirits into the state. “Bulk” in this context refers to large volumes typically shipped in totes, barrels, or tanks, rather than retail-ready bottles. The form captures critical data points such as the business license numbers of the requester, the exact purpose of the import (e.g., blending, flavoring), and technical specifications of the alcohol (proof, gallons, category). It creates a paper trail that tracks the alcohol from the supplier to your manufacturing floor, ensuring that all imported spirits are accounted for within the state’s regulatory framework.

How To File Montana Form ASA-1

Filing the Montana Form ASA-1 is a multi-step collaborative process.

- Initiate: You (the manufacturer) fill out the top sections of the form, sign it, and send it to your supplier.

- Supplier Action: The supplier completes their designated section, confirming the order details and invoice number.

- Submission: The supplier (or you, once you get it back) must email the completed form to

DORAlcoholicBeverageControl@mt.gov. - Approval: The Department of Revenue reviews the request. If approved, they sign the bottom section authorizing the shipment.

- Shipment: Only after the Department of Revenue has signed and returned the form can the supplier legally ship the product to you.

Do not attempt to receive the shipment before getting this final signature. Keep the approved form with your shipping manifests for inspection.

How To Complete Montana Form ASA-1

Requester Information (You)

- Business Details: Enter your Business Name and the Request Date (MM/DD/YYYY).

- Addresses: Provide both your Billing Address and Shipping Address (if different).

- Contact Info: Enter the name, phone number, and email of the primary contact person, plus an alternate contact.

- License Type: Check the box for either Distillery or Brewery. Enter your specific state License Number and your Secretary of State Business #.

- Purpose: Clearly state why you are ordering this product (e.g., “Blending for XYZ Liqueur,” “Fortifying ABC Stout”).

Product Information

You must list the specifics for each product being imported.

- Product Description: Name of the spirit (e.g., “High Proof Neutral Grain Spirit”).

- Quantity: Number of containers.

- Proof: Alcohol proof of the liquid.

- Container Type: Specify if it is a Tote, Barrel, or “Other” (list specific type).

- Gallons Per Container: Note the conversion (1 Barrel = 31 gallons; 1 Tote = 275 gallons).

- Category: Classify the spirit (Bourbon, Vodka, Rum, etc.).

Supplier Information

- Supplier Details: Enter the Supplier Name, Email, Contact Name, and Phone Number.

- Signature: You (the requester) must sign and date the “Requester Signature” line to certify the information is true.

Supplier Section (For The Supplier To Fill Out)

Send the form to your supplier at this point. They must:

- Check Boxes: Confirm if the order will be filled (Yes/No), and if the product is Consumable or Denatured.

- Invoice Number: Enter the specific invoice number associated with this order and attach a copy of the invoice if possible.

- Return: The supplier sends the form to the Department of Revenue email listed on the form.

Department Of Revenue Use Only

Leave this section blank. This is where the state official will sign and date to formally authorize the shipment from the Supplier to the Requester.