When your distillery’s production outpaces your onsite storage capacity, expanding into a separate warehouse is a logical next step, but it requires specific regulatory approval. The Montana Form DDWHAPP is the official application used by licensed domestic distilleries to request a “Storage Warehouse Endorsement” from the Montana Department of Revenue. This endorsement allows a distillery to own, lease, maintain, and operate a non-contiguous warehouse—meaning a facility not physically attached to the main distillery—solely for the purpose of storing liquor. This is not a license to produce or sell alcohol at the new location; it is strictly for storage. Before filling out this form, applicants must ensure they have already secured federal approval from the Alcohol and Tobacco Tax and Trade Bureau (TTB) and have obtained the necessary sign-offs from local building, health, and fire officials. The application process involves a thorough investigation by the Department of Justice, so accuracy and completeness are paramount to avoid delays. This guide breaks down the application into manageable sections, helping you gather the required documents, calculate fees, and submit your request correctly.

What Is Montana Form DDWHAPP

The Montana Form DDWHAPP is a multi-page application packet designed for existing domestic distillery licensees. It serves as a formal request to add a storage facility to your operations. The form collects comprehensive details about the applicant, the proposed warehouse location, and the nature of the transaction (whether it’s a new application or a transfer of location). Beyond the form itself, the application is a checklist for critical supporting documents: you must provide proof of TTB registration, local safety approvals, floor plans, and evidence of property ownership or lease agreements. Essentially, this form acts as the bridge between your business needs and state compliance, ensuring that your new storage facility meets all legal standards for security and safety before you store a single barrel there.

How To File Montana Form DDWHAPP

Filing the Montana Form DDWHAPP is a manual process that involves mailing the completed form, fee, and all supporting documents to the state. There is no online submission option mentioned on the form itself for this specific endorsement application. You should bundle your completed application, the required floor plans, lease/ownership documents, and TTB verifications into one package. Include a check for the total fees (typically $100 for the processing fee plus any other applicable costs) made payable to the “DOR Alcoholic Beverage Control Division.” Mail the entire packet to: Montana Department of Revenue, Alcoholic Beverage Control Division, PO Box 1712, Helena, MT 59624-1712. Due to the requirement for physical documents like floor plans and signed affidavits, sending this via certified mail is recommended to track its delivery.

How To Complete Montana Form DDWHAPP

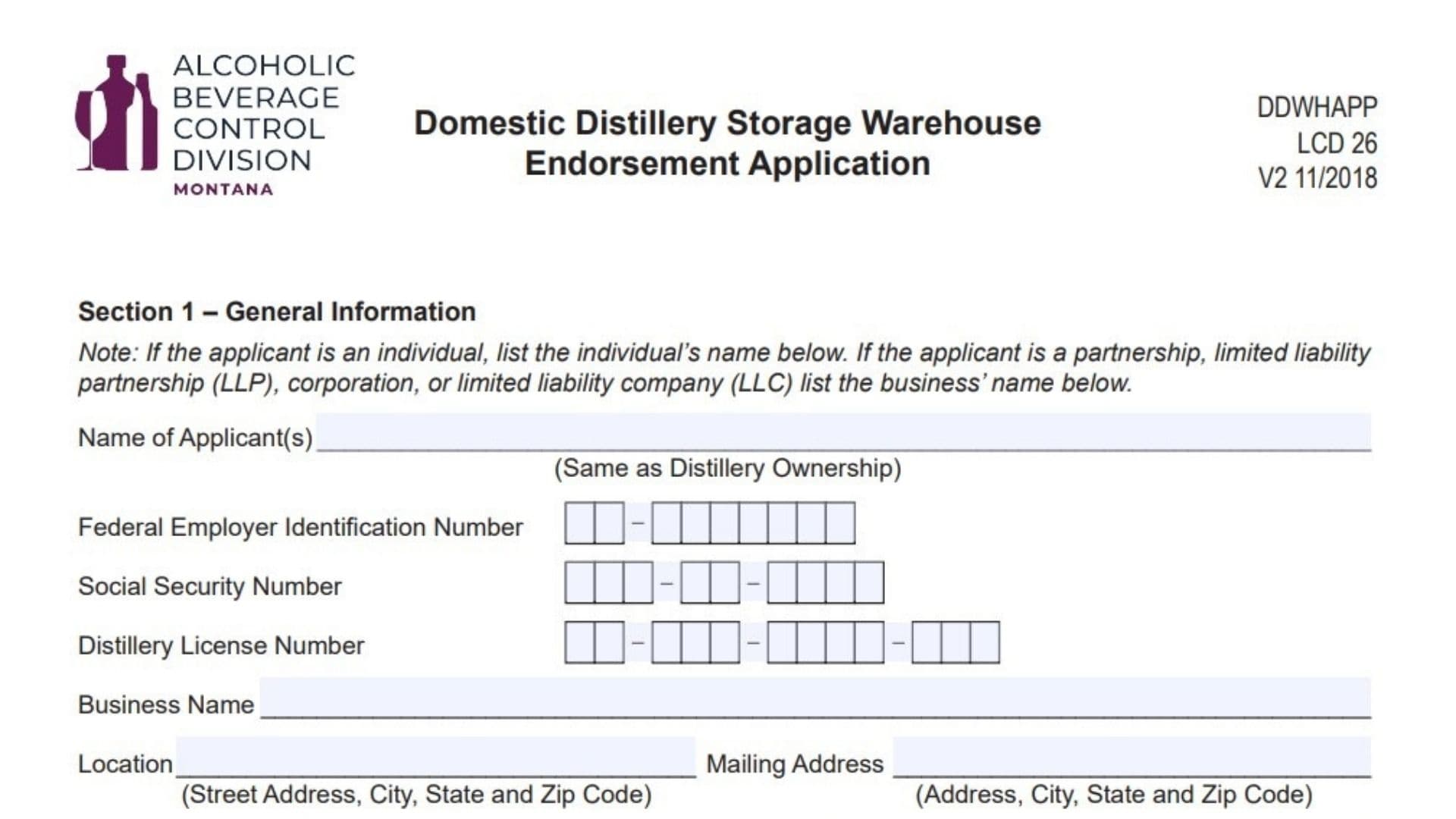

Section 1: General Information

- Applicant Name: Enter the individual name or business entity name (LLC, Corp, Partnership) exactly as it appears on your current Distillery Ownership records.

- ID Numbers: Fill in your Federal Employer Identification Number (FEIN), Social Security Number (if applicable), and your existing Distillery License Number.

- Business Details: Enter the Business Name (DBA), the physical Location of the proposed warehouse (Street, City, State, Zip), and your Mailing Address.

- Contact Info: Provide a Daytime Telephone, Fax, Cell Phone, and Email Address.

- Attorney Representation: If an attorney is handling this application, check the box and provide their full contact details to ensure they receive all correspondence.

Section 2: Type Of Transaction And Fees

- Application Type: Mark the box for “New Application” if this is your first warehouse, or “Transfer of Location” if you are moving an existing warehouse.

- Fees: A $100 Processing Fee is required for all transactions. Enter “$100” in the “Total Amount Enclosed” box.

Section 3: Questions

Answer these compliance questions truthfully:

- Ownership Interest: Disclose if any applicant/owner has an interest in other alcohol licenses (retail, agency store, wholesaler) in any state or country. If “Yes,” explain.

- Financial Interest: Disclose if anyone other than the applicant has a financial interest in the business. If “Yes,” verify their details on a separate sheet.

- Building Ownership: Indicate if you own or are purchasing the building. If “Yes,” attach the purchase agreement or tax bill. If “No,” attach the lease agreement.

- Furniture/Fixtures: Indicate if you own the equipment at the location. If “No,” attach the lease/purchase agreement.

- Readiness: Is the building ready for use? If “No,” list the expected completion date and indicate if it is new construction or a remodel.

Section 4: Declaration And Affidavit

This is a legal oath.

- Signatures: The applicant or authorized representative must sign and date the form. There are spaces for multiple signatures if the entity structure requires it (e.g., partners).

- Printed Name and Title: Print the name and official title of each signer clearly.

Required Attachments Checklist

Before sealing the envelope, ensure you have included:

- TTB approval verification.

- Local building, health, and fire official approvals.

- Lease/Deed/Purchase documents proving possessory interest.

- A clear floor plan (copy only, not original blueprints) showing dimensions and storage areas.