For airlines, railroads, and other common carriers, serving a drink to a passenger while crossing state lines involves specific tax obligations. Montana Form LCT, officially the Quarterly Common Carrier Tax Report for Distilled Spirits Served In/Over Montana, is the designated tool for calculating and remitting taxes on those miniature bottles of whiskey, vodka, or rum consumed within the state’s borders. Because it is practically impossible to track exactly when a passenger cracks open a bottle at 30,000 feet over Billings, this form allows carriers to use an apportionment formula—based on departures or revenue miles—to estimate the taxable amount. The report is filed on a quarterly basis, with strict due dates falling 30 days after the quarter ends (April 30, July 30, October 30, and January 30). Failing to file on time triggers a cascade of penalties, including a late filing fine and accruing interest. Whether you are a major airline or a boutique rail service, mastering this form ensures you stay on the right side of the Montana Department of Revenue while keeping the drinks flowing for your customers.

How To File Form LCT

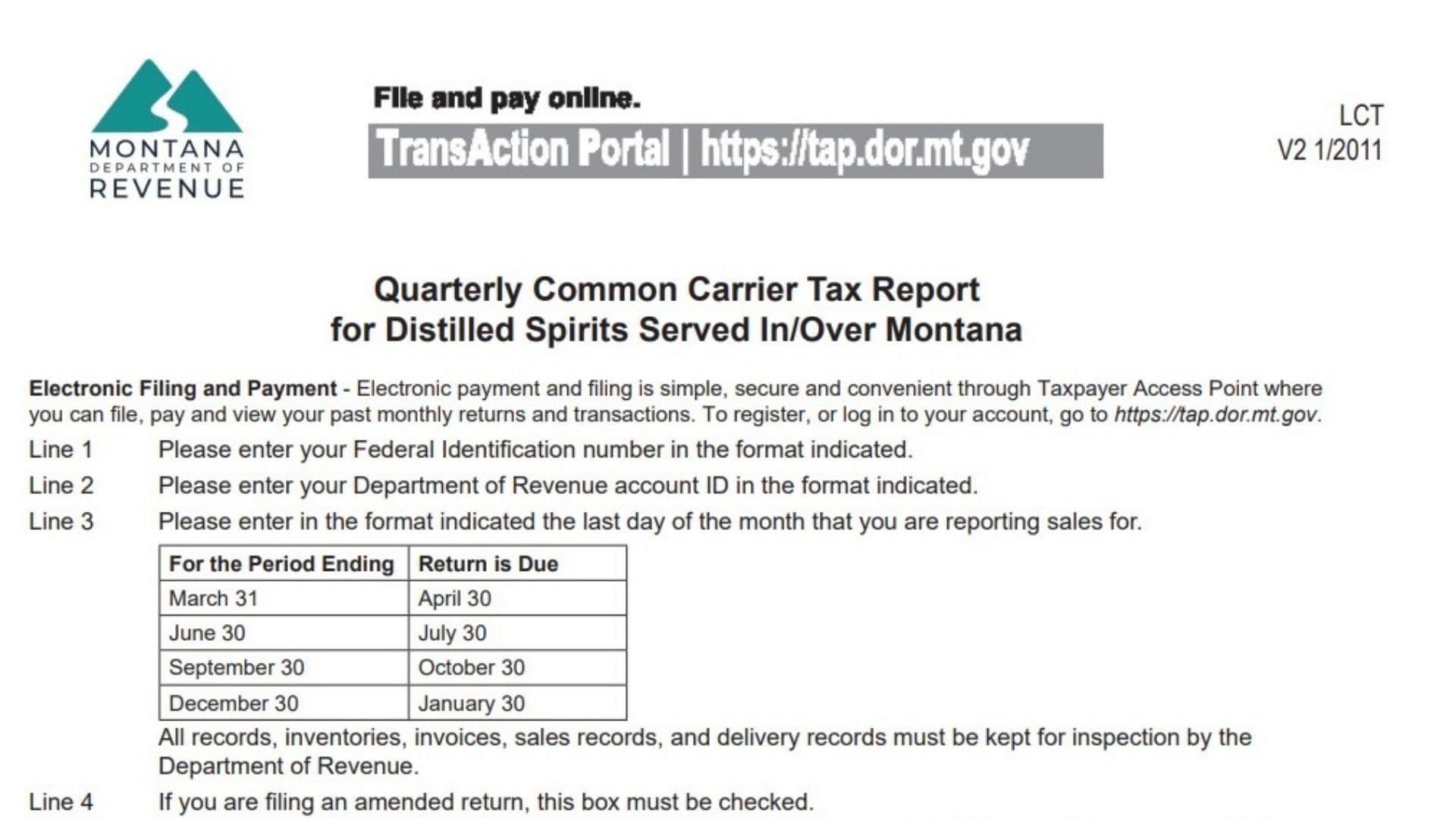

You have two primary options for submitting this report, though the state encourages digital filing for speed and security.

- Electronic Filing (Preferred): You can file, pay, and view past returns through the Taxpayer Access Point (TAP).

- Mail Filing: If you prefer paper, you can mail the completed form and a check (payable to the Department of Revenue) to:

Department of Revenue

PO BOX 1712

Helena, MT 59624-1712

How to Complete Montana Form LCT

Business Identification

- Name & Address: Enter the legal name and mailing address of the common carrier.

- Line 1 (FEIN): Enter your Federal Employer Identification Number.

- Line 2 (Account ID): Enter your Montana Department of Revenue account ID.

- Line 3 (Period Ending): Enter the last day of the quarter you are reporting (e.g., 03/31/2026).

- Note: The quarters end on March 31, June 30, September 30, and December 30.

- Line 4 (Amended Return): Check this box only if you are correcting a previously filed return.

- Line 5 (Address Change): Check this box if your mailing address has changed and print the new address in the space provided.

- Line 6 (Final Report): If you are no longer in business, enter your final date of operations to cancel the account.

Tax Calculation

This section calculates the tax based on bottle size.

- Line 7 (50 ML / Miniatures): Enter the number of miniatures served in/over Montana.

- Calculation: Multiply the quantity by 0.61 to get the tax due.

- Tip: Use the apportionment formula at the bottom of the page (Lines A-E) to determine this number if you don’t track exact sales.

- Line 8 (750 ML Bottles): Enter the number of 750 ML bottles served.

- Calculation: Multiply the quantity by 9.11 to get the tax due.

- Line 9 (1 Liter Bottles): Enter the number of 1 Liter bottles served.

- Calculation: Multiply the quantity by 12.13 to get the tax due.

- Line 10 (Total Tax Due): Add the amounts from Lines 7, 8, and 9. Enter the total here.

Penalties And Interest

- Line 11 (Penalty): If you are filing late, you must calculate penalties.

- Late Payment Penalty: 1.2% per month (max 12% of tax due).

- Late Filing Penalty: The lesser of $50 or the amount of tax due.

- Line 12 (Interest): If payment is late, calculate interest at 12% per year (calculated daily) from the original due date until paid.

- Line 13 (Total Amount Due): Add Lines 10, 11, and 12. This is the amount you must pay.

Apportionment Formula (Optional but Recommended)

Use this section if you need to estimate Montana servings based on system-wide data.

- Line A: Enter the total miniatures served system-wide (everywhere you operate).

- Line B: Enter the total number of departures system-wide OR total revenue miles.

- Line C: Divide Line A by Line B to get the “Average miniatures served per departure/mile.”

- Line D: Enter the number of Montana departures OR Montana revenue miles.

- Line E: Multiply Line D by Line C. This gives you the estimated “Number of miniatures served in/over Montana.”

- Action: Copy the result from Line E to Line 7 above.

Signature

- Declaration: The authorized person must sign, print their title, date the form, and provide a phone number. By signing, you declare under penalty of false swearing that the information is true.