As a non-resident alien, you are required to file two documents with the IRS, one with the U.S. Virgin Islands and the other with the U.S. government. When filing with the IRS, your original form 1040 is sent to the U.S. government for processing. When you file your return with the IRS, you must attach Form 8689 to your form 1040. To attach the forms, arrange them in sequence. Then, send them to the IRS Service Center.

When to File Form 8689?

The Virgin Islands are considered an unincorporated territory of the United States. If you pay tax in the U.S. but are not a bona fide resident of the Virgin Islands, you will need to file Form 8689 to report your income.

If you’re a non-resident of the Virgin Islands, you’ll need to file Form 8689. This form is for non-resident aliens who are not bona fide residents of the U.S. Virgin Islands. This form is used to determine the amount of income tax that should be allocated to the U.S. Virgin Islands from the income you pay in the United States.

The U.S. Virgin Islands requires you to file a tax return with them each year. The U.S. Virgin Islands Bureau of Internal Revenue, which administers taxes in the territory, accepts Form 8689.

How to Complete Form 8689?

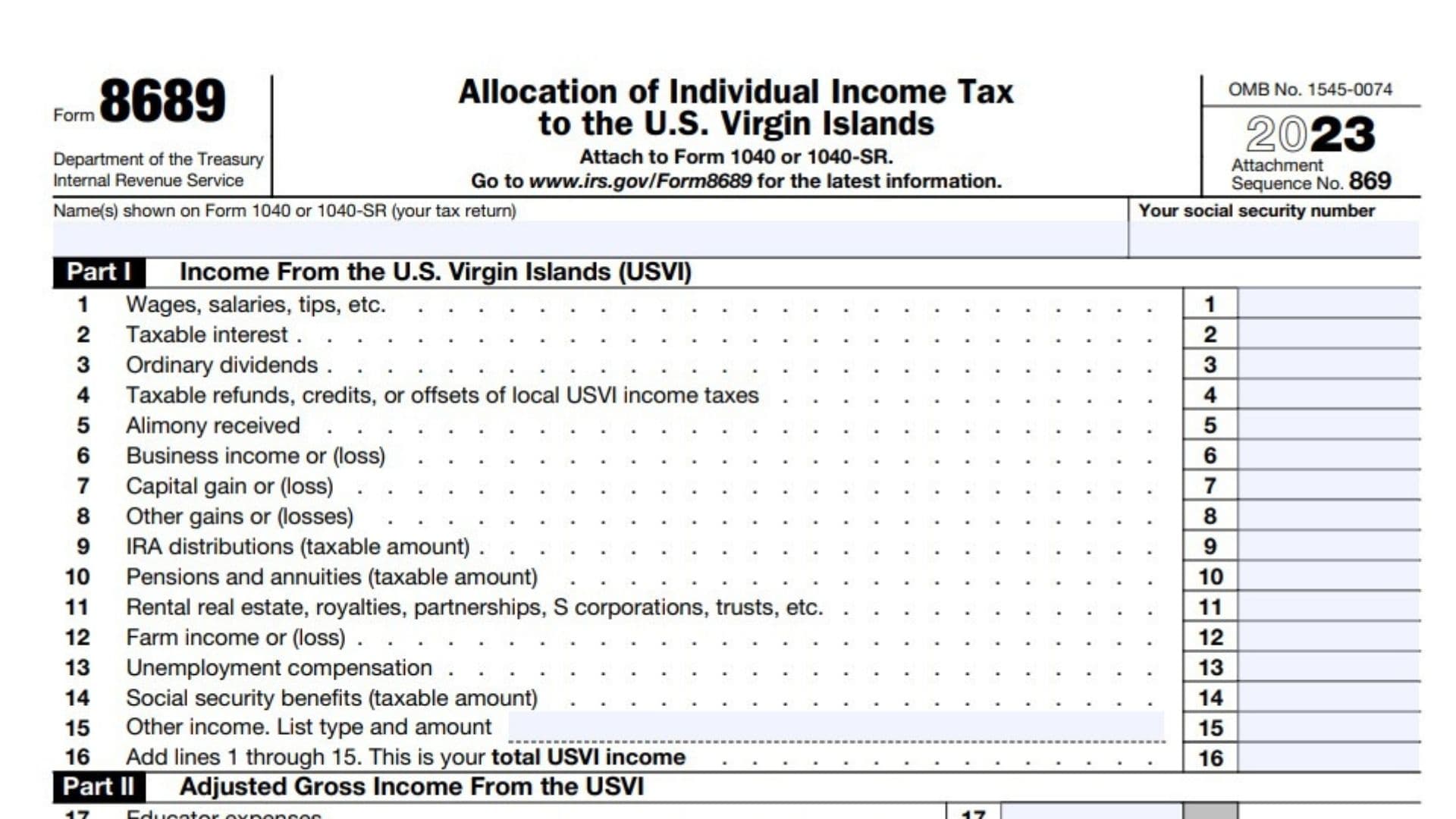

Part I: Income From the U.S. Virgin Islands (USVI)

- Enter wages, salaries, tips, etc., here

- Enter your taxable interest here

- Enter your ordinary dividends here

- Enter any taxable refunds, credits, or offsets of local USVI income taxes here

- Enter alimony received here

- Enter business income or (loss) here

- Enter the capital gain or (loss) here

- Enter other gains or (losses) here

- Enter IRA distributions (taxable amount) here

- Enter Pensions and annuities (taxable amount)

- 11 Rental real estate, royalties, partnerships, S corporations, trusts, etc.

- 12 Farm income or (loss)

- 13 Unemployment compensation

- Social security benefits (taxable amount)

- Enter your other income here

- Add lines 1 through line 15 to learn Your Total USVI Income

Part II Adjusted Gross Income From the USV

17. Enter educator expenses

18. Enter certain business expenses of reservists, performing artists, and fee-basis government officials

19. Enter your possible health savings account deduction

20. Enter your moving expenses for members of the armed forces

21. Enter the amount of deductible part of self-employment tax . . .

22. Enter self-employed SEP, SIMPLE, and qualified plans

23. Enter self-employed health insurance deduction

24. Enter penalty on early withdrawal of savings

25. IRA deduction

26. Enter student loan interest deduction

27.–Reserved for future use–

28.–Reserved for future use–

29. Add lines 17 through line 28

30. Subtract line 29 from line 16. That makes your USVI-adjusted gross income

Part III: Allocation of Tax to the USVI

31. Enter the amount from the total tax line on your tax return

32. Enter your total tax return

33. Subtract line 32 from line 31.

34. Enter the amount from the AGİ line on your tax return.

35. Divide line 30 above by line 34 and enter the result as a decimal. (Don’t enter more than 1.000 )

36. Once you multiply line 33 by line 35, you will learn your tax allocated to the USVI

Part IV: Payments of Income Tax to the USVI

37. Enter Income tax withheld by the USVI

38.2022 estimated tax payments and the amount applied from the 2021 return.

39. Amount paid with Form 4868 (extension request).

40. Add lines 37 through line 39. These are your total payments to the USVI.

41. Enter the smaller of line 36 or line 40. Add this amount to the total payments line of your tax return

42. Overpayment to the USVI. If line 40 is more than line 36, subtract line 36 from line 40

43. line 42: the amount you want refunded to you.

44. line 42: the amount you want applied to your 2023 estimated tax

45. Enter amount you owe to the USVI. If line 40 is less than line 36, subtract line 40 from line 36.

46. Enter the amount from line 45 that you will pay when you file your income tax return. Add this amount to the total payments line of your tax return. On the dotted line next to it, enter “Form 8689” and show this amount.