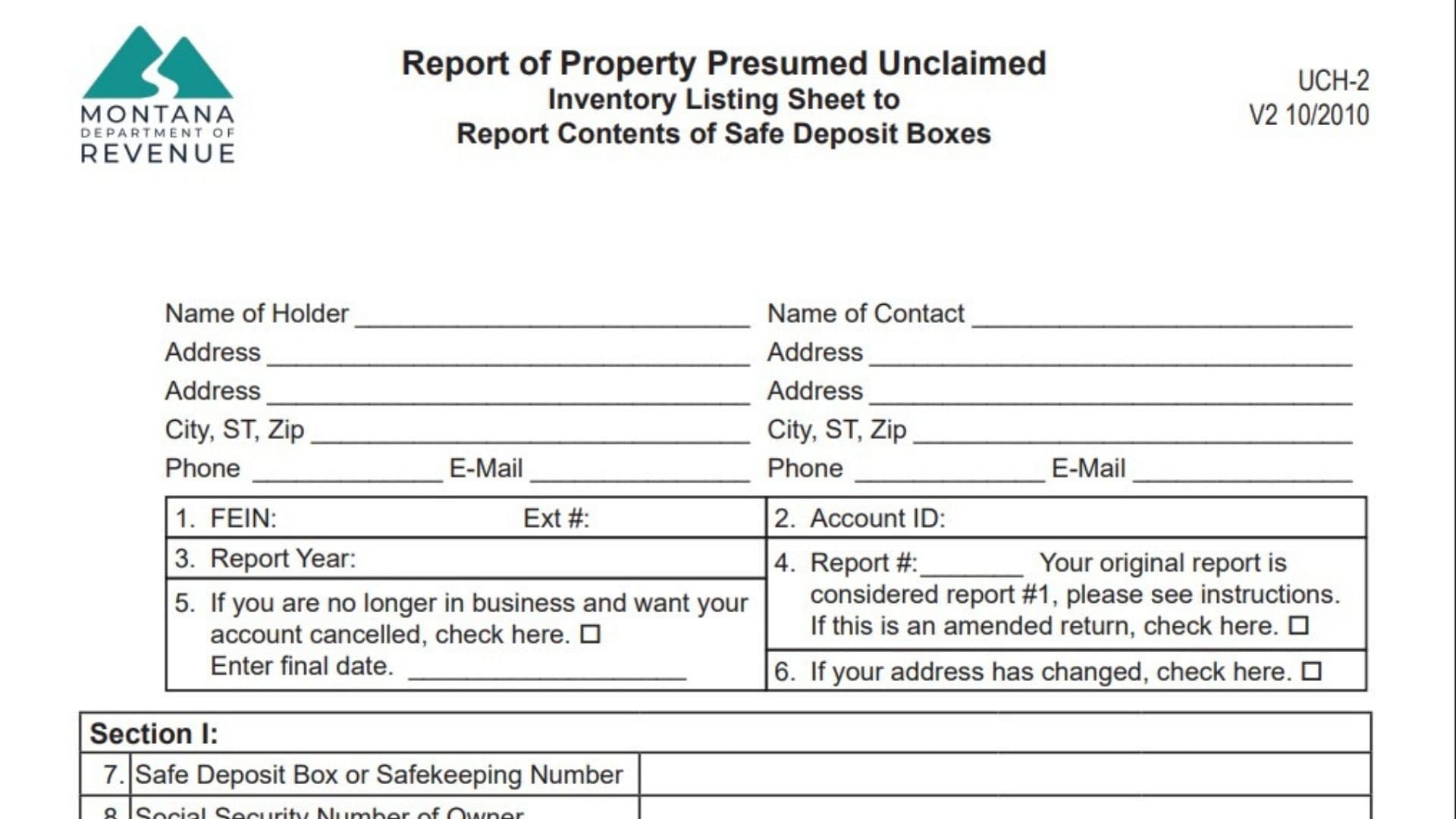

The Montana Form UCH-2, titled “Inventory Listing Sheet to Report Contents of Safe Deposit Boxes,” is a mandatory compliance document used by financial institutions and other entities holding tangible personal property found in safe deposit boxes or safekeeping repositories. Its primary purpose is to report assets that are presumed unclaimed under Montana law because the owner has not generated any activity or contact for a specific period—typically five years for safe deposit box contents. This form serves as a detailed inventory that must accompany the physical delivery of the unclaimed items to the state. It allows the holder to deduct unpaid rental charges and drilling fees from the value of the property before turning it over. By filing this form, holders transfer the custody of these abandoned items—which can include jewelry, coins, stock certificates, wills, and other valuables—to the Montana Department of Revenue, which then holds them for the rightful owners.

How To File This Report

You have two options for filing this report: electronic submission or paper filing. The Montana Department of Revenue encourages electronic filing through their secure file transfer service using the standard NAUPA II format in a text file (not encrypted or password-protected). If you choose to file by paper, you must mail the completed report to the Department of Revenue’s Unclaimed Property division at their PO Box in Helena. However, the physical contents of the safe deposit boxes must be shipped to a different physical address (Roberts Street in Helena) to the attention of the “Unclaimed Property Team – Tangible Contents.” Ensure you include a copy of the inventory list with the shipment.

How to Complete Montana Form UCH-2

Holder And Report Information

Line 1: Federal Employer Identification Number

Enter your organization’s Federal Employer Identification Number (FEIN). If you are a branch filing separately from the main office, include the specific extension number for your location.

Line 2: Account ID

If the state has assigned you a specific Account ID for unclaimed property reporting, enter it here.

Line 3: Report Year

Indicate the reporting period this document covers. For most holders, this is the fiscal year ending June 30, with the report due by November 1. Life insurance companies follow a calendar year ending December 31, with the report due by May 1.

Line 4: Report Number And Type

Enter the sequence number of this report. Your initial report for the year is always Report #1. If you are filing a subsequent report in the same year, number it accordingly. If you are correcting a previously filed report, check the box to indicate this is an “Amended” return, which replaces the original in full.

Line 5: Business Closure

Check this box only if your business has closed or ceased operations and you wish to cancel your unclaimed property account. You must also enter the final date of business operations.

Line 6: Address Change

Check this box if your mailing address has changed since the last time you filed an unclaimed property report.

Section I: Owner And Box Details

Line 7: Box Or Safekeeping Number

Enter the unique identifier or number assigned to the safe deposit box or safekeeping account being reported.

Line 8: Owner Identification Number

Provide the Social Security Number (SSN) or Federal Tax Identification Number of the owner listed on the account.

Line 9: Owner Name

Enter the full legal name of the owner, starting with the last name, followed by the first name and middle initial.

Line 10: Owner Address

List the last known mailing address for the owner, including the street, city, state, and ZIP code.

Line 11: Lease Expiration Date

Enter the date when the rental agreement or lease for the safe deposit box officially expired.

Line 12: Rental Charges

Enter the amount of any unpaid rental fees owed to your institution for the box.

Line 13: Drilling Or Opening Fees

Enter the cost incurred for drilling or forcing open the safe deposit box, if applicable.

Line 14: Total Bank Charges

Sum the amounts from Line 12 and Line 13 and enter the total here. This amount represents the lien or deduction you are claiming against the value of the contents.

Instructions For Page 2: Inventory Listing (Section II)

Item Number And Description

In this section, you must create a detailed inventory of the box’s contents. For each item found, assign a sequential number (1, 2, 3, etc.) and provide a specific description. Do not use vague terms; describe the item clearly (e.g., “Gold wedding band,” “Stock certificate for 100 shares of XYZ Corp”). If you have more items than fit on the page, you may photocopy Page 2 or attach a computer printout, provided it uses at least 10-point font and follows the same format.

Certification And Signature

Signature Block

An authorized officer or representative of the holder must sign the form. By signing, you declare under penalty of perjury that the report is true and complete and that you have met the legal requirement to send a written notice to the owner between 60 and 120 days before filing.

Contact Information

Print the name and title of the person signing, along with the date. Provide a phone number, fax number, and email address for a contact person in case the state has questions regarding the report.