Form 8396 is a U.S. Internal Revenue Service (IRS) tax form titled “Mortgage Interest Credit.” This form is used by individuals who meet certain criteria to claim a tax credit for mortgage interest paid on their principal residence. The purpose of Form 8396 is to help eligible taxpayers reduce their federal income tax liability by providing them with a tax credit for a portion of the mortgage interest they paid during the tax year.

To be eligible to file Form 8396 and claim the Mortgage Interest Credit, you must meet the following criteria:

- You must have a qualified mortgage credit certificate (MCC) from a state or local government’s program. An MCC is typically issued to first-time homebuyers to incentivize purchasing homes in certain designated areas.

- You must meet the income limitations set by the IRS for the tax year in question. These income limits can change from year to year, so it’s important to check the IRS guidelines for the specific tax year you are filing for.

- You must have incurred mortgage interest on the mortgage for your primary residence, and this interest must be eligible for the credit under IRS rules.

- You must not have used the proceeds of tax-exempt mortgage revenue bonds to finance your home.

- You must not have owned a principal residence in the three years leading up to the date of the purchase of the home for which you’re claiming the credit.

- You must not be listed as a dependent on someone else’s tax return.

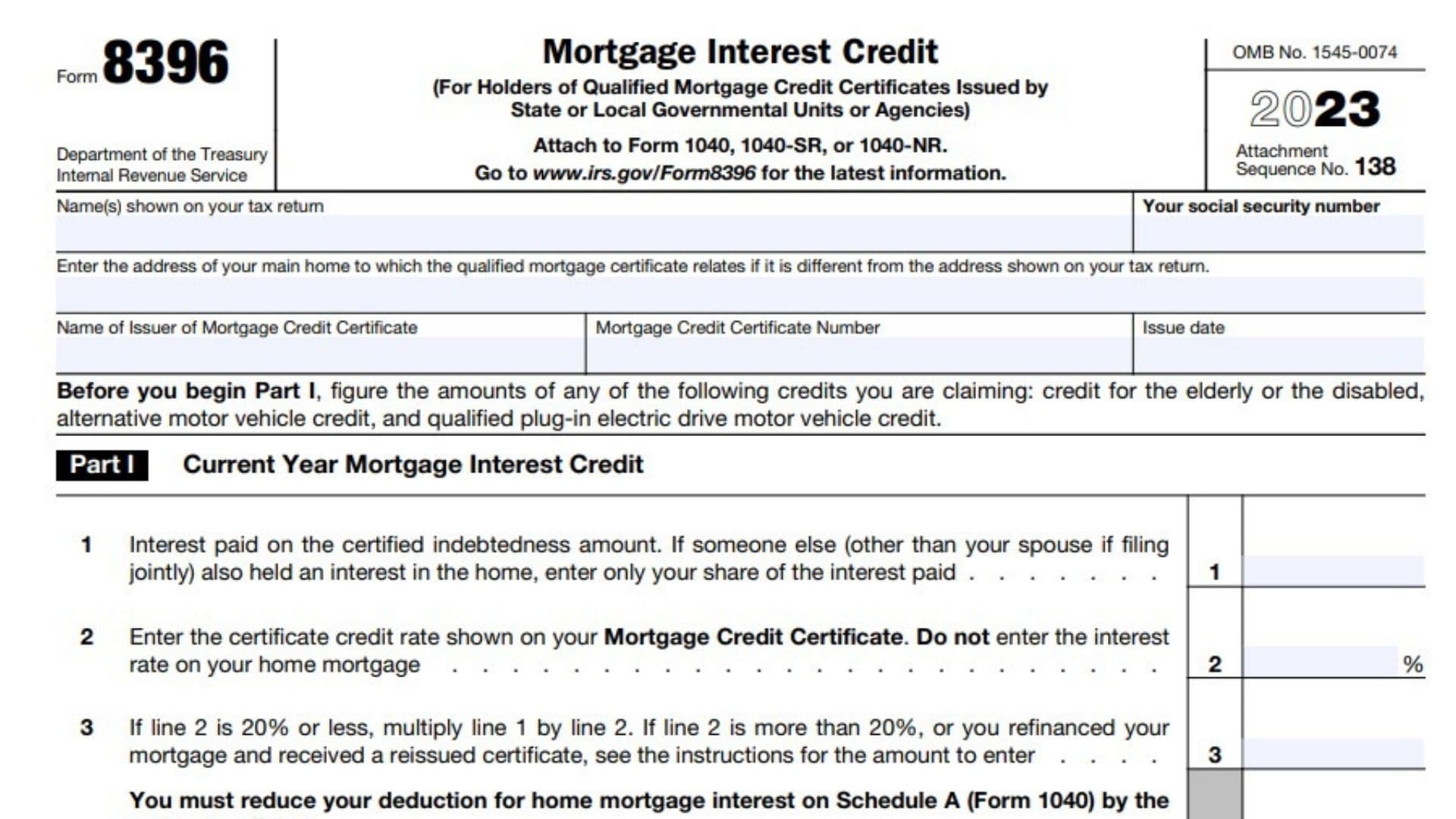

How to Complete Form 8396?

- Enter the name(s) on your tax return.

- Enter the address of your main home ( to which the qualified mortgage certificate relates if it is different from the address shown on your tax return)

- Enter name of Issuer of MCC.

- Ener MCC Number

- Enter issue date

Before you get started, you need to figure the amounts of any of the following credits you are claiming:

- Credit for the elderly or the disabled

- Alternative motor vehicle credit

- Qualified plug-in electric drive motor vehicle credit

Part I – Current Year Mortgage Interest Credit

Line 1: Enter interest paid on the certified indebtedness amount. If someone else (other than your spouse if filing jointly) also held an interest in the home, enter only your share of the interest paid.

Line 2: Enter the certificate credit rate shown on your Mortgage Credit Certificate. Do not enter the interest rate on your home mortgage.

Line 3:

- If line 2 is 20% or less, multiply line 1 by line 2.

- If line 2 is more than 20%, or you refinanced your mortgage and received a reissued certificate, see the IRS instructions for the amount to enter.

Line 4: Enter any 2019 credit carryforward from line 16 of your 2021 Form 8396.

Line 5: Enter any 2020 credit carryforward from line 14 of your 2021 Form 8396.

Line 6: Enter any 2021 credit carryforward from line 17 of your 2021 Form 8396.

Line 7: Add lines 3 through 6

Line 8: Enter the amount from line 3 of the Credit Limit Worksheet in the IRS instructions. This is the Limitation based on tax liability.

Line 9: Enter the smaller of line 7 or line 8. Also include this amount on Schedule 3 (Form 1040), line 6g. This is your Current year mortgage interest credit.

Part II – Mortgage Interest Credit Carryforward to 2023

- Complete this part only if line 9 is less than line 7

Line 10: Add lines 3 and 4.

Line 11: Enter the amount from line 7.

Line 12: Enter the larger of line 9 or line 10.

Line 13: Subtract line 12 from line 11.

Line 14: 2021 credit carryforward to 2023. Enter the smaller of line 6 or line 13.

Line 15: Subtract line 14 from line 13.

Line 16: Enter the smaller of line 5 or line 15 to figure 2020 credit carryforward to 2023.

Line 17: Subtract line 9 from line 3 to figure 2022 credit carryforward to 2023. If the amount is zero or less, enter -0-.